This article was originally published in AQUILA’s 3Q 2016 Austin Office Market Report and will not be updated. Please contact us if you have specific questions regarding the information in this article.

Whether it’s your first time looking for office space or you’re a seasoned veteran of the site selection process, understanding basic local market conditions can help inform your search and ultimate negotiation for office space. In Austin, rental rates are rising to all-time highs and landlords are tightening up concessions all around. A Tenant Improvement (TI) allowance that once might have covered costs for a standard build-out, now might have some companies reaching into their own pockets due to rising construction costs.

Read Now: What Is a Tenant Improvement Allowance and What Does It Cover?

In this article, we will look at the current state of tenant improvement allowances in Austin and answer six important questions that all current and prospective Austin tenants – and landlords – need to read.

1. Do Tenant Improvement Allowances Cover the Cost of Construction?

The thought that the cost of moving into a new space will be covered by the tenant improvement allowance is becoming more of a myth than an expectation in today’s market. Listing brokers may sell this dream early in the touring stages, but when further due diligence is done, build-out costs rarely come in below final TI packages.

TI allowances today range from $3 to $4 per square foot, per year of term, which comes out to $25 yo $50 for a long-term deal. Construction costs alone rarely come in below $20 per square foot, proving that it is extremely difficult to negotiate a deal in which your tenant improvement package covers the construction of your new space.

2. What Costs Should I Consider That Aren’t Included in Tenant Improvement?

In addition to construction costs, many tenants fail to account for other fees such as design, engineering, and consulting fees. These can cost anywhere from $2 to $6 per square foot depending on the scope of the project.

Things like test fits and architectural drawings typically fall outside the allowance that landlords provide. Legal fees pertaining to negotiation services and construction contracts, which can range between $1 to $3 per square foot, can also be an overlooked cost that can end up making a large impact on the overall cost of a project.

TIs are typically structured such that furniture, data, cabling, and moving costs are specifically excluded. Because these items do not provide value to the building beyond the lease term, most savvy landlords won’t reimburse for these expenses.

Find out more about the costs that you may encounter in the first year of your lease, including build-out costs and rental expenses, in our article What Are the All-In Costs of Relocating My Office?

Lastly, hiring a project manager generally costs +/- 5% of the overall project cost, but can ultimately end up saving you twice that fee in design and construction. A skilled project manager can help identify efficiencies and, if brought in prior to lease negotiations, draft preliminary budgets to help provide leverage during TI negotiations.

3. What Happens to TIs in Response to Overall Market Conditions?

Some tenants think that as construction costs rise, landlords will be pressured to increase TI allowances accordingly. However, this is not the case.

