Originally published November 2019, updated October 2023.

The St. Elmo area, south of Austin’s city center, has started to pique the interest of developers, tenants, and shoppers alike. What was mostly industrial space five years ago is now an up-and-coming shopping, eating, and entertainment district with plenty of nearby housing options and commercial developments to match.

If you have been wondering where the next development boom in Austin might happen, this could be it. With hundreds of multifamily units recently delivered and thousands of square feet of commercial space proposed and under construction in the area, St. Elmo is growing fast. In this report, we take a look at the St. Elmo micromarket, including:

- The St. Elmo area, past and present

- What is drawing development to the area?

- Future outlook for the neighborhood

- Why tenants and developers should be interested

St. Elmo, Past and Present

Before we can begin to discuss the St. Elmo area, we first have to define what its boundaries are. In the strictest sense, the area’s boundaries are Highway 71 to the north, IH-35 to the east, South Congress Avenue to the west, and East St. Elmo Road to the south. These boundaries are where most of the newest developments are occurring today and where the majority of commercial real estate investment interest is taking place.

That said, there are a number of developments in the works further to the south of the “core” St. Elmo area that we feel have an influence on the St. Elmo micromarket, so we will be including those as well.

The St. Elmo Micromarket

St. Elmo Micromarket Overview

Historically, the St. Elmo micromarket has not been a place someone would think about spending a Saturday afternoon. Aside from employees working in its industrial spaces or residents living in the area, there was no obvious reason why someone would be there other than to visit Music Lab, a building full of rehearsal studios for local bands to practice that was the only non-industrial building in the area for some time.

Part of the reason is that over the past half-decade, the St. Elmo micromarket has been fairly stagnant as far as new development is concerned. In 2014, the micromarket was comprised of 1.6 million square feet of industrial space, 3,200 multifamily units, 187,000 square feet of office space, and roughly 1,000 single-family houses.1 The vast majority of industrial development took place before the 2000s, and only two apartment complexes would have been considered “new” in 2014; nearly all of them were built prior to 2008. Of the office buildings, none would have been considered Class A and nearly all were less than 20,000 square feet and single story.

However, a lot has changed since then, and today the St. Elmo area is starting to show signs of growth. Even Tesla has gotten in on the action, opening a new showroom in the old Music Lab space at 500 E St. Elmo. While the area is still very much in the early stages of redevelopment and is likely years away from seeing the same success as markets like Austin’s Eastside, it can already be hard to find parking on a Saturday afternoon due to the influx of visitors to the area.

Projects Built, Underway, and Nearing Completion

Today the St. Elmo micromarket is becoming a hub for new development, offering affordable space options close to Austin’s downtown. Through a mix of ground-up development and the redevelopment of existing buildings, over 2,000 multifamily units and 200,000 square feet of commercial space have been delivered since 2016.

The Yard, which is responsible for the majority of commercial space delivered to this point, was a renovation of existing warehouses into retail and “maker” spaces marketed to “community-minded companies, makers, social entrepreneurs and all sorts of hard-working folks.”2 The project has already leased most of its available space to its target tenant type, with companies like the Austin Winery and Eco Roof & Solar calling The Yard home.

The Yard Site Map

The Austin Winery at The Yard

Still Austin Whiskey Co at The Yard

Following the success of The Yard, the Public Lofts condos was the first major ground-up multifamily development in the heart of the St. Elmo micromarket, delivering 217 units in 2018. The success of this development helped prove that people would not only visit a newly revitalized St. Elmo but would live there as well.

As for projects currently under construction and proposed, there are a number of noteworthy developments underway that are expected to have a significant impact on the micromarket as a whole. For starters, the St. Elmo public market is a mixed-use project promising office, hotel, residential and retail space, including, as its name suggests, an indoor market where vendors and restaurants will be able to lease space and sell their wares.

St. Elmo Plaza Rendering (Source: CoStar)

While not ready to be made public, we also have it under good authority that several office projects could soon be added to this list as well.

