Just beyond the downtown skyline lies Austin’s Eastside. Less than a mile from the CBD sits one of Austin’s most authentic, eclectic and rapidly changing neighborhoods. An area that has, for most of its recent history, been a working-class neighborhood is now one of the city’s hippest hangouts.

This article was originally published in AQUILA’s 2Q 2016 Austin Office Market Report and will not be updated. Please contact us if you have specific questions regarding the information in this article.

Named one of the hippest neighborhoods in the country, coffee shops, bars, breweries, and taco stands can be found just steps from rows of quaint two-bedroom houses that have stood there since the days of the Great Depression.

In this article, we will discuss:

- The history of East Austin

- What the East Austin office market looks like today

- The East Austin Submarkets

- What’s under construction in East Austin

- What the emergence of East Austin means for you

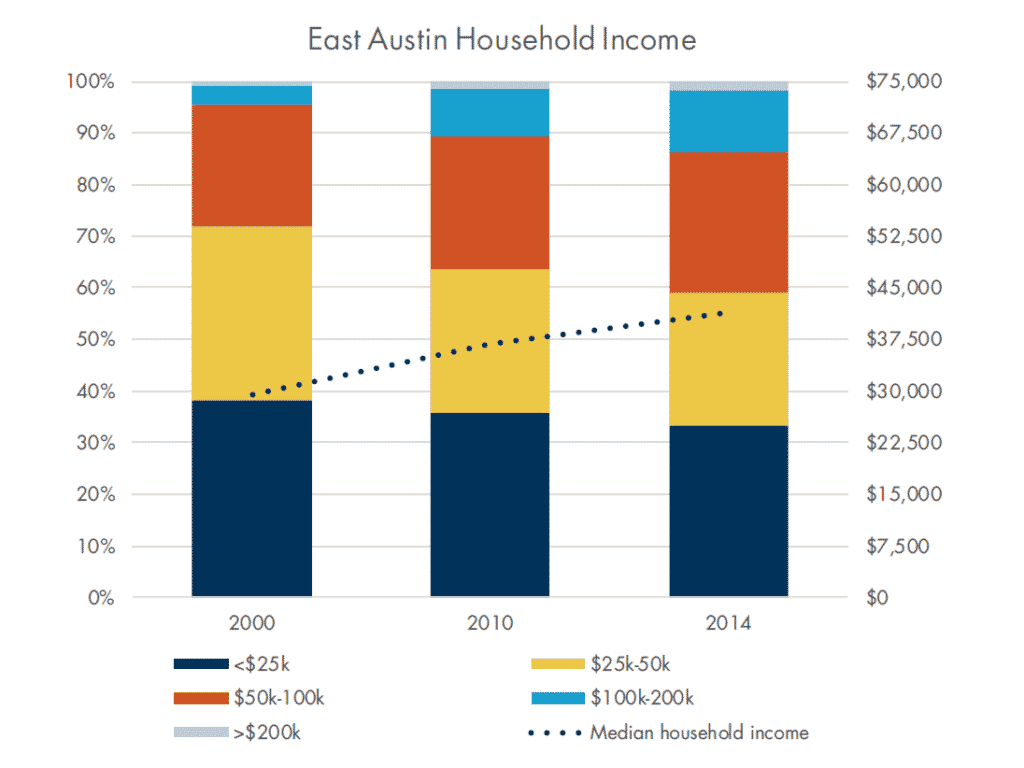

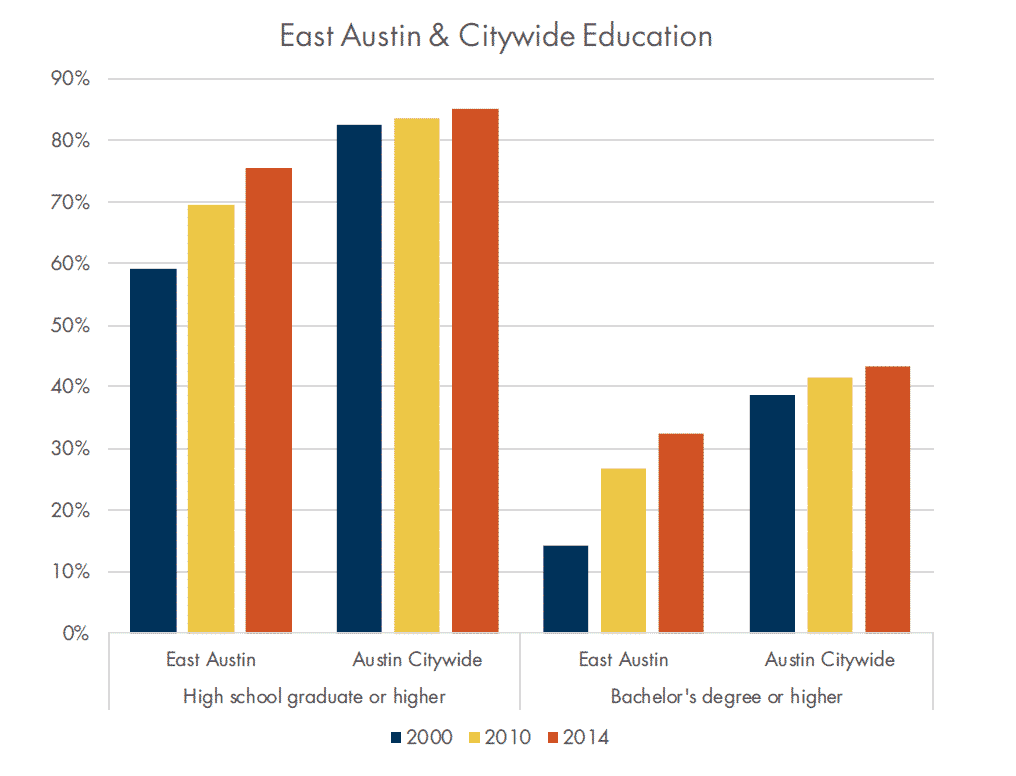

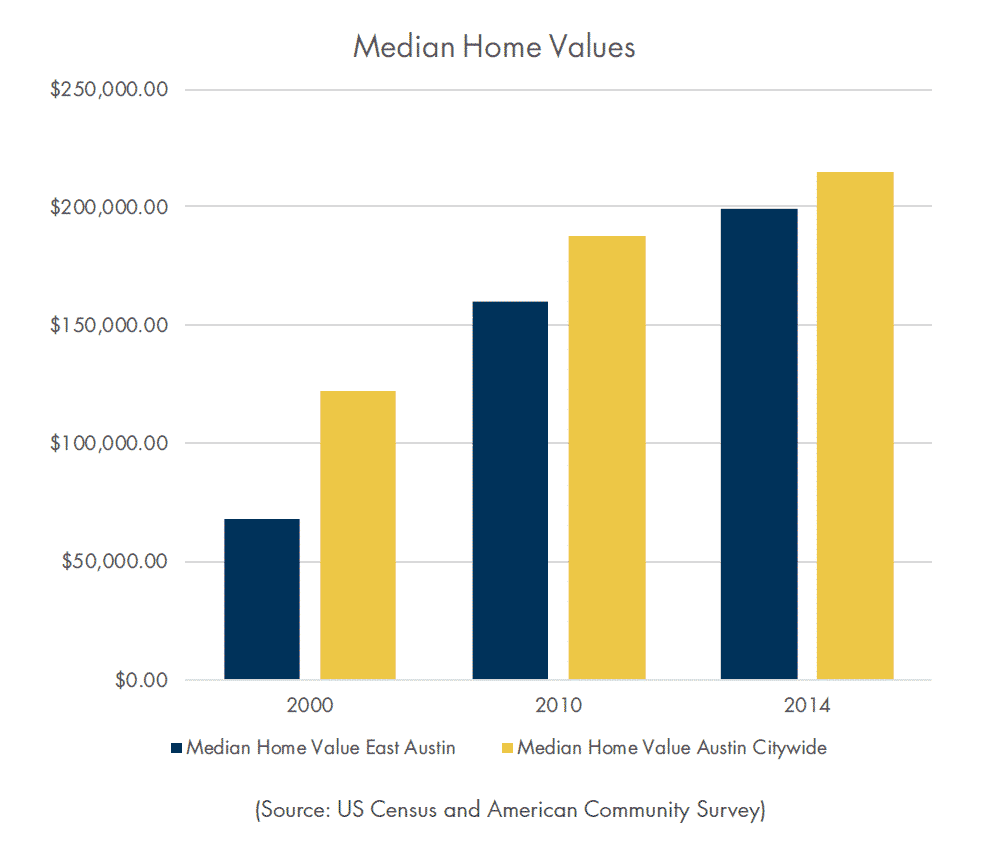

In 1990, out of the 21 census tracts that make up the “Eastside,” 15 were eligible for gentrification, but only one actually achieved gentrification status over the next ten years.1 In 2000, eighteen tracts were eligible for gentrification, and all but four of those have achieved it today – more than all other eligible tracts in Austin combined.

