Many, many thanks to you for your persistence and assistance in helping us to find a new home for our employees in Austin and negotiate a lease that should serve us well for the next 10 years. We couldn’t have done it without you. I know we’re all happy to have it completed.”

– Global Director of Real Estate, Fortune 500 Company

AQUILA represented a Fortune 500 public company in January 2022. As the world was identifying the new norms post-COVID, this company needed as much time as possible to understand its own new “normal.” As the company was approaching the lease expiration for its +/-100,000-square-foot space, they realized that the existing space was inefficient, outdated, and no longer fit the company’s needs. The challenge became finding a new space that would allow them to downsize their footprint and finish their buildout prior to their existing lease expiration.

The company had the ability to leverage its name and achieve a good deal on their own – but they needed to engage a broker to take their deal from good to great. The company hires commercial real estate brokers in each of their markets based on trust and integrity, best-in-class market intelligence, and the ability to navigate the negotiation process by leveraging their credit. Their past experience with AQUILA proved not only could we drive a process that would receive internal approval from the company, but it would also present a solution that the public markets would not scrutinize by virtue of the fact that it would generate the most favorable results.

To start the process, we began pursuing a building the client was interested in that was bordering their geographic parameters and offering an above-market three-digit TI Allowance. This helped to create immediate and significant leverage with three other buildings in the market. Because of this, after several rounds of negotiation with all of the parties, we leveraged the second option’s economics to significantly improve the final proposal at a fourth building.

Of the three other buildings, only one was on the edge of the location parameters needed. We waited on sending an RFP and encouraged an unsolicited proposal from the landlord. We encouraged the company not to respond to the proposal so that we could position the alternative to that landlord as “pioneering” with regard to tech and engineering talent. Ultimately, the landlord’s long-term desire to drive more office users into the park that are utilizing the tech and engineering talent created more leverage for our client. AQUILA used a strategy typically found in retail developments by positioning the company to the landlord as an “anchor tenant” and a “loss leader” that would “brand” the park as a magnet for large companies for future tech and engineering talent. This statement would not be believable without the company’s occupancy. Accordingly, AQUILA was able to negotiate and achieve economics that was $3.00 per square foot per year less than any other alternative in the market at the time and generated a market-high TI allowance package of $135 per foot.

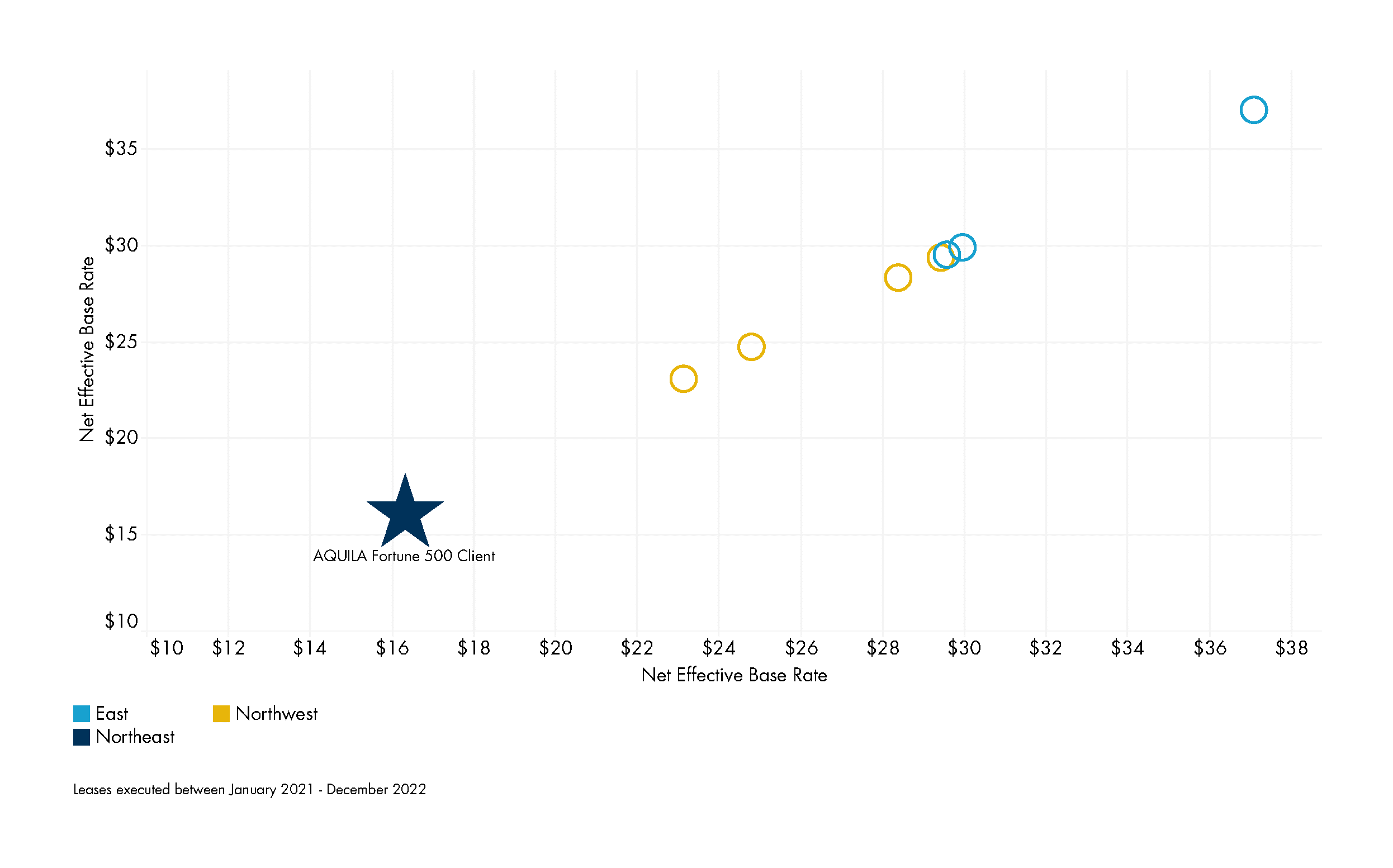

Net Effective Base Rate Comparisons

Prior to founding AQUILA, Jay Lamy represented the Fortune 500 company while he was working at a different firm. Due to these prior lease negotiations representing this client, AQUILA was able to leverage a three-month extension at their current location and at their existing rates. This helped to ensure the company had enough time and flexibility to navigate the permitting and buildout process through the City of Austin which was running serious delays due to post-COVID-19 employment shortages.

As shown in the graph above, the net effective rate terms achieved in this transaction well out-pace any of the other large transactions completed in the same timeframe in Austin dating back to January 2021. This is due in large part to the record-setting tenant improvement allowance.

We were able to reduce the company’s square footage by almost 14,000 square feet and helped them occupy a building that is more efficient and less expensive. Additionally, we used transaction-specific market intelligence and incorporated one of our foundational company values of authentegrity to negotiate with the landlord. This resulted in generating over 36% savings on GAAP Rent and 153% of NPV Rent utilizing the tenant’s trailing twelve-month return on assets as compared to the initial proposal. This means that the upfront benefits were so enormous, the landlord should be happy its return on capital is not equal to that of the tenant or they would have lost money.

Ultimately, because of all these efforts, we drove savings for the Fortune 500 company to over $8.4 million over the life of their lease.

Ready to talk about finding your next office space?

An AQUILA tenant representation expert is ready to talk to you. Schedule your consultation today.