This article is updated quarterly and was last updated in March 2024.

At AQUILA, we understand how challenging it can be to find office space in Austin’s competitive market today. Most existing space is already occupied, and many new developments are being delivered partially or fully leased.

Read Next: What Are Operating Expenses for Office Space in Austin, Texas?

After helping hundreds of clients navigate the Austin market, we’ve found that one of the most common questions clients ask is, “what are vacancy rates in Austin?”

To answer this question, we’ve taken a detailed look into:

- How vacancy is calculated

- What vacancy rates are today in Austin’s major submarkets

How Vacancy Rates are Calculated

Vacancy rates are fairly straightforward to calculate, but there are some slight nuances that are important to understand as you begin to analyze them. The vacancy rate calculation is made up of three parts:

- Direct vacant square feet

- Sublease available square feet

- Net rentable area

Direct & Sublease Vacancy Rate = (Direct Vacant SF + Sublease Available SF)/(Net Rentable Area)

Direct vacant square feet refers to vacancy in the traditional sense, meaning that no tenant is occupying the space and the landlord is not receiving any rent payments for that suite. For example, if an office building is 100,000 square feet and has a direct vacancy of 10,000 square feet, the office building has a direct vacancy rate of 10%.

Sublease available square feet follows the same set of principles but has a few differences. First, the term “available” is used instead of “vacant” because, with a sublease, it’s possible that the original tenant is still occupying the space while they are trying to find a sublessee. Second, the original tenant will still be paying rent to the landlord, even if they are not occupying the space. However, only vacant sublease space is included in the vacancy rate calculation.

Lastly, the net rentable area acts as the denominator in the vacancy rate calculation. To calculate the vacancy rate in a specific building you will use the building’s net rentable area. If you are calculating the vacancy rate of a submarket you will use the total net rentable area of office buildings within that submarket’s boundaries.

When calculating vacancy, it is important to only include “currently” vacant or available space and not “upcoming” or “expected.” This is essential to accurately find what the vacancy rate is today.

Vacancy Rates in Austin’s Major Submarkets

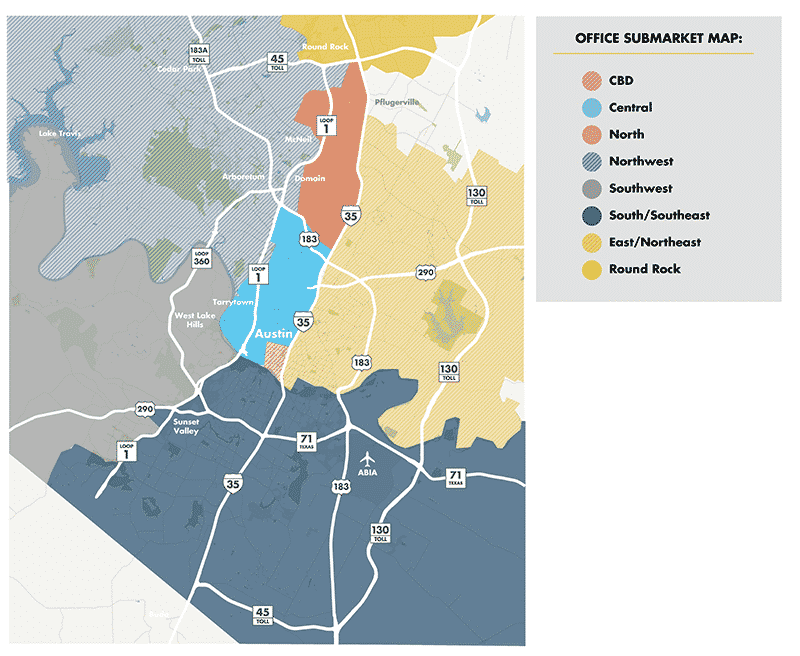

Now that you understand how vacancy rates are calculated, let’s go deeper into what vacancy rates are in Austin today. We’ll focus on four primary areas of office space in Austin:

- The Central Business District

- The Northwest submarket

- The Domain micromarket

- The Southwest submarket

Please note the vacancy rates quoted below are based on our competitive set building lists, which include primarily Class A office buildings. These rates also only take into account existing buildings, not buildings under construction or planned.

Market conditions are impacted by a myriad of external variables like rates of development, tenant preferences, and more, but as a general rule, less than 10% vacancy is considered a competitive market for tenants.

To learn more about pre-leasing trends, read our article Office Pre-Leasing and Speculative Development Trends in Austin, Texas.

Downtown Vacancy Rates

The Central Business District (CBD) is home to Austin’s largest and most recognizable Class A office buildings. The CBD is a highly sought-after location for companies looking to lease space in Austin, leading to fierce competition for the available space.

Below you can see the history of vacancy rates in downtown Austin and where the vacancy rate is today.

As you can see, the vacancy rate in the CBD currently sits near 22%.

Northwest Vacancy Rates

Northwest Austin has seen significant growth in recent years, not only in terms of office space but also in terms of the number of people who call northwest Austin home. As Austin’s population center of gravity continues to shift in this direction, employers hoping to capitalize on the proximity to potential employees have significantly increased demand for office space.

Currently, the vacancy rate in the northwest submarket is about 19%.

The Domain Vacancy Rates

While the Domain micromarket is included in the northwest competitive set above, we feel this market is important to look at as its own unique area. Like Austin’s CBD, the Domain has successfully drawn large, national, and international tenants to its office space, many of which signed preleases for entire buildings well before the buildings were delivered.

Read More: Northwest Austin: Understanding the Arboretum/Domain Micromarket

As you can see, the vacancy rate in the Domain is 13%

Southwest Vacancy Rates

Austin’s Southwest Submarket has become a top choice for companies looking to leave downtown, as well as those hoping to capitalize on the views and scenery offered by the Texas Hill Country. Due to its desirability, the southwest has been experiencing fairly low vacancy rates for some time.

Currently, the vacancy rate in the Southwest submarket is roughly 20%.

What This Means for Tenants

As you can see by the low vacancy rates across Austin’s primary office markets, finding space that is both available and a fit for your company can be a challenge. That’s why we recommend starting your search well in advance of your requirement, so you will have plenty of time to weigh your options and find the best space for your needs.

Of course, in a market like Austin’s today, where landlords are having very little issue leasing space and rental rates are continuously increasing, it can be hard for a tenant to create leverage during the negotiation process on their own. We recommend utilizing the services of an experienced tenant representation broker to ensure you get the best deal possible on your lease.

What This Means for Landlords

Landlords in Austin should be pleased with the low amount of vacancy in our city today, but they should also be aware that the market can change and vacancy can rise in the future. To protect against this, landlords should factor in a higher vacancy rate in their forecasts so they are prepared for greater vacancy down the road.

If you’d like to learn more about the Austin Office Market, check out these articles:

- How Much Does It Cost to Lease Office Space in Austin, Texas?

- What Are Typical Tenant Improvement Allowances in Austin, Texas?

- What are the Largest Companies in Austin, Texas Today?

Or download our latest Austin Office Market Report to get the full story on the rental and vacancy rates, large leases and major property sales, the city’s development pipeline and more.