Amazon, Apple, Oracle, Facebook, Indeed; these companies and more have filled the headlines of commercial real estate news in Austin for years. Stories of companies leasing huge swaths of office space, building new campuses, and preleasing years in advance have now become so common that they are more expected than they are surprising. But how much space do companies like these actually occupy in Austin? Are they really becoming the dominant players in the market, or do transactions with smaller companies still comprise the bulk of the leasing activity in Austin?

Read Now: Why Austin Is a Great Place for Your Business

As of March 2024, these are the largest office occupiers in the Austin, Texas market:

| Rank | Company | Square Footage |

| 1 | Dell Technologies | 2,040,788 |

| 2 | Apple | 1,536,085 |

| 3 | IBM | 1,401,312 |

| 4 | Meta | 1,269,405 |

| 5 | 1,015,924 | |

| 6 | Amazon | 713,550 |

| 7 | Internal Revenue Service | 678,174 |

| 8 | National Instruments Corporation | 612,000 |

| 9 | Teacher Retirement System of Texas | 592,135 |

| 10 | Oracle | 550,750 |

| 11 | Advanced Micro Devices, Inc. | 472,714 |

| 12 | Charles Schwab | 465,790 |

| 13 | Intel Corporation | 388,430 |

| 14 | The University of Texas at Austin | 336,571 |

| 15 | City Of Austin | 331,305 |

| 16 | Department of Veteran Affairs | 321,009 |

| 17 | Indeed, Inc. | 307,771 |

| 18 | General Motors | 302,604 |

| 19 | Vrbo | 298,815 |

| 20 | Texas Division of Emergency Management | 290,700 |

| 21 | Austin Energy | 274,998 |

| 22 | Travis County | 265,601 |

| 23 | Texas Mutual Insurance Company | 257,364 |

| 24 | The University of Texas System | 241,371 |

| 25 | Arnold Oil Company | 231,188 |

| 26 | Progressive | 217,216 |

| 27 | eBay | 216,000 |

| 28 | Superior Healthplan | 215,812 |

| 29 | Dimensional Fund Advisors | 210,000 |

| 30 | Whole Foods Market | 209,955 |

| 31 | 3M | 204,399 |

| 32 | Texas Commission on Environmental Quality | 201,575 |

| 33 | Natera, Inc. | 191,688 |

| 34 | Trellis Company | 190,790 |

| 35 | SolarWinds Worldwide, LLC | 178,464 |

| 36 | Visa Inc. | 176,883 |

| 37 | SailPoint Technologies, Inc. | 164,818 |

| 38 | Atlassian Corp PLC | 157,540 |

| 39 | Department of Assistive and Rehabilitative Service | 154,000 |

| 40 | Farmers Insurance | 150,905 |

| 41 | State Bar of Texas | 150,000 |

*Space sizes per CoStar, only includes office spaces with 150,000 square feet and up

While the table above is updated annually, the article below was originally published in AQUILA’s 2Q 2019 Austin Office Market Report and will not be updated. Please contact us if you have any specific questions.

