This article was originally published in AQUILA’s 3Q 2020 Austin Office Market Report. This article will not be updated, but please contact us if you have specific questions regarding the information in this article.

Usually, in my reports, I stick to writing about Austin’s commercial real estate market. But for this quarter’s Eagle’s Nest, I decided to dig into our city’s residential market and see how COVID-19 has impacted it. But I’m not just digging into the residential market for the fun of it. The residential market is an important building block of a strong office market.

Residential real estate markets help attract and retain a desirable talent pool, which then attracts the companies responsible for filling office spaces. However, housing markets can also negatively impact the talent pool if it becomes too expensive or challenging for employees to live and work in the area. Understanding how Austin’s housing market is performing today can give you a better idea of how the office market might perform in the future.

In this article, I take a look at three key areas of Austin’s housing market, including:

- Transaction volume pre- and post-COVID-19

- Pricing changes

- New residential development

Austin’s Housing Market Transaction Volume Pre- and Post-COVID-19

Transaction volume is an important indicator in the residential real estate world. By looking at how many homes are being put on the market, how many are sold, and the average amount of time in between, you can get a good sense of the market’s health.

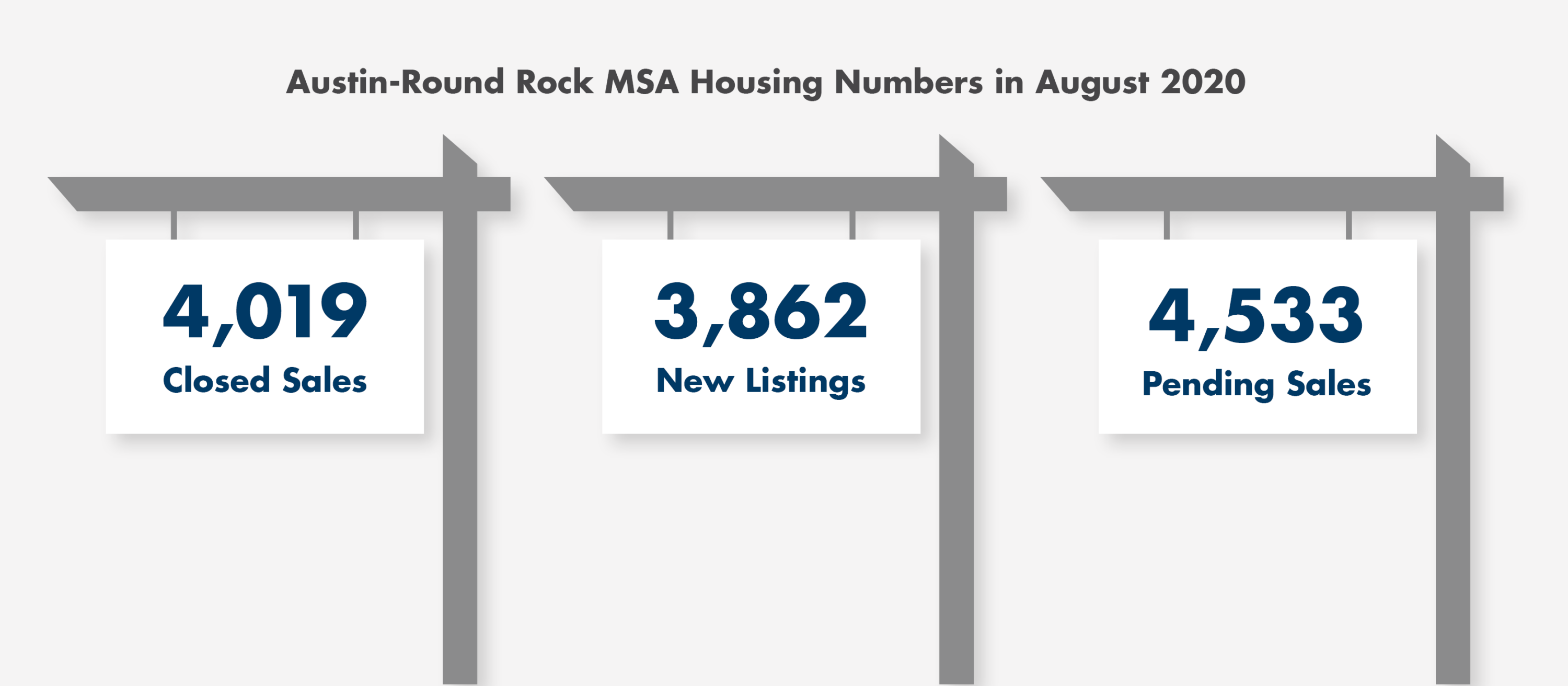

According to the Austin Board of Realtors, the Austin-Round Rock MSA saw a total of 4,019 closed sales in August 2020, an increase of 12% compared to August 2019. There were also 3,862 new listings and 4,533 pending sales.

