The Background

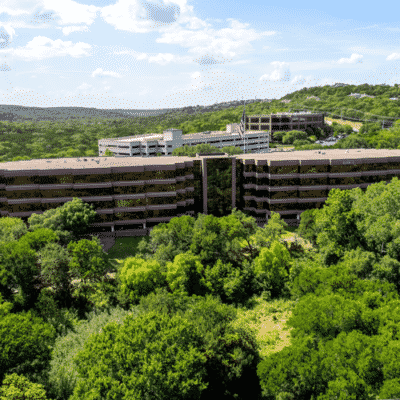

In 2008, AQUILA sourced a 900,000-sf corporate campus in Northwest Austin to Spear Street Capital, a San Francisco-based private equity firm. When Spear Street acquired the property at year-end 2008, the single-tenant campus was 100% leased to Motorola/Freescale through 2014. Freescale had subleased a floor to PayPal and a floor and a half to Indy Mac Bank, which, at the time, was thought to be a stable sub-tenant.

The opportunity lay in the success of using the term remaining on Freescale’s lease as a runway to make improvements to the property in order to make it attractive as a multi-tenant campus. But with the local and national economy in the midst of a recession, Freescale was working hard to cut costs and Indy Mac Bank declared bankruptcy, vacating their space and leaving it available sooner than anticipated. Spear Street and AQUILA realized that the planned transition would have to happen sooner than anticipated.

I had the pleasure to work with the AQUILA team on the redevelopment and repositioning at 7700 Parmer. During that time they truly became an extension of the Spear Street Capital team and treated the property as if it were their own. After working with AQUILA for almost seven years I count them as not just partners, but friends.”

– Peter Kahn, Chief Investment Officer, Spear Street Capital

The Challenge

Spear Street desired to re-tenant the space being vacated by Freescale to mitigate risk of having the entire campus roll when Motorola’s lease expired in 2014. This situation presented several challenges to both the ownership and leasing team:

- A project of this scale and type did not exist in the Austin market. AQUILA needed to craft a message that would convey the opportunity in this project.

- A deal needed to be structured between Spear Street and Freescale to market space intended to sublease, allow Freescale to mitigate as much of its rental obligation as possible during its remaining lease term, and accomplish Spear Street’s goal of backfilling the space with longer term, strong credit leases.

- In order to accomplish this, a number of major improvements were required to transform the campus into the first-class facility that is now 7700 Parmer.

The Solution

Strike a Deal

Before a single lease could be signed, AQUILA had to navigate a negotiation between Freescale and Spear Street, giving new ownership the ability to market and lease Freescale’s surplus space before its expiration in 2014. Favorable terms allowed AQUILA the opportunity to backfill the space vacated by IndyMac and market a space Freescale was set to vacate in 2010.

Backfill the Space

The marketing plan delivered. AQUILA’s prospecting and marketing resulted in long-term leases with PayPal and Ebay, +/-70,000 sf, +/-215,000 sf, respectively. Shortly thereafter, AQUILA and Spear Street secured Polycom’s relocation to +/-137,000 sf, and Electronic Arts’ Global Customer Solutions and IT Management operations within 100,000 sf.

Re-work the Campus

AQUILA and Spear Street worked hand-in-hand to reprogram the campus amenities. Upgrades and additions included:

- Full café renovation. Ultimately Bon Appetite, a Silicon Valley staple, was engaged to replace Aramark.

- Full gym renovation and the introduction of Cross-fit training programs, yoga classes and other group fitness options.

- Lobby and collaborative area modernization.

These upgrades allowed for continued expansions:

- EA leased an additional +/-75,000 sf for ten years and extended its existing +/-100,000 sf premises to expire coterminously. This was a huge endorsement for the 7700 Parmer experience.

- Oracle expanded in two increments bringing their total space to +/-180,000 sf.

- Google leased +/-60,000 sf and subsequently expanded by 64,000 sf, bringing their total space to +/-123,800 sf.

- Following expiration of the South University sublease, Dun & Bradstreet leased in its entirety ( +/-61,500 sf).

The Results

A project six years in the making, the AQUILA leasing team was creative and diligent in its pursuit to lease the entire campus. The result was the creation of enormous value for ownership and the future of the property. Over the course of Spear Street’s ownership, AQUILA successfully:

- Converted a single-tenant development into a premiere Class A multi-tenant campus.

- Recruited some of the world’s top name brand technology companies, including PayPal, Google, Oracle, EA and Polycom.

- Completed 22 lease transactions, including new leases, renewals and expansions for a total of 1,142,691 sf of space.

- Increased starting rents from $13.50/sf NNN to $25.79/sf NNN from 2011 to 2015.

- Leased the property to 94% occupancy rate and facilitated the sale to Accesso Partners at end of 2015

Since the Accesso purchase in late 2015, AQUILA completed six lease transactions, including new leases, renewals and expansions for a total of 428,813 sf of space. Starting rents increased from $23.75/sf NNN in 2015 to $28.50/sf NNN in 2021.

Ready to talk about leasing your property?

An AQUILA leasing expert is ready to talk to you. Schedule your consultation today.