Over the past decade, East Austin has become a hotbed for house flippers, graduate students, young professionals, and new families. Multifamily development has skyrocketed, drawing a new demographic to live in the neighborhood. Over the past six years, more than 1,700 multifamily units have delivered on the Eastside. As of the second quarter of 2015, there were another 1,900 multifamily units under construction, with almost one thousand more approved for development and ready to break ground.

To see the appeal of the neighborhood is easy: its relative affordability within the city, proximity to downtown, and rich culture have made it a popular place to live and play. And now, the authenticity and sense of quirk that originally drew in Austin’s creative class is attracting new office prospects as well.

The Eastside is serving up to tenants what it is they are looking for: close proximity to CBD, affordability, a plethora of nearby amenities, diverse transportation options, and “creative” office space build-outs.

As rents in Austin’s three primary office submarkets steadily climb, demand has increased for well-located, amenity-rich alternatives. In the current real estate cycle, East Austin has emerged as a front-runner to be Austin’s next established office market.

A Different Office Product in East Austin

While many of the Austin office buildings AQUILA traditionally analyzes are large, Class “A” multi-tenant properties with built-in amenities such as fitness facilities, delis, etc., the office projects rising on the east side are of quite a different ilk. You won’t find high rises or large, sprawling corporate campuses here. Instead, offices on the Eastside range from converted warehouses to new mid-rise, mixed-use construction. These office projects often embody the eclectic vibe of the neighborhood, giving way to multiple “creative office” projects under development.

Given the unique positioning of East Austin within the overall office market, this budding area offers spaces to suit the needs of different types of tenants. Typical spaces offer open ceilings, stained concrete floors, and exposed brick and ductwork. Floorplates are also smaller than those in the other primary submarkets, resulting in more open layouts. This is largely due to the land use and development restrictions that run through much of the Eastside.

Some of the built-in amenities typically found in the other submarkets aren’t found in Eastside office projects. Rather than having an on-site deli or fitness area, offices capitalize on the abundance of pre-existing retail within walking distance. Some companies even offer credit to their employees to make use of nearby fitness studios.

Much like the houses in the area, the office buildings each have their own unique architecture. Eleven11, for example, features a rust-colored facade with a striking cantilevered terrace covering the sidewalk below. Further east, you will find old warehouses converted into creative office suites alongside breweries and bistros. These aesthetics and amenities tend to attract a millennial-minded tenant base.

East11 is an example of creative office that can be found in Austin’s Eastside.

While established accounting or legal firms continue to look for space in the Southwest, Northwest, or CBD, Eastside office projects are competing instead to attract more creative tenants such as advertising, media, music, and web-design companies, which are the fastest-growing segments of talent moving to Austin, and more specifically the Eastside.

