This article is updated quarterly and was last updated in March 2024.

At AQUILA, our industrial experts understand how difficult it can be to find the right industrial space in Austin, Texas. After meeting with hundreds of clients, we’ve found that one of the first questions clients ask is, “what does industrial space cost in Austin?”

Read Next: Types of Industrial Buildings Defined (Warehouse, Flex, Distribution, etc.)

To answer this question, we’ve compiled a detailed look into:

- What makes up industrial rental rates

- What average rental rates are today

How Industrial Rental Rates Are Calculated

Before we dive into specific costs around the Austin area, it is important to understand how to calculate your total annual rent expense. Calculating your industrial lease requires four numbers:

- The square footage of the lease

- The base (or NNN) rental rate

- The estimated operating expense

- Electrical and janitorial expenses (E&J)

It’s important to note, that often industrial rates are quoted on a monthly, not annual, basis in Austin. This varies from market to market, and as the Austin market continues to grow, some landlords are beginning to quote annual rates – be sure to check how your property is quoted.

To find the total annual cost to lease your industrial space, multiply the monthly full-service rental rate (the sum of the base rent, operating expenses, and electrical and janitorial) by the square footage of the space, then multiply by 12 months.

Total Annual Rent Cost = [(Base Rent + Operating Expenses) x Square Feet] x 12 Months

For the sake of this article, we will be quoting monthly NNN rates, because operating expenses and E&J rates can vary across properties and tenant types.

Why Operating Expenses and Electrical & Janitorial Rates Vary in Industrial

Operating Expenses

Your operating expense is comprised of three primary components:

- Property Taxes

- Insurance Rates

- Common Area Maintenance

Each year these rates are estimated by the property managers and are included in your full-service rental rate. However, depending on the quality, age, and location of the building, these rates can fluctuate widely from property to property.

A good tenant representation broker should typically be able to negotiate a cap on the percentage that a landlord can increase the common area maintenance fees year over year.

In a mature building, typically the tax and insurance will stay consistent year over year. In a new building though, it can be harder to estimate exactly what this annual cost will be, and you may find that the landlord under (or over) estimated the required op/ex. Additionally, at around the two-to-three-year mark, properties will typically experience a hike in property taxes as they are reassessed.

While op/ex can vary, typically tenants can anticipate paying somewhere in the range of $0.15 to 0.47 per square foot each month, with recently delivered distribution buildings falling on the low end and mature flex buildings falling on the higher end.

Electrical & Janitorial

While the op/ex rates are set by outside parties, you, the tenant, actually have complete control over the E&J expenses.

Industrial suites are actually individually metered, as there can be a wide range of use types across tenants, with an equally wide range of costs. For example, a manufacturer with 100% HVAC, who is running machines 24 hours a day is going to have a much higher electrical bill than that of a distribution center, which has no HVAC and only runs the lights eight hours a day.

For this reason, industrial landlords keep this separate from the rental rates, and industrial tenants are required to contract and cover their own E&J. This is different than office landlords, who anticipate a standard forty-hour work week, with the typical lights, HVAC, and computer/printer needs for all building tenants, are able to incorporate this into the op/ex.

Additionally, as the E&J is completely tied to your use type, we cannot include this in our averages below.

To provide a general idea, however, a typical flex user can anticipate paying somewhere in the range of $3 per square foot annually in E&J.

