At AQUILA, we believe data is our best resource. No matter where you may be looking to lease space in Austin, our market research team is here to offer up-to-date information and help answer your most pressing questions. In fact, we are so confident in our research team that we tasked them with answering the most important question of all: who will win Super Bowl LIII?

This weekend, people around the world will be gathering around their televisions to see the Los Angeles Rams take on the New England Patriots. However, for the optimistic Super Bowl viewer it may be disheartening to realize that the winner of the Super Bowl is determined by more than just hard work.

Who Will Win Super Bowl LIII?

Looking at data over the past 10 years, we have observed trends that show a connection between success and depth of pockets. Seven out of the last ten Super Bowl champions have had a higher franchise value when compared to their opponent and 60% of the time the winner of the Super Bowl had higher annual revenue when compared to their opponent.

So what does this mean for the match up this weekend? The news may not be good for Rams fans. This year the Rams have been valued at $3.2 Billion USD while that Patriots clock in at a whopping $3.8 Billion. If the past trend continues we may see Tom Brady and Bill Belichick secure their 6th Super Bowl Ring together this Sunday.

How Will the Super Bowl Affect You?

The outcome of Sunday’s game could have an impact on your own financial standing as well, as there seems to be a slight indication that the winner of the Super Bowl impacts the stock market’s performance that year. Based on this theory, a victory for the NFC (in this case the Rams) would indicate a strong financial year, while an AFC victory (the Patriots) may forecast a downturn in 2019. And the statistics don’t stop there; statisticians have found trends across all aspects of the game, all the way down to what color of Gatorade the winning team’s coach will be doused in.

In addition, since our in-house research indicates that the performance of the stock market can be a useful one year lagging indicator of how the Austin commercial real estate market will perform (that’s an analysis for another article), and since the Philadelphia Eagles (NFC) won in 2018, there is definitely an argument to be made that 2019 will be a great year in Austin.

What Does AQUILA Predict?

With that said, the great thing about sports is that anything can happen. So while we may not be staking our reputation on a Super Bowl winner, we would definitely put money on our ability to predict rental rates and vacancy rates in Austin.

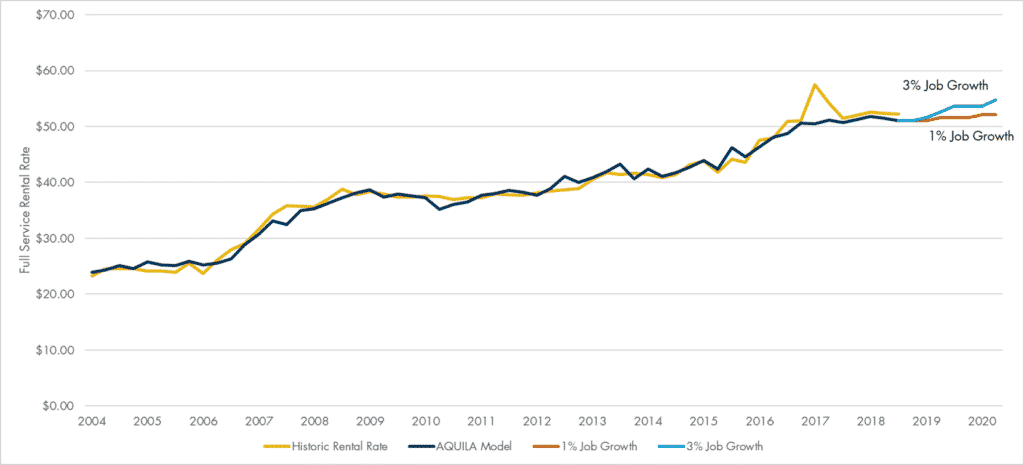

Thanks to our market research team, AQUILA’s proprietary prediction models have had great success predicting where rental and vacancy rates are headed in the CBD, Northwest and Southwest submarkets.

CBD Office Rental Rate Projections

Using these models, along with our extensive collection of market data, our brokers are able to not only advise our clients on what is happening today, but what is likely to happen in the future. These models are published in our quarterly Austin Office Reports, so make sure to take a look each quarter to gain insight into where the Austin market is headed.

Want a free copy of our lasted Austin Office Report? Get your copy today.

So, while our research team might not be experts at predicting the Super Bowl, we are ready to tackle whatever commercial real estate challenges you want to throw our way!