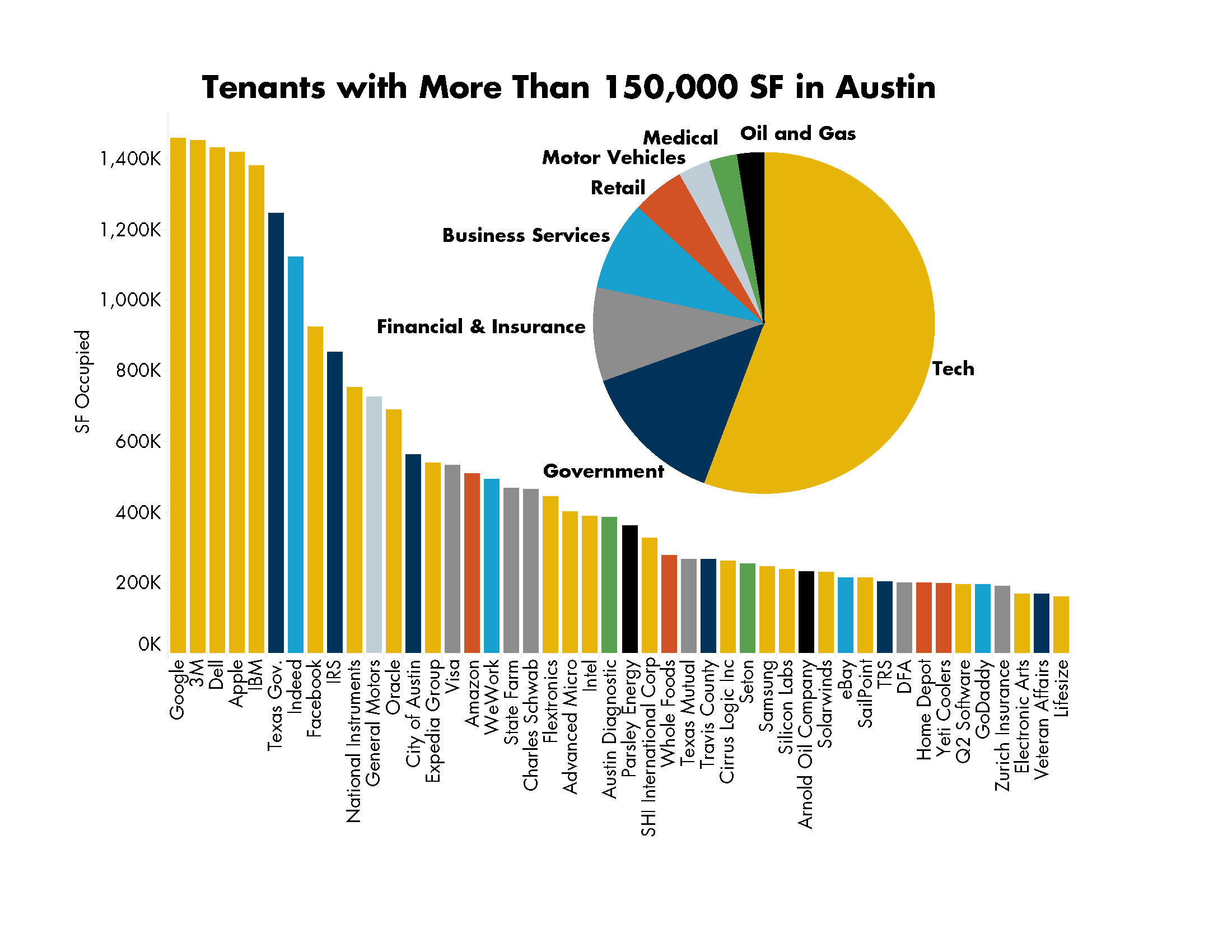

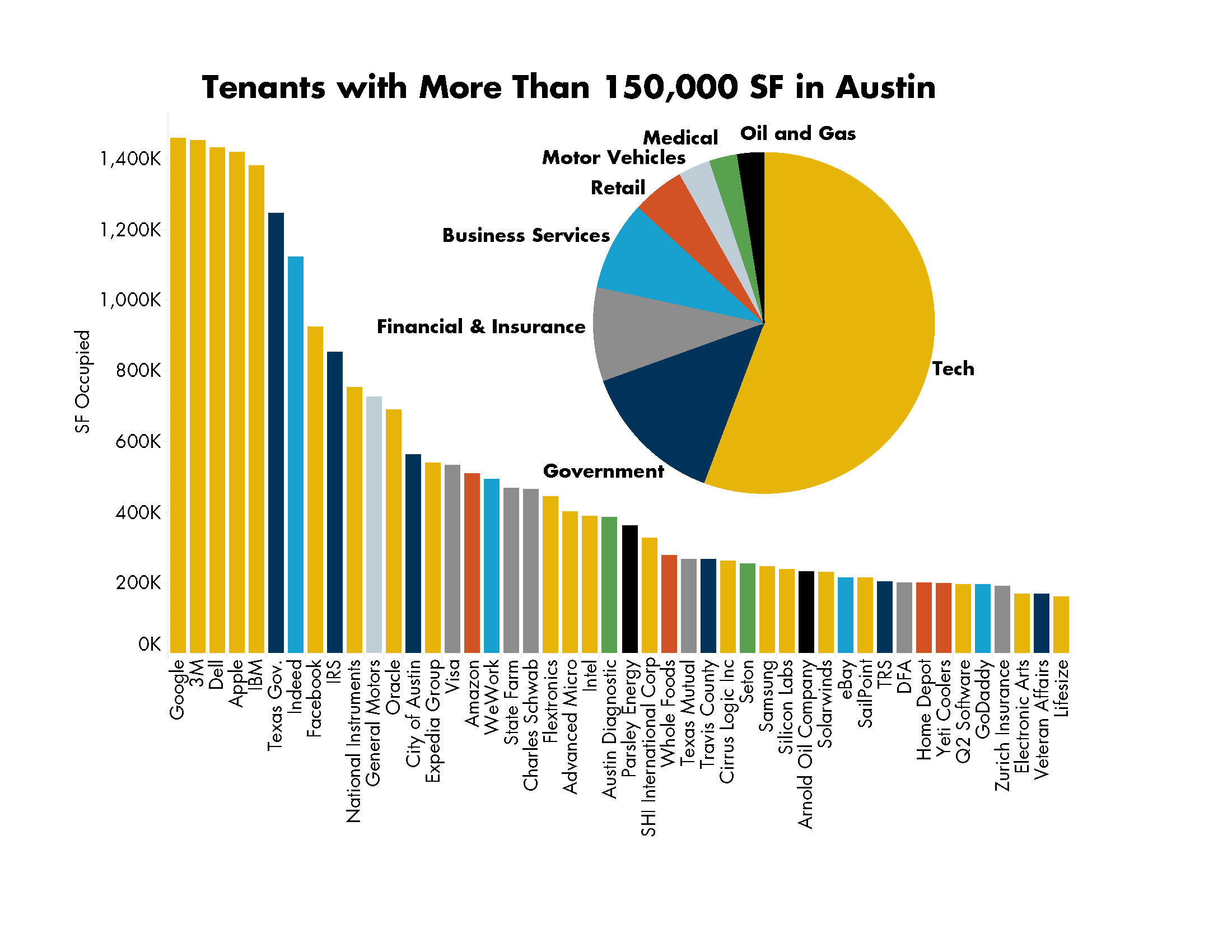

In this special report, we answer these questions and more by looking at:

- Companies with greater than 150,000 square feet in Austin today (by industry and location)

- How the Austin Metro Statistical Area (“MSA”) compares to other competitive cities in terms of large tenants

- Which companies are expected to expand their presence in Austin

METHODOLOGY

To do this analysis, we utilized CoStar to identify the major companies in the Austin MSA and determine the total amount of square feet they currently occupy. We limited our search to existing and under-construction office space only and classified a “large company” as one with greater than 150,000 square feet of office space within Austin’s MSA boundaries. The same methodology was followed to identify large companies in other MSAs.

Large Companies in Austin Today

Today, Austin is home to 46 companies occupying greater than 150,000 square feet of office space. Combining them together, this adds up to roughly 24 million square feet. For comparison, the total square feet of office space in the Austin MSA is 109 million.

Of these companies, 28 are publicly held, 12 are private and six are government entities.

As one would expect, more than half of these companies fall under the “tech” category, including names like 3M, Dell, Apple, and Facebook. Being the state capitol, government offices also occupy a significant amount of space in Austin, ranging from the City of Austin and the Government of Texas to the IRS and Department of Veteran Affairs.

While a number of these companies are newcomers to the Austin scene, just as many have been here for the long haul. Even looking back to 2008, companies like Dell, IBM, Apple, and Whole Foods had already established a significant presence in our city, each employing more than 1,000 Austinites.

Pictured: Third + Shoal (middle). Facebook is the main tenant in the new Third + Shoal development in Austin’s Central Business District, now occupying over 900,000 square feet in Austin. (Photo from CoStar).

A few insights can be gleaned from the graph above, the most obvious being the confirmation that tech companies really are occupying a lot of space in Austin. They account for 13.3 million of the 24 million square feet total and hold the top five spots in the ranking of largest Austin companies.

Another insight is that there are a number of companies with significant leaseholds in Austin that, frankly, we rarely hear about. General Motors (“GM”), for instance, has more than 700,000 square feet of office space spread across three buildings, yet has only been mentioned in six commercial real estate articles in the Austin Business Journal since the start of 2018. Facebook, in comparison, has received a mention in at least 30 articles in 2019 alone as of June. While this is obviously due in part to the fact that GM has remained largely steady in its Austin real estate holdings while Facebook has been actively expanding, one would still expect that a company of GM’s size would be mentioned a little more frequently.