Projects Delivered 2016-Present

| Title | Product Type | Address | Square Feet/Units | Status | Delivery Date |

| TwoTwenty South | Office | 222 Industrial Boulevard | 22,750 | Renovated | 2016 |

| Ten-O-Five | Flex | 1005 St. Elmo | 59,674 | Ground Up Construction | 2018 |

| The Public Lofts | Condo | 4361 S Congress Ave | 217 | Ground Up Construction | 2018 |

| The Yard | Retail/Warehouse | 444 St. Elmo | 141,175 | Renovated | 2016 |

| James on South First | Multifamily | 8800 S 1st St | 250 | Ground Up Construction | 2016 |

| Skybridge Lofts | Multifamily | 604 N Bluff Dr | 112 | Ground Up Construction | 2017 |

| Urban Oaks | Multifamily | 6725 Circle S Rd | 135 | Ground Up Construction | 2017 |

| Sur 512 | Multifamily | 5010 S Congress Ave | 352 | Ground Up Construction | 2016 |

| 44 South | Multifamily | 4411 S Congress Ave | 275 | Ground Up Construction | 2021 |

| Bexley Soco | Multifamily | 6001 S Congress Ave | 262 | Ground Up Construction | 2020 |

| Lenox SOCO | Multifamily | 135 Foremost Dr | 300 | Ground Up Construction | 2020 |

| Windsor South Congress | Multifamily | 8121 S Congress Ave | 308 | Ground Up Construction | 2020 |

| Aloft Hotel | Hospitality | 4108 S IH 35 | 135 | Under Construction | 2022 |

| St. Elmo Living | Multifamily | 4323 S Congress | 387 | Ground Up Construction | 2022 |

| The Prescott | Multifamily | 8200 S Congress | 348 | Ground Up Construction | 2023 |

Total Multifamily Units Delivered: 2,864 Units | Total Commercial Square Feet Delivered: 223,599 square feet

Proposed & Under Construction

| Title | Product Type | Address | Square Feet/Units | Status | Delivery Date |

| St. Elmo Public Market | Retail | 4329 S Congress | 24,000 | Under Construction | TBD |

| Public Market Apartments | Multifamily | 4329 S Congress | 385 | Proposed | TBD |

| St. Elmo Plaza Office | Office | 4329 S Congress | 105,000 | Proposed | TBD |

| Congress Lofts | Condo | 4315 S Congress | 139 | Under Construction | 2024 |

| The Saint | Multifamily | 4329 S Congress | 274 | Proposed | 2024 |

| 4515 S Congress | Multifamily | 4515 S Congress | 210 | Proposed | TBD |

| The Station at St. Elmo | Condo | 4510 Terry-O Ln | 123 | Under Construction | 2024 |

| 6000 S Congress | Multifamily | 6000 S Congress | 69 | Proposed | TBD |

| 401 N Bluff Residences | Condo | 401 N Bluff Dr | 30 | Proposed | TBD |

| Hill’s Café Redevelopment | Mixed-Use | 4700 S Congress | 400 units / 100,000 square feet office / 40,000 square feet retail | Proposed | TBD |

| Bishop Momo | Multifamily | 4341 S Congress | 274 | Under Construction | 2024 |

| Prospect | Multifamily | 122 Sheraton Ave | 255 | Under Construction | 2024 |

Total Multifamily, Condo & Hotel Units To Be Built: 2,159 Units | Total Commercial Square Feet To Be Built: 269,000 square feet

What is Drawing Development to the St. Elmo Area in Austin?

Clearly, the St. Elmo micromarket is beginning to share in the development activity that has been going on in the rest of Austin, but that does leave us asking the question, why St. Elmo?

