This article was originally published in AQUILA’s 3Q 2021 Austin Office Market Report. This article will not be updated, but please contact us if you have specific questions regarding the information in this article.

Change is the only constant in life, and this has never been more true for the Austin office market since the beginning of the pandemic.

Read Next: What’s Going on in Southeast Austin?

AQUILA has been on top of these changes and we have kept tabs on everything going on in our market. This quarter’s Eagle’s Nest takes a look at three interesting trends emerging in the Austin office market, including:

- Full-floor availabilities in Downtown Austin

- Office demand rising despite COVID-19

- Environmental, social, and governance factors

1. Full-Floor Availabilities in Downtown Austin

Over the last several years, when analyzing Downtown Austin, the recurring sentiment was “there is no space available.” Most buildings were fully leased and, for the ones that weren’t, large availabilities were few and far between. Tenants needing a significant amount of space could only find it by preleasing space in new developments. Due to the variety of changes we experienced in 2020, that is no longer the case.

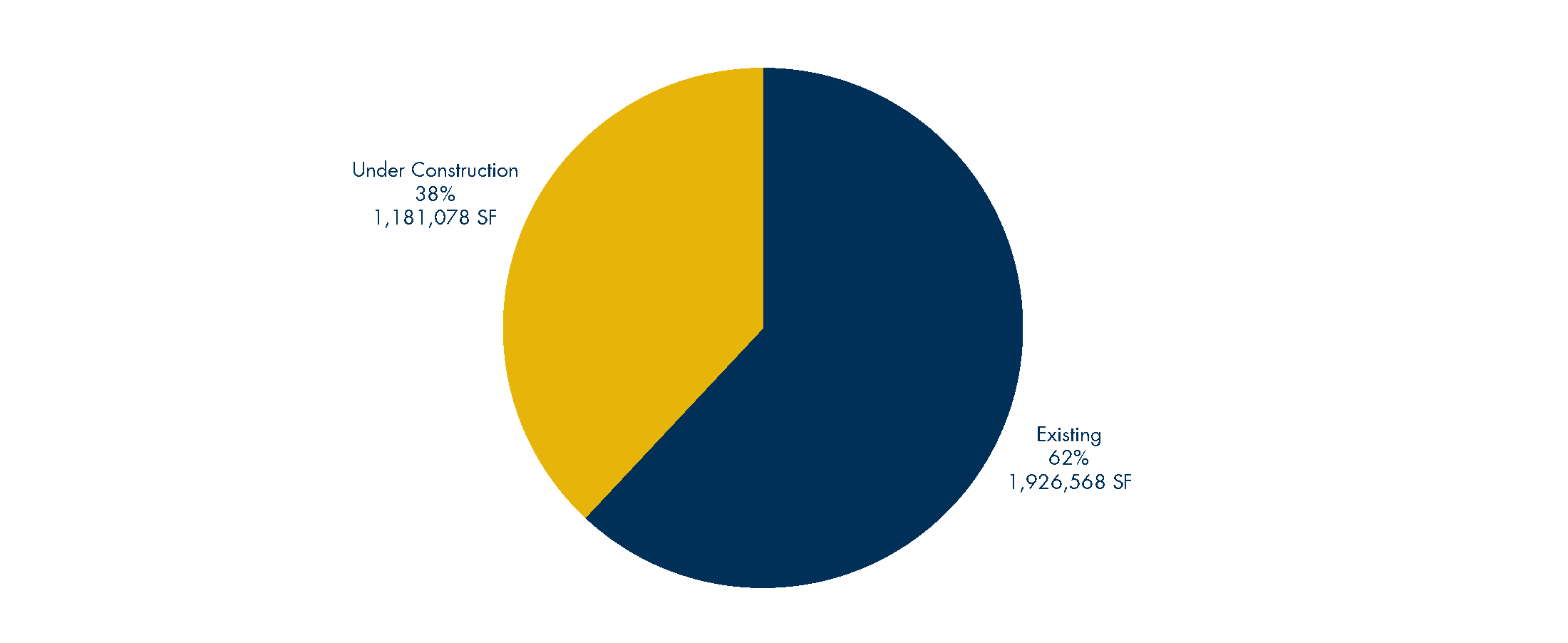

As of this writing, there are roughly 135 full floors of office space available in Downtown Austin, totaling 3.1 million square feet. (“Available” space means space that is currently listed on the market for lease regardless of whether the space is vacant. All “vacant” spaces are available, but not all “available” spaces are vacant.) Existing buildings account for 62% (1,926,568 square feet) of this availability and buildings under construction account for 38% (1,181,078 square feet).