The “months of inventory” in the Austin-Round Rock MSA was only 1.4 months in August, a decrease of 1.2 months from the year before. Average days on the market also decreased by 10 days since last year, currently sitting at 42 days.

Months of Inventory: How quickly all the existing homes on the market would be sold assuming no new homes are listed.

In other words, more homes are not only being sold faster than a year before but so many are being sold that the available inventory can’t keep up with demand.

Some of this increased demand likely has to do with people looking to relocate from more densely populated, less affordable cities. A survey conducted by Redfin in May 2020 showed that roughly 50% of respondents in New York, Seattle, San Francisco, and Boston would move away from those cities if they could continue to work from home permanently.

While this movement from densely populated cities was already occurring prior to COVID-19, the pandemic has further highlighted the benefits of living in a city like Austin.

Another factor playing a role is the increased demand being driven by Tesla employees. Tesla executives had already started searching for homes only weeks after Tesla announced it would be building a factory in Austin, and with an estimated 5,000 new jobs being created it’s likely that many of those employees will be participating in Austin’s residential market soon.

With numbers like these, it’s clear to see that the Austin area’s residential market has actually heated up as a result of COVID-19, at least compared to 2019.

An aerial view of houses in West Lake Hills.

While this increased activity is good from a housing market perspective, from a potential employee’s perspective it might be concerning. Employees currently residing in Austin aren’t significantly impacted by the lack of inventory, but employees considering moving to the area might have difficulty finding housing in the location or price range they require. If the available inventory continues to decrease, employees could start looking elsewhere and taking their potential employers with them.

There’s a fine balance between too much inventory and too little, so it will be interesting to see how these numbers continue to change over the coming months.

Pricing Changes in Austin’s Housing Market

As one would expect, a mix of high demand and decreasing supply has led to an increase in home prices across the Austin-Round Rock MSA.

According to Zillow’s Home Value Index, the typical value of a home in Austin was $426,000 in September 2020, up 14% from the year prior. For comparison, the typical price in January 2020 was only $397,000, meaning home values have increased by $29,000 in less than a year, all while going through a global pandemic.