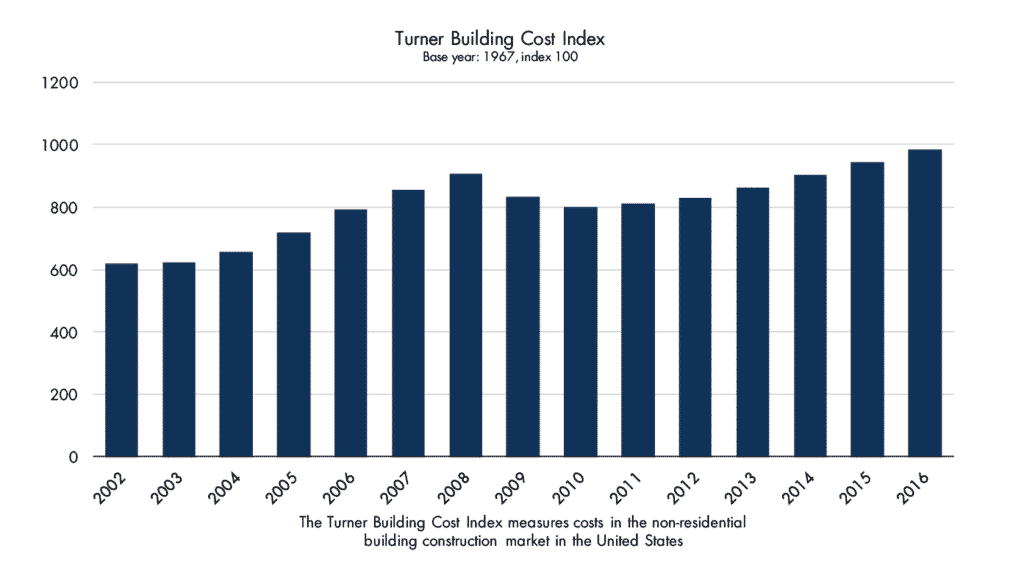

Tenant improvement allowances tend to increase with rental rates in a strong market, though not proportionately. The higher TI allowances in a tight market are more of a response to increasing construction costs than landlords providing an increased incentive for tenants to move into their buildings. The increase in construction costs means the tenants have less purchasing power with those TI dollars, thereby forcing them to come out of pocket more than in a down market.

Some landlords may also use the strength of a market as an opportunity to drastically repurpose their spaces. By improving their properties’ spaces, they can fetch a higher rental rate, thereby increasing the capitalized value of the building, which will return a higher multiple on the additional TI provided. Furthermore, in high-demand markets, new construction is prevalent. Owners of new buildings typically offer much larger TI packages to tenants for shell spaces than the existing second-generation ones – often twice as much.

Landlords’ tenant improvement packages are quite different in down markets. Because construction costs typically follow the trend of the overall economy, so do TI allowances. However, the TI dollars will likely get tenants more than they would in a strong market. Furthermore, in a tenant’s market, landlords are more willing to promote shorter-term deals with low TI allowances just to weather the downturn. While landlords may promote longer terms, tenants typically have more leverage regarding the length of their lease, which results in more long-term deals being signed in down markets than in strong ones.