For tenants needing large, contiguous space downtown, this is great news. These spaces average a little over 20,000 square feet per floor, and many are contiguous with other floors in the same building. If a tenant is looking to solidify its presence in Downtown Austin, now is the time to do it.

However, this level of availability could be slightly concerning for landlords. Although some of these spaces are only available and not necessarily vacant (meaning a tenant is still currently occupying the space and paying rent), the CBD’s vacancy rate has increased to 18% in existing buildings compared to 5% prior to COVID-19.

This can partially be attributed to the large blocks of space put on the market like Parsley Energy’s space at 300 Colorado and the space previously set aside for TRS at Indeed Tower that is now on the market as direct space. But, those spaces don’t account for all of the increased vacancies.

It will be interesting to see how Downtown Austin continues to perform through the remainder of the year and moving into 2022. Demand for downtown office space definitely seems to still be there, but how long will it take that demand to fill space?

2. Office Demand Rising Despite COVID-19

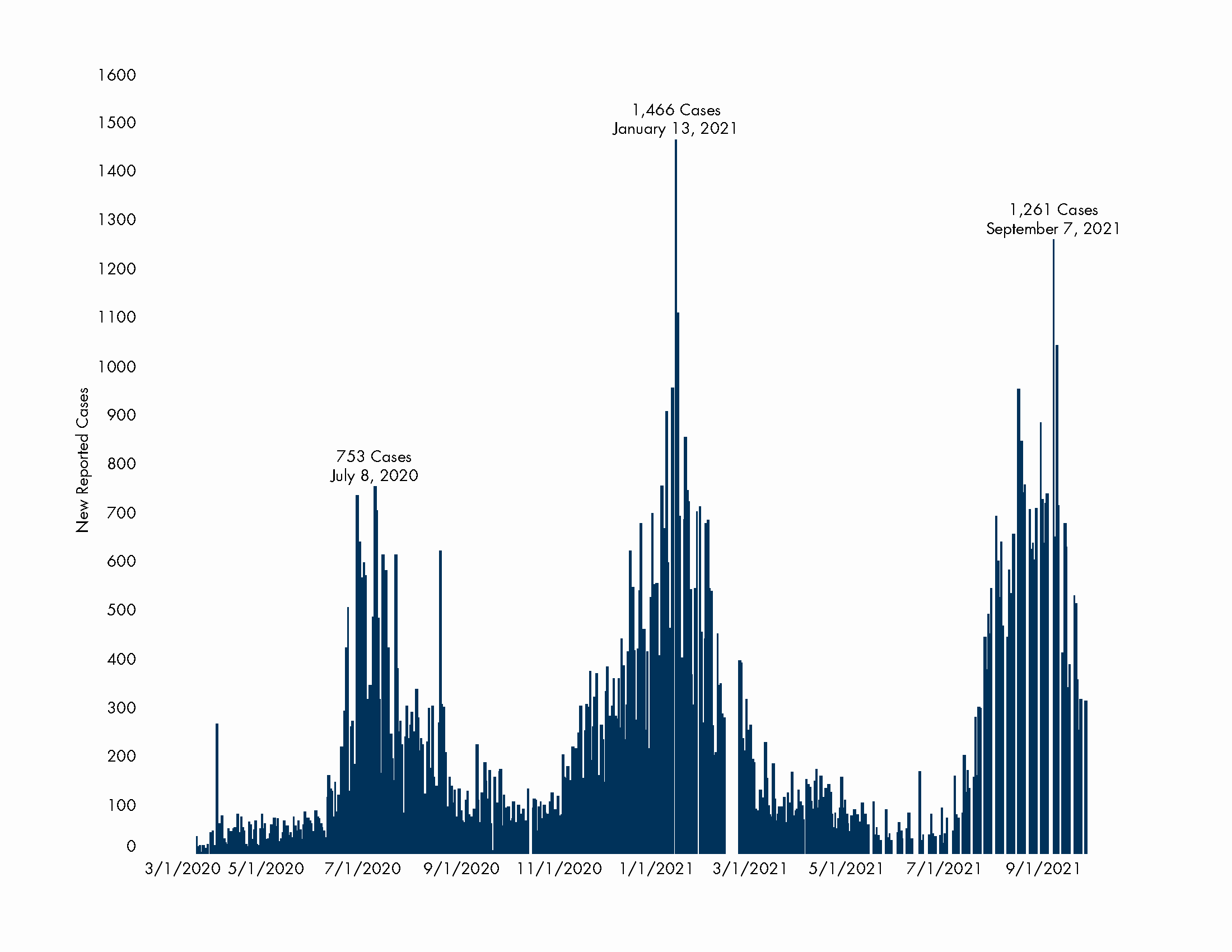

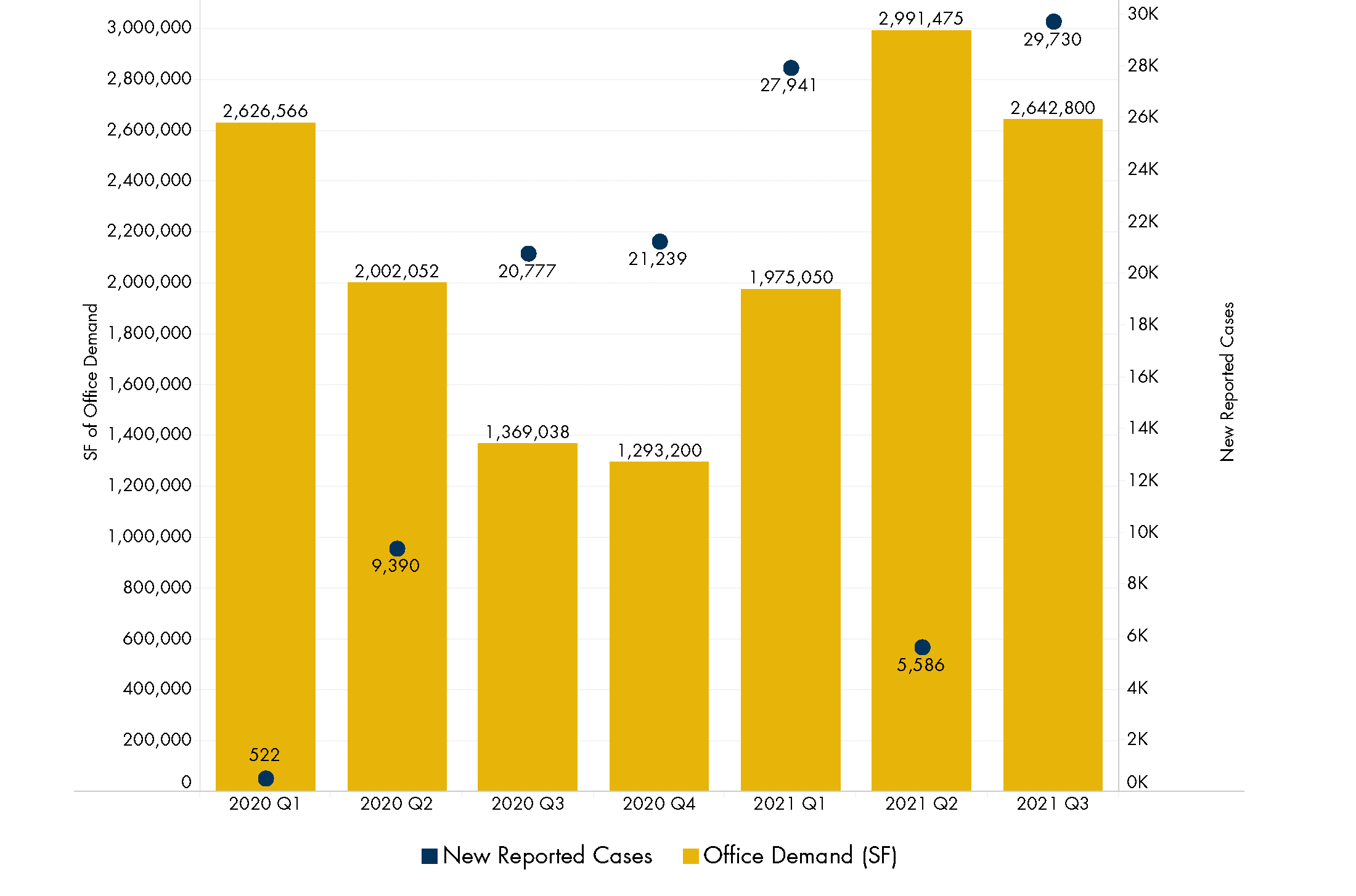

It’s no secret that Austin saw a spike of confirmed COVID-19 cases in 3Q 2021. Whether it’s due to the Delta variant or simply an increase in the amount of in-person interaction we are having, there’s no denying cases were climbing.

