As a Texas commercial property owner, your property taxes can make up a large portion of your monthly expenses. Understanding what you’re paying can be difficult at times, but it’s essential to know where your property taxes come from and how they work.

Looking for information about commercial property taxes in Travis County? Read our article Commercial Property Tax Rates in Austin, Texas.

Read Next: The Ultimate Guide to Hiring a Commercial Property Management Company

At AQUILA, we ensure our commercial real estate investor, developer and corporate clients are educated on the Austin market every day. One thing our clients frequently ask us about is the property taxes in various counties. Austin is primarily in Travis County, but with Williamson County to the north and Hays to the south, it’s important to know the differences in each Austin MSA county.

To help answer this question for Hays County and Williamson County, we’ve examined the following questions in this article:

- Who sets property taxes in Williamson and Hays County?

- Which jurisdictions can affect these rates?

- How are tax rates calculated?

- How to find the tax rate for a specific property?

Who sets property taxes in Williamson and Hays County?

According to the Williamson County website, tax rates are set by the governing bodies of the applicable taxing jurisdictions for a particular property. Since the state of Texas doesn’t have a standard state property tax, the decision falls on local entities. Property owners are encouraged to express their views at their taxing jurisdiction’s tax rate public hearings.

School districts and counties are typically the primary taxing entities in most areas, and Williamson and Hays County are no exception. There are also other entities that might further impact a particular property’s tax obligation such as emergency districts, cities, and so on.

Texas caps how much the commercial property tax rate can increase each year at 3.5%. But, there is no cap on the valuation of your property. This means that if your property value goes up 20%, and your tax rate stays the same you will still be paying 20% more.

The Williamson and Hays Tax Assessor-Collector’s offices have the responsibility of collecting the property tax for each respective county. Meanwhile, each county’s Central Appraisal District handles determining the taxable values and taxing jurisdictions for particular properties. These two offices operate as separate local agencies and are not responsible for setting tax rates or determining property values.

Which Jurisdictions can affect these rates?

Properties in Williamson County and Hays County may be subject to taxes from some or all of the following entities:

- School District

- County

- City

In addition, sometimes properties fall within special districts such as:

- Municipal Utility District

- Water Control and Improvement District

- Emergency Service District

How Much of Your Taxes Go Towards Each Jurisdiction for Williamson County in 2021

| Jurisdiction | % of Total Rate |

| School District | 54.7% |

| County | 20.0% |

| City | 14.6% |

| Special Districts | 10.8% |

How Much of Your Taxes Go Towards Each Jurisdiction for Hays County in 2021

| Jurisdiction | % of Total Rate |

| School District | 58.1% |

| County | 18.5% |

| Special Districts | 11.8% |

| City | 11.6% |

School District Taxes

As noted from the table, and briefly discussed previously, school property taxes make up the bulk of a typical Texas property owner’s tax bill. Approximately 66% of your tax rate in Williamson County and almost 70% of your tax rate in Hays county is likely to be levied from the school district your property sits in.

Of the school districts in Williamson County, Hutto ISD has the highest tax rate at 1.42% in 2021.

| School District | 2021 Tax Rate |

| Coupland ISD | 1.01% |

| Florence ISD | 1.12% |

| Georgetown ISD | 1.23% |

| Granger ISD | 0.92% |

| Hutto ISD | 1.42% |

| Jarrell ISD | 1.37% |

| Leander ISD | 1.34% |

| Liberty Hill ISD | 1.36% |

| Round Rock ISD | 1.13% |

| Taylor ISD | 1.33% |

| Thrall ISD | 1.29% |

Of the school districts in Hays County, Hays CISD has the highest rate at 1.36%.

| School District | 2021 Tax Rate |

| Dripping Springs ISD | 1.31% |

| Hays CISD | 1.36% |

| San Marcos CISD | 1.17% |

| Johnson City ISD | 1.07% |

| Blanco ISD | 1.02% |

| Comal ISD | 1.29% |

| Wimberley ISD | 1.18% |

County Taxes

If you live in Williamson County, another 24.1% of your tax rate comes from county taxes. Similarly, 22.2% of the tax rate in Hays County is a result of county taxes. As shown in the chart below, Hays County has the lower county tax rate at .36%, and Williamson County has a slightly higher tax rate of .40% as of 2021.

| Jurisdiction | Tax Rate |

| Williamson County | 0.400846 |

| Hays County | 0.3629 |

How are tax rates calculated?

