Originally published October 2017, last updated June 2023.

Owning commercial real estate can be an attractive investment opportunity for both private wealth and institutional investors. But owning these properties can be an involved and complicated endeavor, one that is not for the faint of heart. Successfully acquiring a building, retaining tenants, and attracting new ones is just half the battle.

In order to protect their commercial real estate investment and maximize returns, successful commercial real estate investors engage the services of commercial property management companies to manage their buildings. Whether you are new to commercial real estate investment or a seasoned veteran of the industry, you might be asking yourself what it costs to hire a qualified property management company.

Read Next: The Ultimate Guide to Hiring a Commercial Property Management Company

In this article, you will learn the industry standard fees associated with managing commercial properties in Austin, Texas, including:

- How management fees are structured

- What standard property management fees are

- What influences the pricing for these services

- Additional costs landlords might incur related to the management of their properties

- An overview of how landlords can recoup some of these fees

How Are Management Fees Typically Structured?

While management fees can vary for a variety of reasons we will discuss later, typically the agreements will fall into one of three categories:

- Percentage of Gross Receipts – most agreements are set up in this manner

- Flat Fee – primarily used for buildings with a large amount of vacant space

- Hybrid – the greater of a Flat Fee or Percentage of Gross Receipts

Percentage of Gross Receipts

For this type of structure, an owner of commercial real estate property in Austin can expect to pay between 2% and 4% of the gross receipts collected on the property.

Annual Property Management Fee = 2% – 4% x Annual Gross Receipts

“Gross receipts” differs from gross revenue (or rent) collected in that it includes certain charges that tenants may incur during their occupation of the space. These tenant charges may include:

- Prior year operating expense reconciliations

- Utility bill backs for tenants with extraordinary utility needs

- Additional services the tenant may require above and beyond the building standard, such as special janitorial needs or after-hours air conditioning

Annual Gross Receipts = Base Rent + Operating Expenses + Other Tenant Charges

Essentially, the management fee is applied against virtually everything the tenant pays the landlord for occupying the space, with the exception of the security deposit.

The details of these fees will be outlined in your property management agreement. Be sure to understand everything that’s included so you can be better informed as to the overall cost of the agreement.

Read Now: What Does a Property Management Company Do?

Flat Fee

For buildings with a significant amount of vacancy, it often makes sense for both owners and property management companies to use a flat fee arrangement. In this scenario, the owner will be charged a flat monthly fee based on the property manager’s determination as to the amount of time required to properly maintain the building, with a reasonable margin built in.

The flat fee structure can also be used for high occupancy buildings; however, your prospective property management company will likely steer you towards a percentage fee as it best insulates both parties against fluctuations in occupancy.

Hybrid

A hybrid structure is the most commonly used management fee structure because it is able to cover a wide variety of occupancy scenarios.

During low occupancy, the owner pays the agreed-upon flat fee. As rental income increases and the percentage of gross fees outweighs the flat fee, the property management company receives a higher fee to help account for the additional work required by having more occupied square footage.

Agreement Terms & Renewals

Regardless of the structure, most management agreements are for a one-year term with a 30-to-60-day cancellation option. Either party can cancel the agreement at any point, and if no cancellation occurs, the agreement automatically renews for another one-year term.

Ready to start marketing your commercial real estate property?

Download the Property Marketing Checklist to keep your project on track and see what you may have missed.

Factors Influencing Price/Cost

Now that you understand how these agreements are structured, let’s discuss the reasons why there is such a large range of rates you may be charged. The difference between a 2% and 4% fee can be substantial, and you might be inclined to shop around until you find a company that will agree to the lower fee.

But be careful before automatically choosing the low-cost provider. Experienced and reputable commercial property management firms, while willing to negotiate, understand the amount of time and effort required to effectively manage your building and maximize its value (for both short and long-term strategies). Absent the following, a low fee may be indicative of the quality and depth of service you can expect.

Square Footage/Portfolios

It’s a simple concept; The more square footage you own, the more likely you are to negotiate a lower rate. Owners of large class A buildings and/or commercial real estate portfolios are generally more likely to get better rates given economies of scale and the overall value of their business to the property management firms. Even the prospect of getting additional business from you in the future will often entice these companies to agree to a reduced fee.

Number of Tenants

A single-tenant, 50,000-square-foot office building requires fewer resources to manage than one with 10 smaller tenants. There are fewer rent checks to collect, leases to administer, client relationships to maintain, and expense reconciliations to be made. If you own the latter, don’t expect firms to budge much on price. But if you have relatively few tenants given the building’s size, you may be able to negotiate a more favorable rate.