Defining the East Austin Submarket

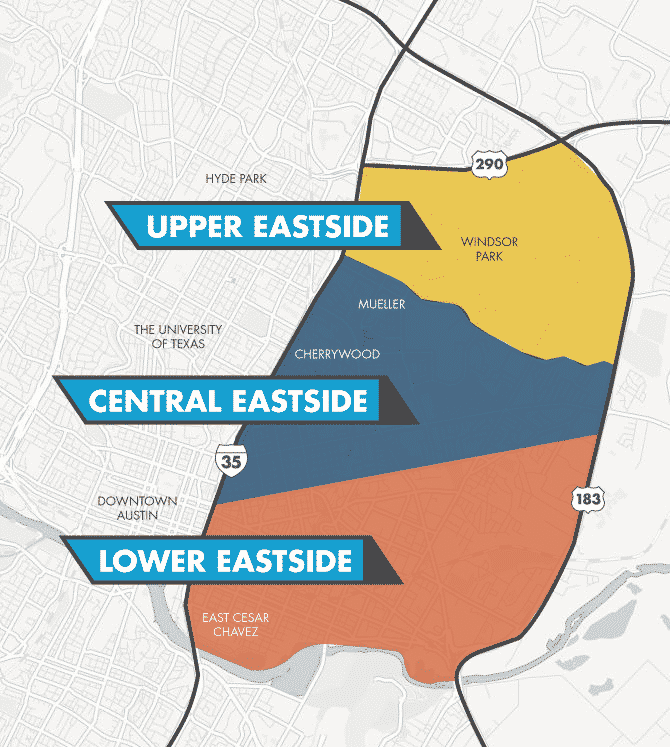

Lower Eastside

The Lower Eastside is comprised of the area north of the river, west of 183, and south of 12th Street. This micromarket is so close to the CBD—just across I-35—that it is almost an extension of downtown itself. The city has instituted several measures to help facilitate growth in the area, and the area has responded favorably.

Here you will find the highest density of bars and restaurants outside of downtown. The East 6th Street entertainment district, for example, has seen an explosion of college students and young professionals spending their weekends in the area, whereas the thought of crossing I-35 on a Saturday night was not even a consideration just five years ago. Now, locally-owned businesses thrive east of downtown, bringing in customers who might live just blocks away or across the country on vacation. What was once a generally overlooked neighborhood full of worn-down houses is now being redeveloped into a tourist destination live with contemporary homes and nationally-renowned boutiques, bars, and restaurants.

The increase in popularity can be partially attributed to the city designating East 6th as a core transportation corridor, allowing increased traffic flow to and from downtown. The added ease of access has given rise to thousands of Class A multifamily units being developed over the past decade, with many more under construction and in the planning stages.

The Whisler’s patio on East 6th Street.

Developers are also taking advantage of the Lower Eastside’s popularity with several mixed-use projects. One such project, Eastside Village, is currently under construction and offers both a new Class A office building (recently purchased by CIM Group in June) and 800 multi-family units atop ground floor retail. Tenants who have signed on at Eastside Village early to take advantage of the excitement of the area include C3 Presents, who relocated their headquarters from downtown, and Conde Nast, who will be opening their new Digital Innovation Center in the building.

Blocks away from Eastside Village will be Endeavor Real Estate Group’s Plaza Saltillo, which will offer over 100,000 square feet of retail and office space, a public park, and 800 residential units. Plaza Saltillo is one of the city’s two designated Transit Oriented Development (TOD) sites on the Eastside. The TOD presents an exciting opportunity for tenants to capture a whole new mix of commuters who will be brought to their

area from as far away as Leander via MetroRail. Endeavor’s involvement on the Eastside is a testament to the area’s high demand for office product. The developer of The Domain in Northwest Austin first dipped their toes into Lower Eastside waters with a little project at 2021 E. Fifth Street in 2013. Targeted towards the creative workers that reside in the area, the project was quickly preleased by EnviroMedia, one of Austin’s most notable marketing firms. The success of the development has since been followed by another, larger proposed office project, 901 E. 6th, which is still in the planning stages.