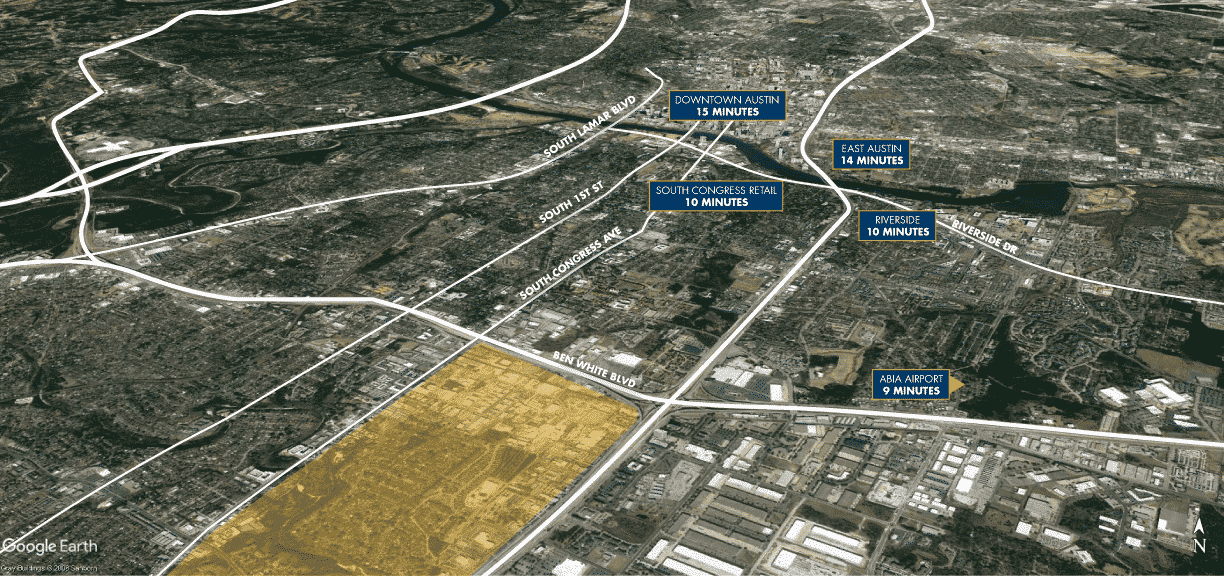

Travel

St. Elmo is located in a prime confluence of the most important arteries of transportation in Austin. South Congress Avenue, IH-35, and Highway 71 all offer easy access to most of the city, and the concentration of numerous, relatively affordable housing options in the area means employees should not have to drive far to get to work.

Due to its proximity to US-290, St. Elmo also offers better access for executives living in west Austin than other comparable markets, such as the Eastside.

Demographics

Comparing St. Elmo to other relatively new office markets in Austin, namely the Domain and the Eastside, we see that the population surrounding the St. Elmo micromarket shares many similarities.

| 2021 Working Age Population | 2021 Bachelor’s Degree | 2021 Millennial Population (%) | ||||

| 3 Mile | 5 Mile | 3 Mile | 5 Mile | 3 Mile | 5 Mile | |

| St. Elmo Submarket | 112,568 | 236,135 | 30.87% | 32.88% | 35.82% | 34.69% |

| The Domain | 83,559 | 211,242 | 33.55% | 31.59% | 35.93% | 32.90% |

| East Austin (Plaza Saltillo) | 129,493 | 242,225 | 37.56% | 35.54% | 33.78% | 33.92% |

| 2021 Total Population | YOY Population Growth (2010-2021) |

2021 Median Household Income |

||||

| 3 Mile | 5 Mile | 3 Mile | 5 Mile | 3 Mile | 5 Mile | |

| St. Elmo Submarket | 169,149 | 353,386 | 1.90% | 2.40% | $61,429 | $70,801 |

| The Domain | 124,097 | 322,749 | 1.30% | 1.70% | $74,036 | $74,090 |

| East Austin (Plaza Saltillo) | 189,714 | 363,123 | 2.70% | 2.10% | $64,125 | $66,658 |

St. Elmo has no shortage of potential employees, with a working-age population of 112,568 within three miles compared to 83,559 for the Domain and 129,493 for East Austin. This population is also educated, with 30% having attained a Bachelor’s degree compared to 33% and 37% at the Domain and East Austin, respectively.