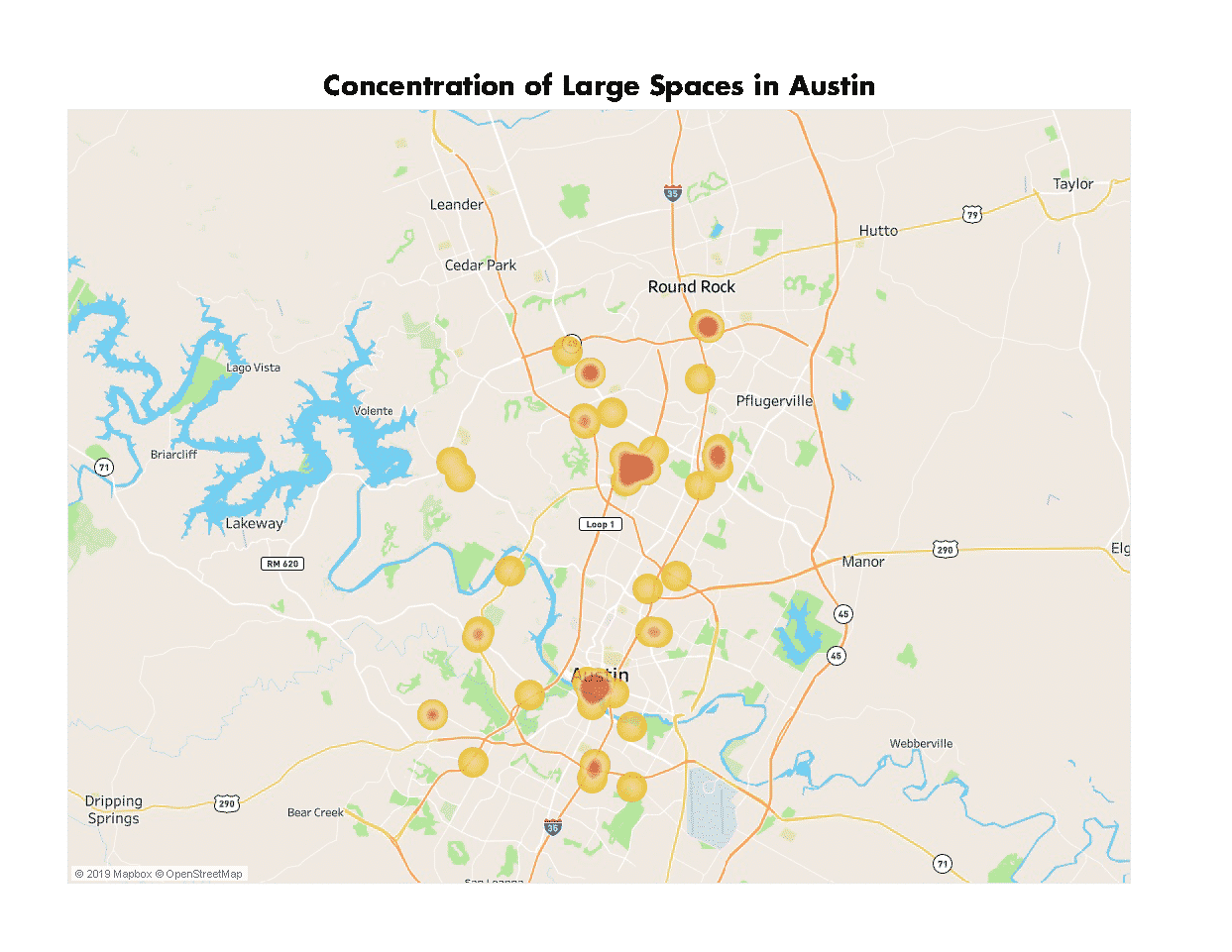

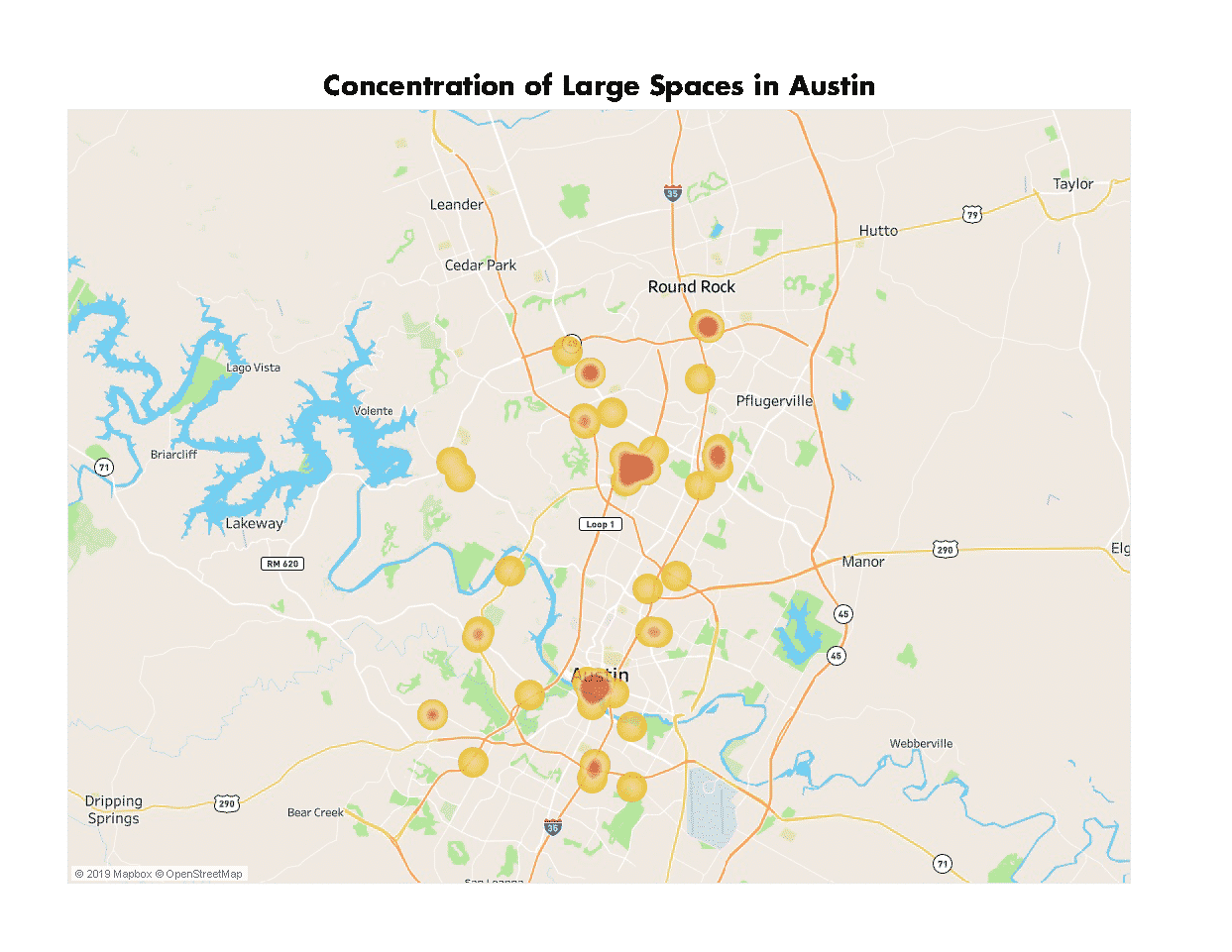

Locations of Large Companies in Austin

The distribution of the large companies in Austin offers more insight into where these large companies are looking for and locking that space down.

As with many cities, Austin’s CBD is a hotbed for large tenants. The likes of Facebook, Indeed, and Google all call downtown Austin home, taking significant amounts of space in some of Austin’s biggest high-rises. Some of that large leasing activity has even begun to cross to the east of IH-35 into East Austin, as exemplified by Google’s lease at Plaza Saltillo.