Adjacent to Eastside Village and Plaza Saltillo are two more multi-use office developments: The Foundry by Cielo and Fourth & by Capsa Ventures. Currently under construction, these two projects combined will feature over 100,000 sf of office space and 115 residential units. Although smaller than Transwestern’s and Endeavor’s developments, the rise of these live/work/play solutions attest to the growth of the Lower Eastside’s popularity, proving that just one or two developments are not enough to capture all of the demand in the area.

While large ground-up mixed-use redevelopment projects like the Eastside Village and Plaza Saltillo are getting most of the hype on the Lower Eastside, there is a plethora of smaller projects that continue to

change the landscape. Central Austin Management Group, for example, has two projects along Springdale Road – Canopy and Springdale General – that will include over 200,000 sf of space across more than 15 buildings. Also in planning stages is 1719 East 2nd Street. Much like the recently delivered 2400 Webberville and 1711 Cesar Chavez projects, this 10,000 sf project embodies the “creative” solution that small marketing and technology firms are looking for on the Eastside: white-box conditioned with custom finish-outs at a low rent.

Some of the greatest potential on the Eastside lies in redeveloping existing owner-occupied offices into multi-tenant, Class A buildings. Prime examples of such projects are the former Goodwill Career Academy building at East 6th and Chicon Streets and the Capital Area Rural Transportation System office less than a block down the street. These projects—recently sold to office developers—will add over 200,000 sf to the market. Riverside Resources has four total sites of this kind under ownership on the Lower Eastside awaiting lead tenants to break ground on potentially 300,000+ sf of space between the four of them.

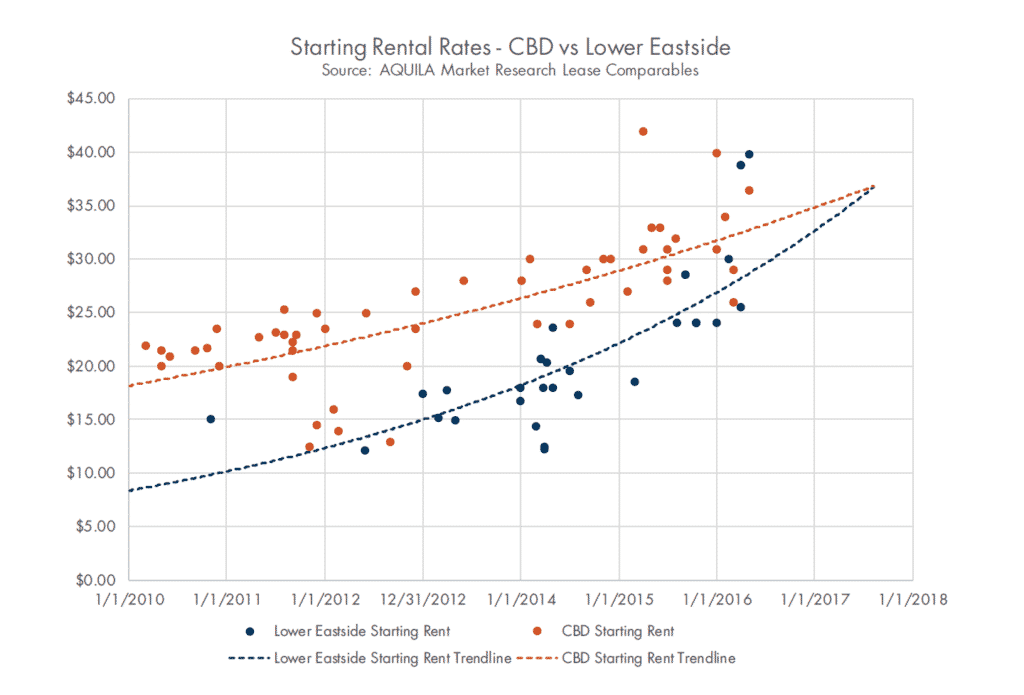

As demand for limited downtown space increases, the rise of the Lower Eastside as an extension of downtown appears to be imminent. As shown in the graph above, starting rental rates are quickly approaching downtown levels for new deals done on the Lower Eastside. While rates have historically hovered around 60% of those in the CBD, recent deliveries of Class A spaces within the past year have fetched rates on par with those in older buildings downtown. With over 800,000 sf of office product in its pipeline, the Lower Eastside is set to prove itself as a major player for centrally-located Austin office space.