Read Next: Austin Office Market Recovery Dashboard

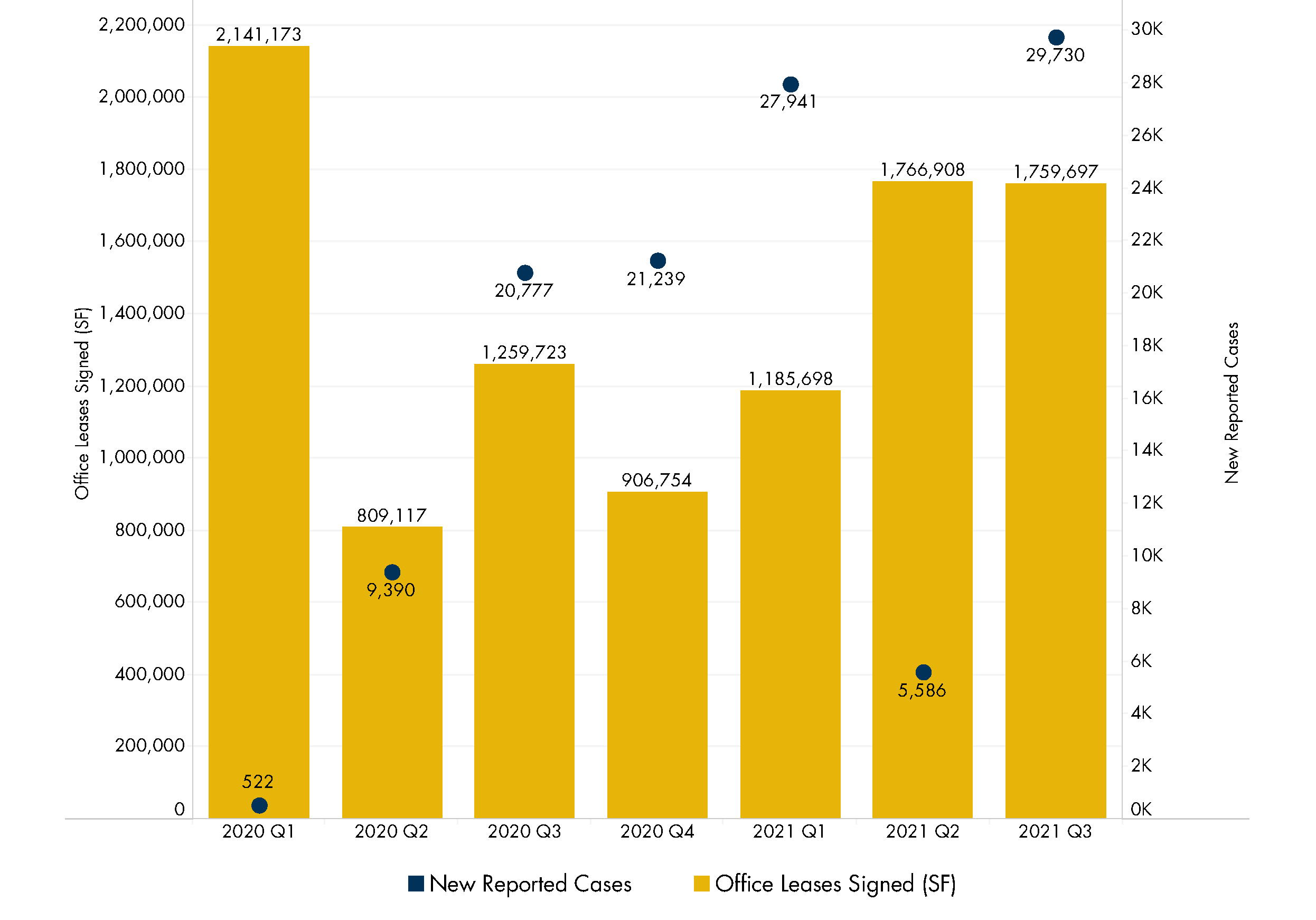

According to the Austin COVID-19 surveillance dashboard, on September 7, 2021, there were 1,261 new confirmed cases, only 205 cases short of the record 1,466 cases seen on January 13, 2021 and well above the 753 cases seen during the highest day in 2020. Compiling the number of new cases by quarter, 3Q 2021 had a record 29,730 reported cases as of this writing. Case numbers do appear to now be dropping, so this number will likely be lower in 4Q 2021.

COVID-19 Cases by Day

Despite experiencing a higher-than-ever number of COVID-19 cases in 3Q 2021, office leasing and demand in Austin are nearing the levels seen before COVID-19 began. According to CoStar, there was roughly 1.7 million square feet of office leasing volume in Austin over the last two quarters, putting it only a few million square feet short of the leasing volume in 1Q 2021. Using AQUILA’s proprietary data, it also appears office leasing demand has not only returned to a “normal” level but has even slightly exceeded what was seen in 1Q 2021.

COVID-19 Cases vs. Leasing Volume

Source: CoStar and Austin COVID-19 Surveillance Dashboard

COVID-19 Cases vs. Leasing Demand

Source: CoStar and Austin COVID-19 Surveillance Dashboard

The question now is, will we see office leasing volume continue to trend upward as cases begin to lessen?

3. Environmental, Social, and Governance Factors Gaining Ground

While it hasn’t had quite as large of an impact as COVID-19 cases and an increase in downtown availability, another interesting trend beginning to emerge in the office world is a focus on environmental, social, and governance (ESG) factors. ESG has been around for a while, but we are just now beginning to see it shift from a “nice-to-have” to a “must-have” for many investors.

ESG factors can range from sustainable building systems to improving diversity in the workforce or purchasing carbon offsets to achieve a net-zero carbon footprint for a new development. According to Nareit’s 2021 REIT ESG Report, 98 of the largest 100 REITs by equity market cap reported publicly on their ESG efforts, and 79% of REITs surveyed have a cross-functional sustainability committee or team. With so much capital backing ESG efforts, it’s no wonder it has started to have an impact on investment decisions.

According to the Global Alliance for Buildings and Construction’s 2020 Global Status Report, direct and indirect energy-related emissions from buildings accounted for 28% of total global CO2 emissions in 2019. As time goes on and this number grows in importance, it’s entirely possible that we may see an increased tenant interest in buildings that incorporate ESG factors and, in turn, improved returns for investors.

Conclusion

With so much change going on it can be hard to keep up, but the one constant through all of this is our confidence in the strength of the Austin office market. We’ve weathered more than one storm before.