Vacancy

If your building has a lot of vacant space, as an owner you will obviously receive less revenue than you would on a fully leased building. That also means the fee paid to the property management company will be lower, outside of a flat fee arrangement. So, if your building is close to full, you will have more leverage in negotiating a lower rate. In a lower vacancy situation, expect your property management quotes to be at or near the higher end of the spectrum, with many likely suggesting a hybrid approach.

Anticipated Amount of Work

This is more of a gut feeling on behalf of the property manager. An experienced one can anticipate the relative amount of effort required to manage a building by viewing its condition, the number and type of tenants, the diversity and complexity of the in-place leases, and the owner’s commercial real estate investment approach for the property.

A property with lots of outstanding deferred maintenance is likely to generate more service calls from tenants. More tenants mean more work. Inconsistent lease terms require a more involved lease administration process. And if you, as the owner, plan to make substantial capital improvements, for example, this will require a significant amount of collaboration with your property management company.

Service Offerings

Generally speaking, when choosing a property management firm, you will not get a “menu pricing” option, meaning you cannot pick and choose which services you want. Most companies have a standard agreement that outlines all the services included in the offering. With that said, some companies are beginning to offer ancillary services, the inclusion (or exclusion) of which could impact the price. Asset management and parking management, for example, are services that some firms are starting to offer as part of their agreements.

When Do You Pay?

Unlike leasing and acquisition fees, which are generally made in one or two lump-sum payments, property management fees are charged on a monthly basis. Payments are made each month for the previous month’s expenses, and most management companies are willing to negotiate the exact due date to fit the landlord’s needs.

So What’s the Bottom Line Cost?

Interestingly, in some cases, the answer may be zero.

While it can vary by the tenant, based on their lease, in most cases, you can pass through the property management fees to them via the building’s operating expense charge.

Costs You Can Pass Through

Whether a percentage-based or a flat rate, the property management fee can typically be passed back to the tenant.

The property manager may also handle things like landscaping, day-to-day maintenance, and pest control, that are not included in the manager’s fee structure. Those costs will be billed to the landlord, and can only be passed through if a tenant’s lease allows it.

For tenants in the Austin area, it is a generally accepted industry practice to pass through all of the above fees, as well as:

- Common area maintenance

- Management’s office costs (copies, supplies, etc.)

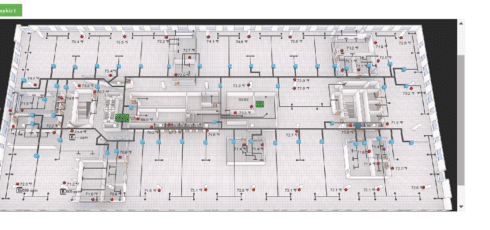

- Heating, ventilation, and air conditioning

- Many more

Since the specific fees that can be passed through depend on each tenant’s lease, it’s essential to fully understand the existing leases in your building to see if you can take advantage of this pass-through. Hiring a landlord broker experienced in the Austin market can tell you more about which fees are commonly passed through and how you can insert them into future leases.

Costs You May Have to Cover Yourself

Even with all the costs a landlord can pass through to tenants, there are some that the landlord must cover if the need arises. These include:

- Legal fees related to the building

- Most capital expenditures

- Late fees

- Costs associated with leasing

While there are technically no set reasons as to why these expenses cannot be passed through to the tenant (unless the lease does not allow them to be), most landlords agree that these costs are not the responsibility of the tenant. As a landlord, it is important that you account for these expenses in your building’s budget.

Conclusion

As with many aspects of commercial real estate, professional property management is an essential service needed in order to properly maintain your asset and maximize its value. And while the basic services provided are similar, each property management agreement has its own nuances and it’s important that you understand everything that’s included.

When looking for a property management firm, be sure to check for accreditations like the AMO® Accredited Management Organization through the Institute of Real Estate Management. These can be a great indicator of a high-quality management company. Read these articles to learn more:

- How to Choose the Right Commercial Property Management Company

- 5 Key Questions to Ask Before Hiring a Property Management Company

Our property management team is one of few in the Austin area to have such accreditation, and they have years of experience working with landlords in the Austin market. If you would like to learn more about property management and what services we offer, contact us today.

Popular Articles:

- Heavy Rain? How to Prepare Your Commercial Property (5 Steps)

- HVAC Preventative Maintenance Checklist for Commercial Buildings (5 Steps)

- Local vs. National Commercial Real Estate Firms: Which Is Better? (Pros & Cons)