Cost to Lease Space in Austin’s Three Major Industrial Submarkets

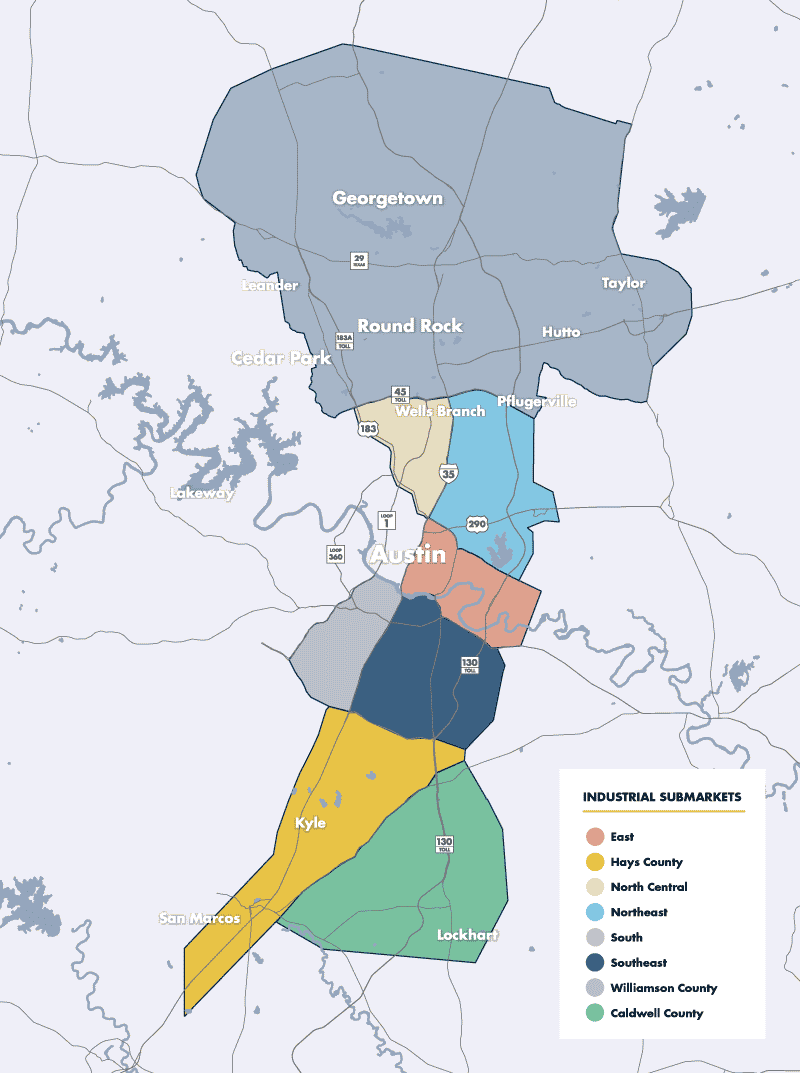

Now that you understand what factors affect rental rates and how that rate is calculated, let’s delve deeper into exactly what rental rates currently are in Austin. We’ll focus on the city’s three major submarkets:

- Williamson County

- Northeast

- Southeast

The rental rates below are referencing direct deals with landlords only. Subleases and other special situations would likely have different rates. These reflect market averages and may vary from property to property.

Williamson County

The Williamson County submarket is defined as the area north of SH-45 and roughly bounded by US-183 to the west and SH-95 to the east. The area has historically been a strong industrial submarket and has seen a significant increase in tenant demand and development volume in recent years. Round Rock, Georgetown, Hutto, and Taylor are all hotspots of development in the Austin market.

Average Current Williamson County Industrial Rental Rate: $0.70

As you can see from the chart at the end of this article, it currently costs approximately $0.70 per square foot monthly to lease space in Williamson County. Using a 50,000-square-foot tenant as an example, that amounts to $418,500 per year, or $34,875 per month plus op/ex and E&J.

A few of the tenants currently occupying space in the Williamson County submarket are:

- 3-Way Logistics

- Amazon

- Samsung

Northeast Rental Rates

The Northeast submarket space is east of IH-35, north of Loyola Ln, out past the 130 Toll, and south of SH-45. This location is ideal for distribution companies, as it allows for easy access to major interstates and highways, with direct routes to surrounding cities including Houston, San Antonio, and Dallas.

In addition, this location appeals to the numerous companies that service Dell, Applied Materials, and Samsung, all of whom have major campuses located within the submarket.

Average Current Northeast Austin Industrial Rental Rate: $0.88

Currently, the average asking rate in the Northeast submarket is $0.88 per square foot per month. With these rental rates, our 50,000-square-foot tenant will be paying approximately $527,500 per year, or $43,958 per month plus op/ex and E&J.

Some tenants currently leasing space in the Northeast are:

- UPS main distribution center

- The State of Texas

- HID Global

Southeast Rental Rates

The Southeast industrial submarket encompasses the area south of the river, east of IH-35, and south to the 45 Toll, essentially surrounding the Austin Bergstrom International Airport.

The Southeast submarket is the closest of the major industrial markets to Downtown Austin. In addition, with the completion of the HWY-71 flyover, the Southeast market is by far the most accessible to executive housing in the affluent west Austin suburbs, including West Lake Hills, Tarrytown, and Rollingwood. This access has allowed the Southeast submarket to flourish, with a number of new developments nearing completion and underway.

In the Southeast, you can find a healthy mix of tenant types – from national brands to local companies, including both warehouse and distribution centers, which also enjoy easy access to San Antonio, Central Texas, and Houston via the surrounding major highways.

Average Current Southeast Austin Industrial Rental Rate: $1.13

Currently, the average full-service asking rate in the Southeast area is $0.91 per square foot per month. With these rental rates, our 50,000-square-foot tenant will be paying approximately $678,500 per year, or $56,541 per month plus op/ex & E&J.

Some tenants currently leasing space in the Southeast are:

To learn more about the rental rates and trends in Austin’s industrial market, including all thirteen submarkets, be sure to download your free copy of AQUILA’s Industrial Report.