4. What Have Tenant Improvement Packages Looked Like in Recent History in Austin?

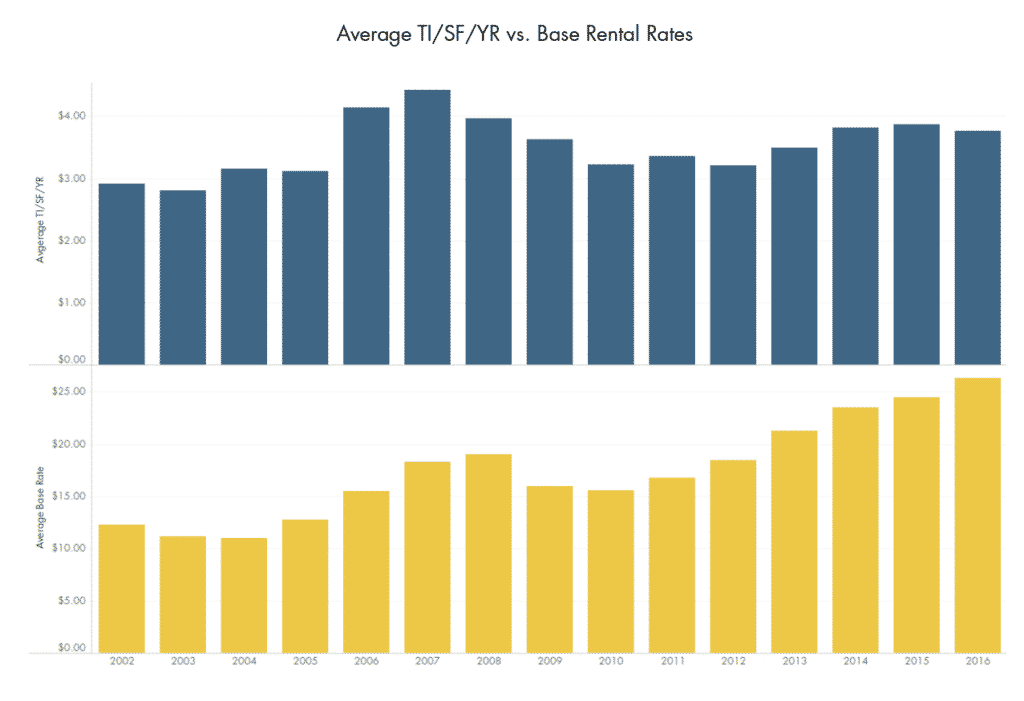

Since 2010, Class A TI dollars per square foot per year have only increased 17%, from $3.22 to $3.77 while base rental rates have increased over $10 to $26.27 from $15.55 – a 69% increase. More recently, since 2014, rental rates have increased 11.9% while TI price per square foot per year has remained relatively flat, hovering around $3.80 per square foot per year.

Juxtapose this recent trend to 2006, when dollars per square foot per year jumped by more than a dollar and reached a record high of an average $4.42 per square foot per year in 20071. In 2006 and 2007 a large swath of new construction was kicking off, giving way to large TI packages for the new shell spaces. New buildings to the market in this time period included San Clemente Building B, Las Cimas IV, and Research Park Place 7 and 8.

Furthermore, several buildings such as Capitol Center, River Place, and Arboretum Atrium were being forced to reconfigure from large, single-tenant blocks to smaller multi-tenant spaces. Landlords of these buildings were able to justify larger TI packages because these intricate build-outs required more capital than a typical second-generation space build-out.

Now, with rental rates reaching all-time highs and new construction delivering at a more deliberate pace, we expect average TIs to remain relatively level in the near future. As construction costs continue to creep upward, there will be even more pressure on tenants to bear more of the final cost to build out their new spaces.

5. What Does This Mean for Tenants?

In today’s tight market, it is more important than ever to understand your improvement goals and financial situation before entering lease negotiations. Sharing this information with your broker will help them find you a space that matches your needs and negotiate a new lease or a renewal that best works for you.

Whether you’re looking for a new space or to refresh your existing one, it’s important to know that landlords are being increasingly less forgiving on concessions and stingier with TI allowances. If covering the cost of your build-out with the TI allowance is a high priority, give your broker the leverage to compromise on other concessions such as term, free rent, or rental rate.

Hiring a broker with an in-house project management team can help set expectations for what you can get for your budget. Getting a project manager involved before you’ve even decided on a space can help provide additional leverage during the negotiating process as they will be able to provide you with estimates of what build-out costs might be. A tenant representation broker alone may understand what comparable TI packages are, but fail to understand what that will get you without having a project management team to freely consult with.

Can the cost of a project manager be paid from your TI allowance?

Ultimately, it depends. More often than not you are able to use a portion of the tenant improvement allowance towards soft costs and fees, including project management services. Your lease should specify what is and isn’t covered more specifically.

6. What Does This Mean for Landlords?

It can’t be denied: right now we’re in a landlord’s market. But it won’t always be. And when competition ramps up amongst buildings, you want yours to stand out. When negotiating tenant improvement allowances, be sure to consider your space five to 10 years from now.

Tenant improvement allowances are a commercial real estate investment in not just that tenant but your building as a whole. Working together to manage TIs can create residual value in the space and building, and will help justify additional funding by landlords. It may also help get a deal over the hump. A poorly conceived space can be difficult to repurpose or costly to revamp in a down market.

If you would like to learn more about the Austin real estate market, download your free copy of our Austin Office Market Report.

Popular Articles:

- What Is a Tenant Improvement Allowance and What Does It Cover?

- What Is an Amortized Tenant Improvement Allowance & How Can It Help Pay for My Office Build-Out?

- What Is the Office Build-Out Process?

1Analysis based on AQUILA’s lease comps in competitive set buildings for which tenant improvement allowances are greater than zero. Base rental rate analysis excludes operating expenses.