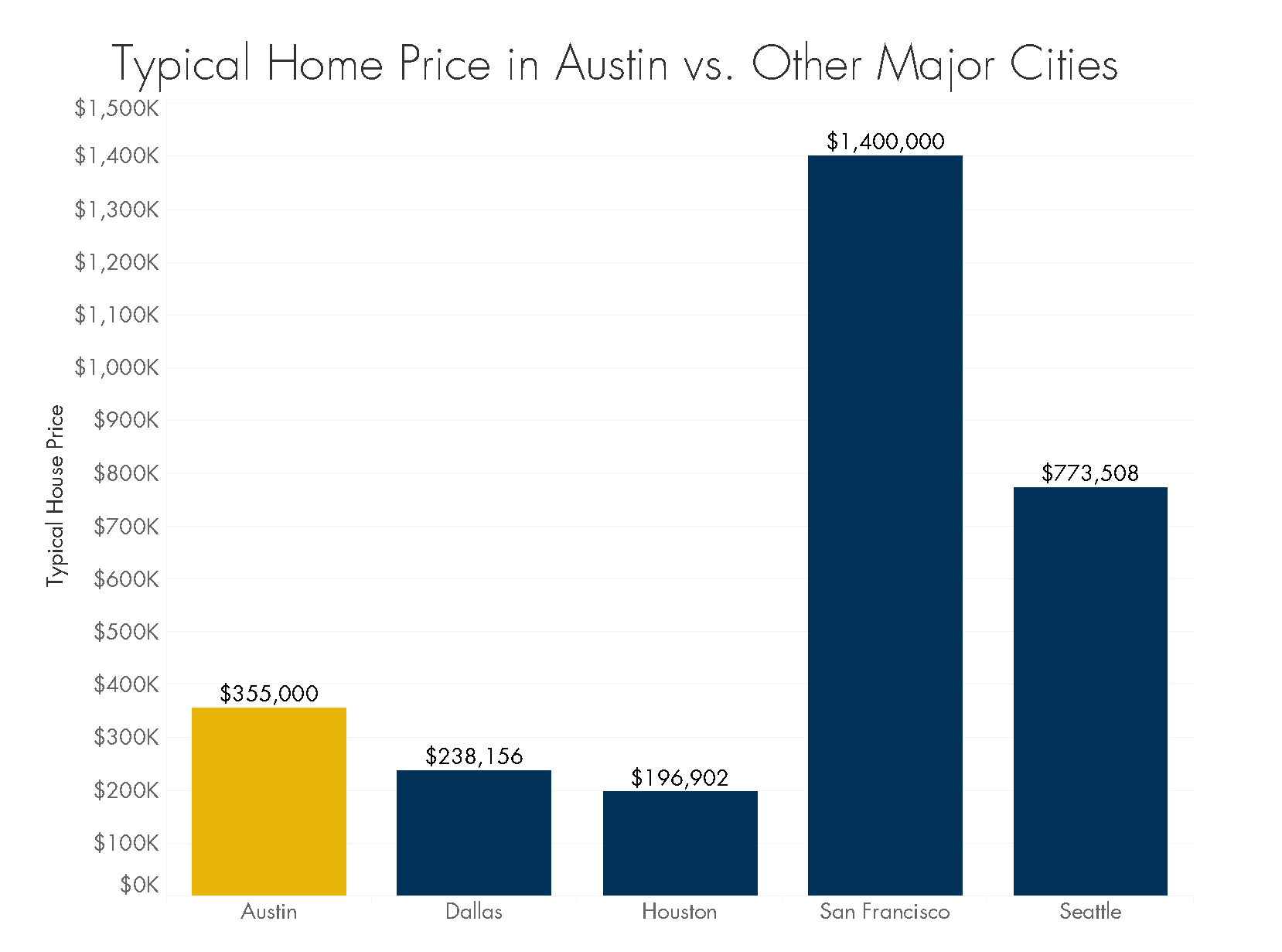

Similarly to the decrease in available inventory, an increase in home prices could be concerning for Austin’s talent pool. However, because many employees are relocating from far more expensive cities like Seattle and San Francisco, home prices in Austin are still vastly more affordable than what these employees are used to.

According to Zillow, the price for a typical home in Seattle today is $773,508 and in San Francisco is $1.4 million. Homes in Houston are currently valued at $196,902, and Dallas at $238,156. While Austin may have one of the more expensive housing markets in Texas, it is still a very affordable option for employees wanting to relocate.

Multifamily pricing has also seen an impact from COVID-19, but in the opposite way as single-family homes. According to CoStar, the average rental rate in Austin today is $1,286, a decrease of roughly 3% from a year ago. This is the largest year-over-year rental rate decrease Austin has seen in many years and is one of the largest rent decreases of any U.S. city this year.

The national rental rate average has remained relatively flat so far in 2020, so it’s interesting to see that Austin’s rental market has gone in a different direction than the country as a whole. It’s hard to say exactly what caused this, but a mix of several thousand new units being delivered to the market over the past few years (Austin built more apartments in the first half of 2020 than any other U.S. city) and an increase in multifamily vacancy have undoubtedly played a role.

However, as long as single- and multifamily housing prices can remain relatively stable through the end of the pandemic, the housing market should present some great opportunities for employees looking to live and work in the Austin area.

New Residential Development in Austin

With Austin being such a development-focused city in recent years, there has been a lot of discussion about what impact COVID-19 will have on new developments. Will new developments continue to be pursued despite the uncertain future?

For the most part in the residential market, the answer seems to be yes.

Whisper Valley in Manor, for example, is one of the larger residential developments happening in the area and is still moving forward. According to the Austin Business Journal, the project will comprise roughly 5,000 homes, 2,500 apartments, and an assortment of stores, offices, and schools.

Easton Park in Southeast Austin is also continuing to move forward and is building and selling homes at a rapid pace. Current estimates indicate roughly 500 homes will be built and sold in the community this year, with another 500 expected to be built next year.

According to the City of Austin, there have been roughly 24 million residential construction-related permits issued in 2020 so far. This is more than any previous year except 2019, which had slightly over 28 million permits issued. The fact that there are still a few months left in 2020 combined with residential developers having to contend with a pandemic, temporary construction shutdown, and new social distancing and worksite safety requirements, it’s impressive to see these numbers so close together.

The one caveat, however, is that 14.8 million of the 24 million are made up of permits for multifamily projects that will house five or more families, which have historically been more impacted by tough economies than single-family permit numbers. It will be important to watch the volume of those permits moving into 2021 to see how much of an impact COVID-19 has had on those projects.

Overall though, residential construction appears to still be moving forward at a steady pace and should be able to alleviate some of the reduced inventory the market is seeing today.

Conclusion

Austin’s residential real estate market is clearly holding strong despite the challenges presented by COVID-19, and may even come out of the pandemic stronger than when it went in. Its current lack of inventory and increasing prices could create some challenges for Austin’s growing talent pool, but those temporary drawbacks likely won’t dissuade employees and the companies that employ them from choosing Austin in the long run.

As long as current and prospective homeowners continue to see Austin as one of the best cities in the country to live, work, and play, our city should have no issue continuing to attract the best talent and companies.