This article was originally published in AQUILA’s 4Q 2020 Austin Office Market Report. This article will not be updated, but please contact us if you have specific questions regarding the information in this article.

Since the pandemic started in early 2020, a phrase I’ve heard referenced time and again is that we will begin to see a “flight to quality” amongst office tenants. The consensus seems to be that, as the recession progresses, the leasing expense delta between new office buildings and existing ones will begin to decrease, leading active tenants to increasingly favor new supply and best-in-class options.

Read Next: 2020 Recap: 5 Largest Office Leases in Austin, Texas

While this idea makes intuitive sense, we were curious to see if a shift is truly underway in the Austin market and, if so, to what extent. In this article, we examine leasing volume in new versus existing office buildings in the Austin market since April 2020.

Are Tenants Leasing More Space in New Office Buildings in Austin?

The Austin office market has seen a total of 2,378,394 square feet of new leases signed since April 1, 2020. This is roughly 4% of the total existing and under-construction space defined by our data set. In other words, tenants signed new leases in 4% of the Austin office market, both in existing buildings and in new developments. For reference, in 2019 the Austin office market saw 9,394,190 square feet of new lease transactions, or roughly 14% of space within the market transacted.

Total New Leases

|

2019 9,393,190 SF |

April 2020 to December 2020

2,378,394 SF |

Existing and Under Construction Market Size

|

2019 65,974,856 SF |

April 2020 to December 2020

67,328,731 SF |

Clearly, the Austin office market has been significantly impacted by COVID-19, but it is, in fact, the distribution of new leases that is most interesting.

Read Next: See how COVID-19 has affected the Austin office market in our Austin Office COVID-19 Dashboard

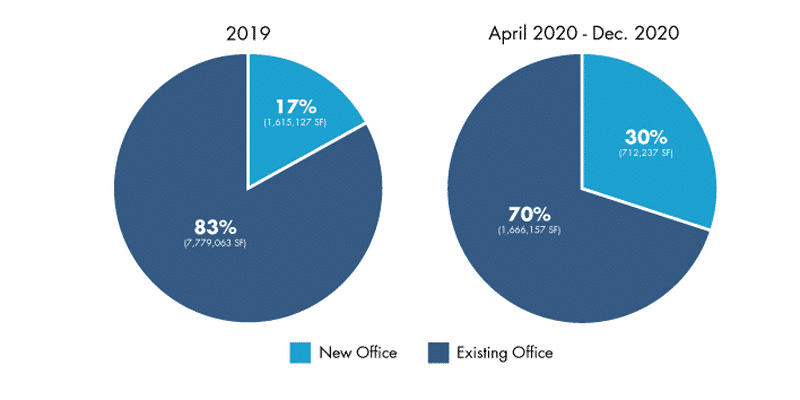

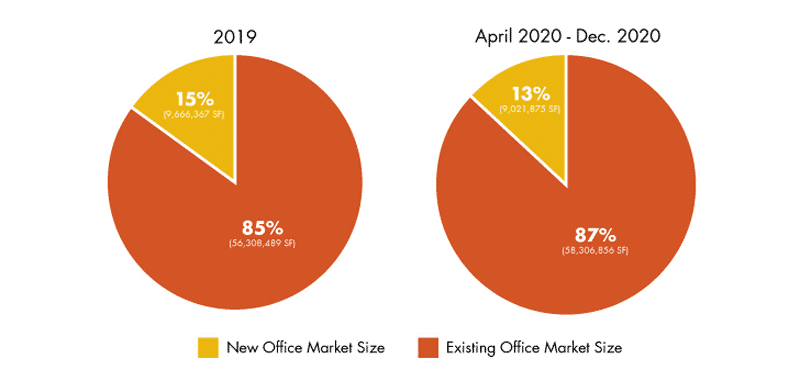

Since April 2020, 30% of new leases were signed in new office buildings, which make up only 13% of the market. In contrast, 70% of new leases were signed in existing buildings, which comprise the other 87% of the market. For comparison, in 2019 new buildings accounted for 17% of new leases, while existing buildings accounted for 83%. In other words, leasing activity in new buildings roughly doubled in 2020 compared to 2019 in proportion to total leasing activity.

New Leases in New vs. Existing Office Buildings

New vs. Existing Market Size

To put these facts and figures in simpler terms, this means “new” office buildings saw a comparatively greater volume of leasing activity on a percentage basis in 2020 than they did in 2019.

As for the size of these new leases, 2020 and 2019 remained relatively similar when it came to leases in new buildings. The average size of a new lease in a new building in 2020 was 23,741 square feet, compared to 21,655 square feet in 2019 (a 9.6% increase). By comparison, leases in existing buildings saw a much greater change on a percentage basis. Leases in existing buildings averaged 3,121 square feet in 2020 and 5,054 square feet in 2019, a decrease of nearly 40%.

While making an exact comparison is difficult due to the fluctuations in leasing volume from year to year, the trend from a percentage basis is still in line with the idea of a “flight to quality” and paints a picture of how this trend is taking shape in Austin.

What This Means for Landlords

Landlords of recently and soon-to-be delivered office buildings will likely see leasing activity on those buildings occur sooner compared to the older, existing buildings in their portfolio. Whereas customers for second-generation space are fewer and farther between at the moment, customers interested in new space are still relatively active in the market. Although many office buildings are expected to deliver mostly or fully vacant in 2021, this flight-to-quality trend will likely lead to those spaces being leased sooner once transaction volume begins to return to historically normal levels.

For landlords without “new” space, an emphasis on higher TI allowances and upgraded amenities could help frame an older building as a quality option.

Learn More: Download our latest Austin Office Market Report

What This Means for Tenants

Tenants looking for office space in Austin need to understand this trend as they enter the site selection process. Newer, higher-quality spaces will come at a premium compared to their older counterparts, so tenants will need to be prepared to pay a higher rental rate (and potentially receive fewer lease concessions) than they would in an older building. That said, tenants looking to make the flight to quality will have plenty of space to choose from as projects deliver throughout 2021.

If a tenant doesn’t mind leasing space in an older building, in the short term they will likely be in a strong position to negotiate favorable rent concessions.

Methodology

All data used in this analysis is from CoStar and AQUILA market data. The Austin office market was defined as existing office buildings plus current developments. New office buildings were defined as properties built in 2020 (2019 for 2019 numbers) or buildings that are currently under construction or expected to break ground soon. Existing buildings were defined as properties built prior to 2020 (prior to 2019 for 2019 numbers). Leasing volume was based on new leases only, not renewals.