Looking closer, it becomes clear that the other hotbed of large leases in Austin is in the Northwest submarket, primarily concentrated in the Domain. This is not a surprising insight for anyone who has been keeping tabs on the success of Austin’s “second downtown,” but it does give visual confirmation of a trend we have been discussing for some time. A number of companies occupying space downtown also choose to open a second location at the Domain (think Facebook, Indeed, etc.) to better access the growing talent pool in Northwest Austin.

Both the CBD and Domain are the easiest location in Austin to deliver dense office space, likely explaining why large companies have chosen to locate in those areas. You will also notice a number of unique pockets dotted around Austin, including the spaces occupied by the IRS in the southeast and Dell’s campus near Round Rock, where individual companies have managed to secure large spaces in a specific building or campus.

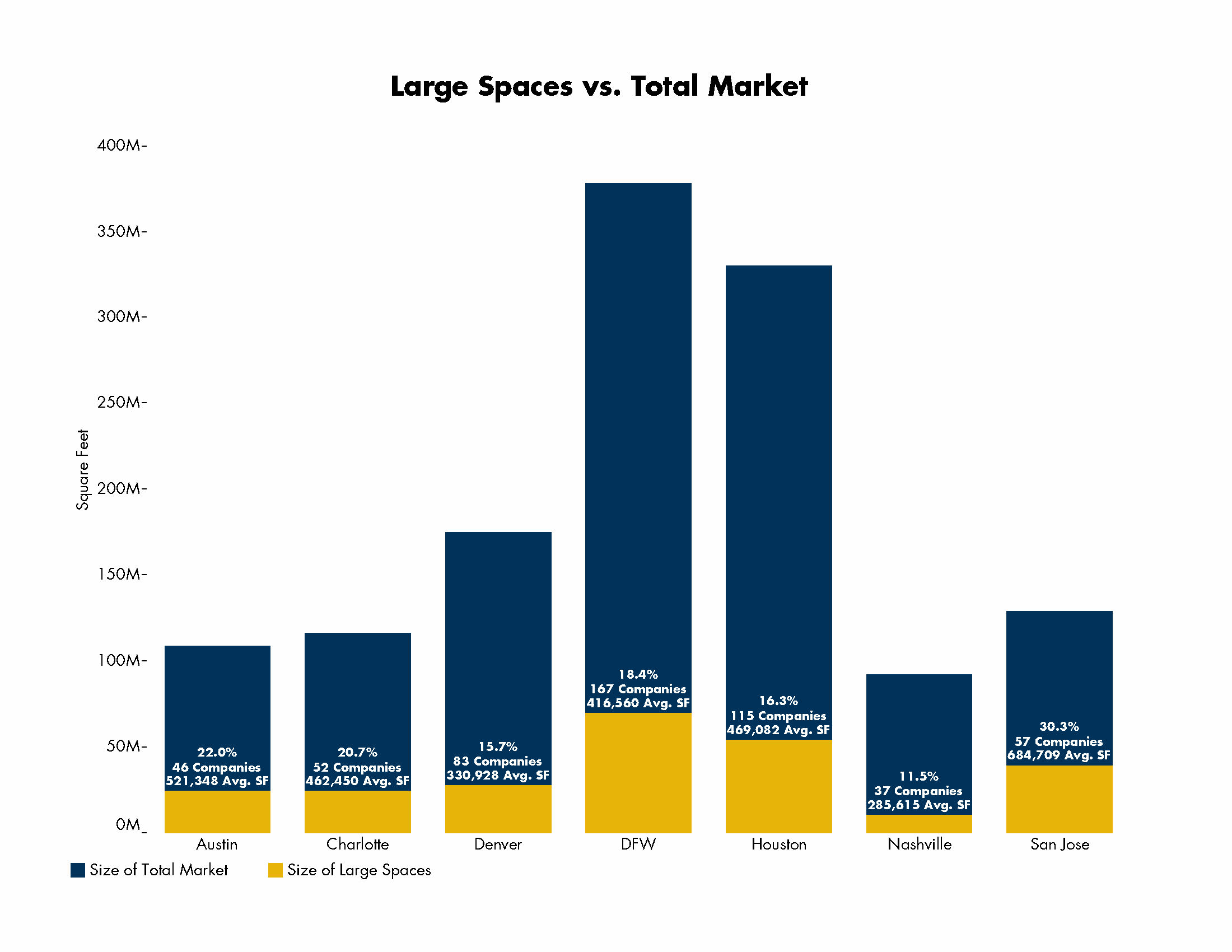

How the Austin MSA Compares to Other Competitive Cities

While this information is all well and good, it only paints part of the picture. Knowing the largest companies is one thing, but how much influence do those companies have on the office market in Austin?