Another useful indicator of the health of the St. Elmo area is the population growth between 2010 and 2021. At 2.4% year-over-year growth within a five-mile radius, St. Elmo is not only attracting residents to occupy its multifamily projects but is outpacing both the Domain and East Austin as well.

The Last Frontier

Perhaps most importantly, a quick look at the map of Austin will tell you that the St. Elmo area is one of the last available options near downtown for a developer to consider. Austin’s CBD is very densely developed (not to mention requires significant capital to build in), the Eastside is already being heavily developed, the western edge is constrained by residential properties and the north has a major mixed-use project of its own, the Highland Mall development.

For a commercial real estate developer wanting to invest in the Austin market, St. Elmo could be an enticing place to look.

Future Outlook for St. Elmo and Austin

But what potential does the St. Elmo micromarket hold 10 years down the road? How much development could we actually expect to see?

To answer those questions, let’s take a look at the area’s current zoning to see what is possible and what could be possible with a few changes.

Today, the core area of the St. Elmo micromarket is mostly zoned limited industrial (LI). Not only does this restrict the type of development that can be undertaken, but a floor area ratio (FAR) of 1:1 means a building cannot have more square feet than that of its lot. For reference, the FAR of Austin’s CBD zoning is 8:1 (with density bonuses allowing up to 25:1), meaning eight times more space can be built on the same size lot. Due to rising land and construction costs, the FAR is a vital metric for developers looking to maximize the amount of space they can build on a given piece of land.

Assuming that the highest and best use for the area would be to transition from industrial space to retail, multifamily, and office space, a more optimal zoning profile for the area would be General Commercial Services (CS). With this zoning, the FAR is increased to 2:1 and the allowable uses are better suited to these types of projects. The City of Austin has historically been open to changing the zoning from LI to CS for aesthetic and environmental reasons, so it’s not entirely outside the realm of possibility.

Taking into account recently developed projects, long-term leases, ownership groups, and a variety of other factors, we estimate that there are roughly 64 acres of land that could potentially be available for commercial development in the foreseeable future. With this number in mind, and using the square feet of development per acre at both the Domain and Eastside as benchmarks, this means roughly 900,000 sf of retail, multifamily, and office space could yet still be developed in the St. Elmo micromarket. For comparison, Domain 8 in Austin’s “second downtown” is roughly 300,000 sf.

| Acres | Square Feet Commercial | Square Feet per Acre | |

| Eastside | 3,993 | 13,269,771 | 3,323 |

| The Domain | 373 | 9,218,937 | 24,716 |

| Average | 14,019 | ||

| Acres | Potential Square Feet Commercial | ||

| St. Elmo | 64 | 899,208 | |

If this number seems high, it’s important to remember that Austin’s Eastside had only 9.5 million square feet of commercial space in 2014, which means 3.7 million square feet was developed in the last five years alone. This was also despite much of the development on the Eastside taking place next to and in between single-family homes, which triggers compatibility setbacks and generally limits how much a developer can build, an issue that the St. Elmo area won’t have to face. If a similar development boom kicks off in the St. Elmo micromarket, 900,000 square feet could be on the low end.

What this means for…

Tenants

For a tenant intrigued by East Austin’s ambiance but unwilling to pay the rental rates that come with it, St. Elmo could present a cheaper and equally hip alternative. Not only do new developments give tenants the chance to work with the developer to make the space truly unique, but getting in at the “ground floor” of an up-and-coming area means initial tenants will have a considerable impact on the culture and image that the St. Elmo micromarket develops. This, mixed with the area’s access to transportation corridors and demographic characteristics, make St. Elmo a great option for tenants.

Developers

Similarly for developers, St. Elmo is essentially a blank slate ripe with possibilities. It has enough space to pursue a large mixed-use development, yet could also be suitable for a one-off office or multifamily project. While it’s important to remember that most of the sites will require a zoning change, a developer willing to take the time and energy to navigate the rezoning process will likely be rewarded with a higher FAR and unlock more potential for their commercial real estate investment.

1Source: CoStar and Esri

2Source: The Yard Austin