Furthermore, Reconnect Austin plans to physically remove the greatest barrier between downtown and the Lower Eastside: I-35. The Reconnect Austin plan proposes to bury I-35 underground and literally bridge the gap between downtown and East Austin with surface-level walkways, mixed-use buildings and open areas. While such plans will likely not be realized anytime soon, they point to the growth of East Austin as a primary urban area.

Central Eastside

To the north of 12th Street from the Lower Eastside lies the Central Eastside. The Central Eastside extends up to 51st Street and East to Highway 183. If the Lower Eastside is considered an extension of downtown,

then the Central Eastside would be considered an extension of the University of Texas. Just east of I-35, UT has its baseball and softball fields, as well as several administrative buildings. The university is still in the market to purchase and redevelop lots as it expands its footprint.

The Central Eastside is tamer than the Lower Eastside, as residents are typically graduate students or young families, often new to Central Texas. To that end, multi-national retailers are more apt to lay claim to

this area, most notably in the Mueller Community. After Austin’s first civilian airport, Robert Mueller Municipal Airport, was replaced by Austin Bergstrom International Airport in 1999, the 700-acre site was redeveloped into a Planned Unit Development (PUD) by Catellus. The area is replete with single and multifamily housing for over 13,000 residents, 4 million square feet of office and retail use, and over 100 acres of public open space. The development is nearing its final stages of construction, with the majority of commercial space completed with the exception of several build-to-suit opportunities.

The most notable tenants of the Mueller district include Seton Healthcare’s administrative campus and Texas Mutual Insurance Co., which announced in April that it will be building its new corporate headquarters next to Dell Children’s Medical Center – one of largest office deals of the year at 270,000 square feet. The close proximity to the new UT medical school and Dell Children’s Medical Center makes the area desirable to medical office users.

The Central Eastside is also home to Austin’s second transit-oriented development east of I-35: MLK Station. Cityline Companies LLC is planning the Cityline at MLK Station development. Set to deliver in 2017, the CityLine Development will offer over 130,000 square feet of office space, 11,000 sf of retail, and 36,000 square feet of residential townhomes, as well as a structured parking garage. Currently under construction across the street, the MLK Station Apartments will also offer 355 multi-family units as well as 11,000 square feet of restaurant and retail space. 100,000 square feet of office space already exists at MLK Station. Completed in 2015, 2921 East 17th Street Buildings B-D are fully leased and home to several Austin nonprofits, including Sustainable Food Center, PeopleFund, Creative Action, and Interfaith Action of Central Texas.

Thoroughfares such as Airport Boulevard, Manor Road, and Martin Luther King Jr. Boulevard are examples of core transit corridors connecting the Central Eastside to the rest of Austin, and many retailers are capitalizing on the added traffic generated by the increased accessibility. Manor Road, for example, has several of the hippest new bars outside of the downtown and East 6th areas, as well as Salty Sow, one of Austin’s must-eat restaurants, as evidenced by Michelle Obama’s recent patronage during this year’s SXSW conference. Lincoln Ventures is one of the first office developers to capitalize on the Manor Road frenzy with two creative office buildings under construction at The Station on Manor – just blocks away from the MLK Station TOD – and another mixed-use development set to break ground later this year: 2015 Manor, which has already signed Texas Mutual Insurance Company for approximately 270,000 square feet.