According to Williamson County, taxes that are owed by a property owner can be calculated as follows:

Property tax amount = (tax rate) x (taxable value of property) / 100

Since property taxes are levied in proportion to the assessed value of the property, areas with higher-value properties typically pay more in property taxes. Property owners can request a review of their valued commercial real estate space, arbitration by the local appraisal review board (ARB), or file a protest with the county appraisal district.

How do I find the tax rate for a specific property?

Visit the Williamson County Tax Office or the Williamson Central Appraisal District in order to obtain an accurate estimate of what property tax rate to expect.

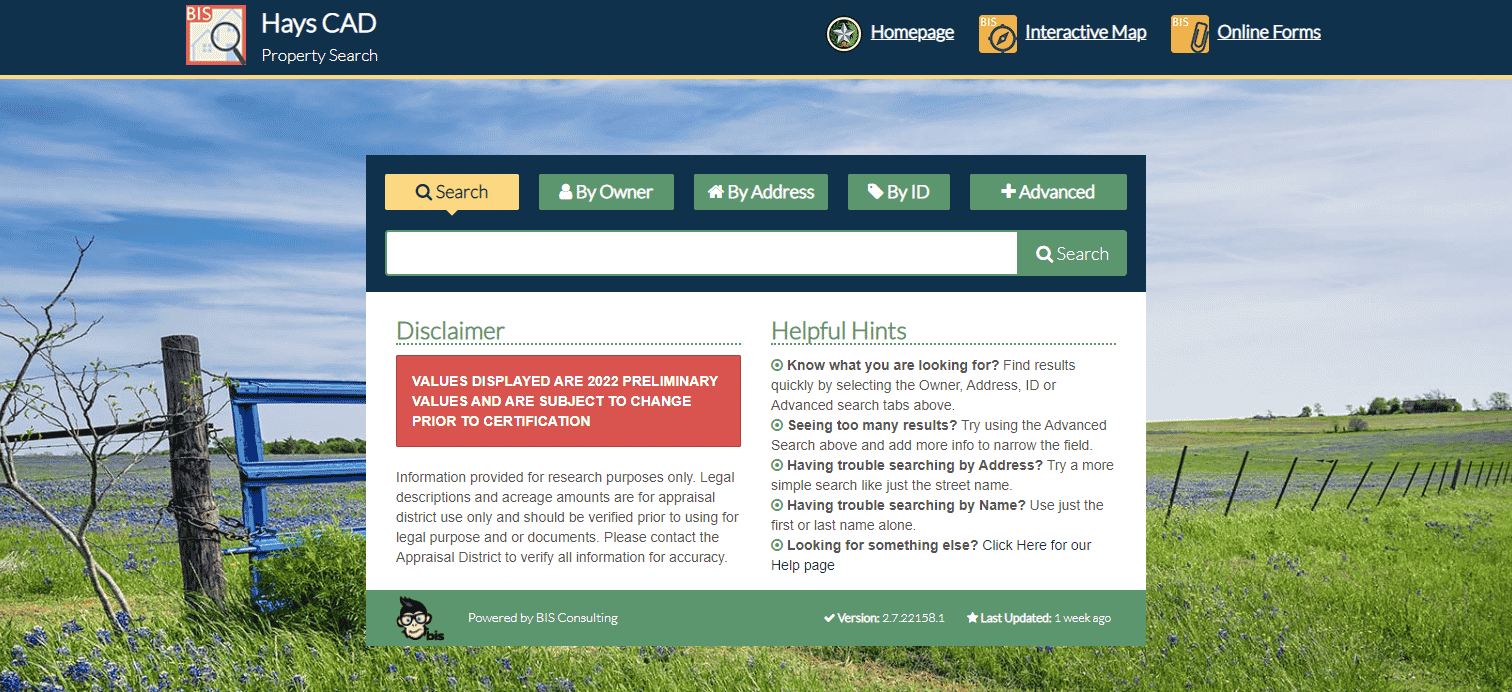

For Hays County, the Hays County Tax Office or the Hays Central Appraisal District are the best resources to use to find property tax rates in the county.

Once you are at your respective appraisal district’s website, the rest of the search process is fairly straightforward. By clicking the “property search” tab, you can find any property in that region.

To find a property, enter the address on the search line and you’ll come across a page that has the owner’s name, preliminary appraisal value, and more details.

Need assistance understanding your property taxes?

When considering purchasing a property, it’s important to consider the total amount of property taxes you’ll be responsible for paying. It’s also important to assume that your property taxes will increase over time and to make plans for that increase.

By staying informed on property tax rates in your county, you can assure your property or the property you are interested in fits into the budget for you or your company.

To get more information and answers to your questions about a property in Austin, schedule a consultation with one of our commercial real estate experts today.