To better understand this, we looked at the total square feet occupied by the largest companies in the Austin MSA and compared that to the total square feet of office space existing today. We repeated this analysis across a number of different MSAs to show how Austin compares to other locations.

Austin’s 46 largest companies take up approximately 22% of the MSA’s office space. This puts it very close to other competitive markets like Charlotte, North Carolina, and Dallas-Fort Worth (“DFW”) and is well below San Jose, California, another one of the country’s technology hubs. To put this another way, for every five square feet of office space in Austin, one square foot is occupied by a “large company.”

However, the real comparison begins when looking at each market’s diversity in terms of the average square feet per company. Spreading the 24 million square feet of space occupied by large companies in Austin across the MSA’s 46 companies, the average space occupied per large company comes out to roughly 521,000 square feet per company. This puts Austin at the second-highest average in our comparison set, falling only behind the San Jose MSA’s average of roughly 684,000 square feet.

So what does this mean? In simple terms, Austin’s economy is more exposed to the fates of large companies.

With fewer companies occupying more space on average, it can be inferred that the leasing activities of these companies are overweight drivers of demand. If that demand were to suddenly cease, the effects would be felt more in Austin than it would be in a market like DFW where there are 167 “large” companies compared to Austin’s 46.

Which Companies Are Expected to Grow in Austin?

The other aspect of this analysis is to not only look at what the large companies in Austin are today, but what companies are expected to grow in Austin in the future. Whether through proposed developments, major releases, or announcements of expansions, there are a number of companies on this list.

First, we’ll start with the obvious. Apple’s plans to build its 3 million-square-foot campus in Northwest Austin (2 million of which is planned to be office space) was major news in 2018 and will position Apple far above the other large office occupiers in Austin in terms of square feet occupied. Because the project is still proposed, it was not included in Apple’s total square feet number in the “Tenants with More Than 150,000 SF in Austin” graph above. With construction slated to begin in August 2019, we shouldn’t have to wait long to begin seeing the increase in jobs promised in Apple’s press release.

Another potential expansion at the top of everyone’s mind is WeWork. The company acquired Waller Park Place at the end of 2018, which holds the potential for roughly 3 million square feet of development depending on what type of project is pursued. The site is in a prime location for development, but no news has surfaced yet of whether WeWork has decided to build its own office tower or pursue some other venture. There have also been discussions that WeWork has been considering a development at an alternative site prior to pursuing Waller Park Place, so only time will tell how much higher on the list of large companies in Austin WeWork will find itself.

Pictured: WeWork’s Domain office. The company recently acquired Waller Park Place, which holds the potential for roughly 3 million square feet of development. This could launch WeWork higher on the list of large companies in Austin. (Photo by Scott Mason Photography)

Zoho, a software company based in California that is currently occupying 13,686 square feet of office space in Austin, is planning to open a 100,000-square-foot office in southeast Austin in the coming years. The company plans to add as many as 500 new jobs to its Austin team as a part of this expansion, and at 375 acres, the site should also offer room for future expansions.

It’s hard to say exactly how many jobs will be created as a result of these coming expansions, but in Austin’s current job market we can be certain that those jobs will be filled quickly.

As of March 2019, Austin’s unemployment rate was a mere 2.7%, compared to 3.8% Texas-wide, and although California Governor Gavin Newsom hopes companies and employees will “start focusing on [the progress California is making] and not just that 13.3% damn tax rate,” it would not be a surprise to see California license plates filling the parking lots at these new offices.

Conclusion

The numbers presented in this study make it clear that Austin has a sizeable (and growing) collection of large tenants occupying space throughout the city. Spread across a number of industries, these tenants, whether publicly owned, private, or government entities, give interesting insight into the makeup of the Austin office market today.

In our fast-paced, quickly evolving market it is hard to say what the results of a similar study would reveal ten years from now, but what we do know is that, for the time being, Austinites should not be surprised to see the names of some of the largest companies in the nation posted on the exterior of our office buildings.