Upper Eastside

The Upper Eastside, defined by the area north of 51st Street, south of Highway 290, and west of Highway 183, is the least developed office market. Here you will find mainly older, Class B and C office buildings along the highways and mid-to-late-century homes in between. The area is not to be dismissed, however, as just north of Highway 290 lie several industrial complexes, and many would argue that the Lower and Central Eastside looked much like this area does now just a few decades ago. As the popularity of East Austin continues to grow, tenants and residents alike will surely desire the next, hippest spots with affordability and proximity to downtown. Furthermore, with Round Rock just to the north and quickly expanding down I-35 as plans are set in place to ease the traffic flow, the two growing areas will have to meet somewhere in between.

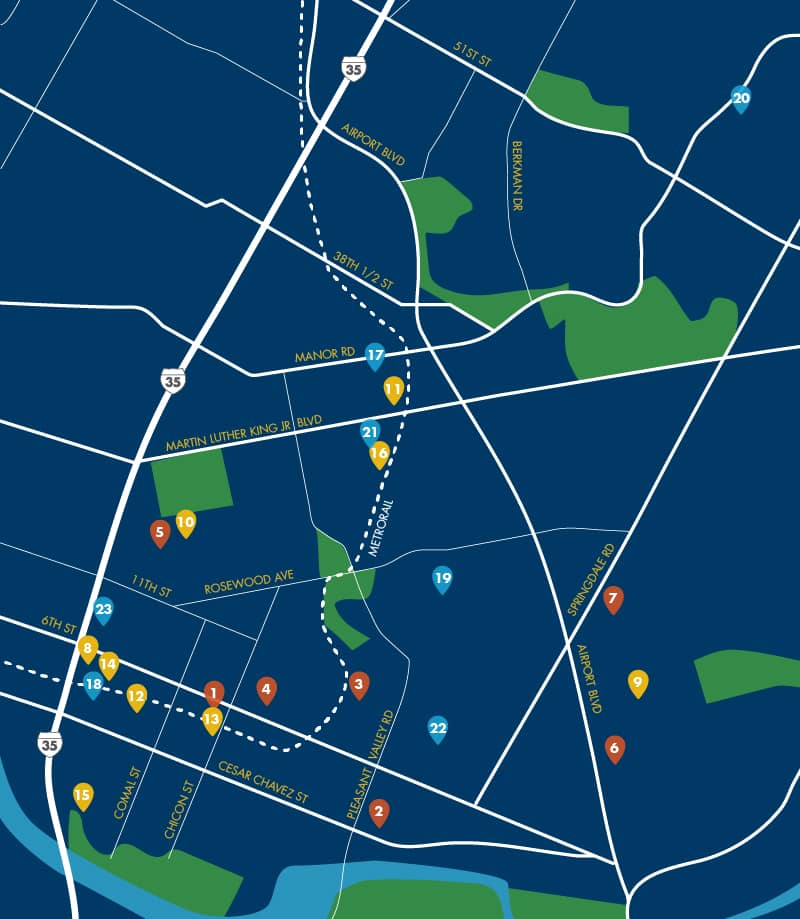

What’s Under Construction on the Eastside?

Below is an overview of the office, mixed-use, and multifamily developments underway on Austin’s eastside.

| Office Developments | |||||

| Project Name | Status | Completion Date | Office SF | Developer/Owner | |

| 1 | 1801 East 6th | Under Construction | 2019 | 134,367 | Riverside Resources |

| 2 | 2903 E 2nd | Proposed | 2019 | 5,000 | TBD |

| 3 | 728 Northwestern Ave | Proposed | 2019 | 10,000 | Equitable Commercial Realty |

| 4 | East6 | Under Construction | 2019 | 115,000 | AQUILA Commercial |

| 5 | 1224 East 12th | Under Construction | 2018 | 30,000 | Pollen Architecture |

| 6 | 1001 Shady Lane | Proposed | 2019 | 10,200 | Weitzman |

| 7 | Springdale General | Under Construction | 2018 | 165,000 | Central Austin Management Group |

| 8 | Springdale General | Under Construction | 2018 | 165,000 | Central Austin Management Group |

| Mixed Use Developments | |||||||

| Project Name | Status | Completion Date | Office SF | Retail SF | Residential Units | Developer/Owner | |

| 9 | 1141 Shady Ln | Proposed | 2019 | 42,288 | 7,714 | – | Bercy Chen Studio LP |

| 10 | 1322 E 12th St | Proposed | 2019 | 8,500 | 24 | Butler Properties | |

| 11 | CityLine at MLK Station | Proposed | 2019 | 134,000 | 11,000 | 22 | Cityline Companies, LLC |

| 12 | Foundry | Under Construction | 2019 | 75,369 | 18 | Cielo Realty Partners | |

| 13 | Fourth & | Under Construction | 2018 | 43,000 | 102 | Capsa Ventures, LLC | |

| 14 | Plaza Saltillo | Under Construction | 2019 | 150,000 | 115,000 | 800 | Endeavor |

| 15 | RBJ Tower II | Proposed | 2021 | 5,000 | 181 | Southwest Strategies | |

| 16 | The Rail at MLK | Proposed | 2019 | TBD | TBD | 235 | Lonestar Development Partners |

| Multi-Family Development | |||||

| Project Name | Status | Residential Units | Completion Date | Developer/Owner | |

| 17 | 2819-2823 Manor Rd | Under Construction | 36 | 2018 | Pegalo Properties |

| 18 | Block 36 | Proposed | 263 | 2020 | Transwestern |

| 19 | Guadalupe-Saldana | Proposed | 90 | 2019 | Guadalupe Neighborhood |

| 20 | Manor Forest | Under Construction | 7 | 2019 | Bunker Lee |

| 21 | Platform – Phase II | Proposed | 200 | 2019 | Lonestar Development Partners |

| 22 | The Guthrie | Under Construction | 310 | 2018 | Argyle Residential |

| 23 | The Tyndall at Robertson Hill | Under Construction | 176 | 2018 | Momark Developement |

This table was last updated in 3Q 2018.

What Does This Mean for You?

For Landlords

The Eastside presents an exciting opportunity to invest in commercial real estate in one of Austin’s fastest-growing submarkets. With so much support from the City of Austin to develop the area, and with more gracious land-use regulations, the neighborhood has certainly not hit its full potential yet. As long as Austin continues to grow, people are going to flock to the Eastside since it embodies so much that Austin stands for: quirky, creative, authentic, and unique. This makes the Eastside more of a competitor to capture the media-type and technology firms that may have historically looked for space in the other primary submarkets. An example of such a company

is Conde Nast. Just five years ago it would have been unimaginable to see a multinational media publishing company sign a lease for space east of I-35. Now, however, the company will feel right at home.

For Tenants

If you’re looking for an opportunity to relocate within Austin, the Eastside is in high demand and can be a great fit for modern tenants. With a burgeoning bar and restaurant scene, employees will be enlivened to office within walking distance of some of Austin’s coolest amenities. Chances are some of your employees are already living there. Time is of the essence though, as rents are growing at a faster pace than in other submarkets. One of AQUILA’s own clients, for example, signed a lease on the Eastside for $12 per sf in 2012. Just three years later they signed another lease on the Eastside for double that amount. With most new build-outs, asking rents are in the low-to-mid-twenties, comparable to those in the Northwest submarket.

Popular Articles:

- Office Pre-Leasing and Speculative Development Trends in Austin, Texas

- 3 Reasons Austin, TX is One of the Most Innovative Cities in the U.S.

- How Office Density Trends Impact Commercial Building Design [Q & A with The Beck Group]

1To be eligible to gentrify, a tract’s median household income and median home value needed to fall within the bottom 40th percentile of all tracts within a metro area at the beginning of the decade. Tracts considered to have gentrified recorded increases in the top third percentile for both inflation-adjusted median home values and percentage of adults with bachelor’s degrees.