This article was originally published in AQUILA’s 2Q 2021 Austin Office Market Report. This article will not be updated, but please contact us if you have specific questions regarding the information in this article.

The COVID-19 pandemic significantly impacted the Austin office market during the past year. Most notably, we saw increased subleases on the market, limited sales activity, and projects put on hold. But, recent market activity points to a recovering market and a bright future.

Read Next: Austin Office Market Recovery Dashboard

This quarter’s Eagle’s Nest highlights three of the major trends we are seeing today, including:

- Increased sales activity

- Subleases coming off the market

- Big projects gaining traction

Increased Sales Activity

Sales activity was limited in 2020 due to the uncertainty caused by COVID-19; but, today’s market activity seems to indicate that the uncertainty has passed. Austin is experiencing a steady increase in transaction volume as we hit mid-year.

The most notable transaction this quarter was Kilroy Realty Corp.’s purchase of Indeed Tower for $580 million (roughly $800 per square foot). Based in California, Kilroy is a newcomer to the Austin market and purchased the property in an off-market transaction from Trammell Crow. John Kilroy, the company’s chairman and CEO, stated in a press release that Indeed Tower is “arguably the best building in Austin,” and “creates a value-add opportunity through lease-up in an office market that is strengthening.”

Read Next: How Expensive Is Office Space in California vs. Austin? (Average Rental Rates, Calculator)

This purchase and others like it are a confirmation of a trend that many of us have seen develop over the past few years. Secondary markets like Austin are becoming more in demand for commercial real estate investment than gateway cities like New York and San Francisco, as firms try to diversify their portfolios. Many firms have over-allocated their portfolios in these gateway cities, and Austin provides a strong alternative (especially when compared to other cities that have been slower to recover from the fallout of COVID-19).

Along with this, we’re also seeing increased commercial real estate investor interest in purchasing new construction, whether the building is leased or not. Projects like Foundry I and II, Centro, and Bouldin Creek are all good examples of projects catching the eyes of commercial real estate investors looking for decent returns in a market that has relatively few properties for sale. It will be interesting to see how this trend continues to develop through the remainder of the year.

Subleases Coming Off the Market

When the sublease market began to significantly increase in early-to-mid 2020, there was definitely concern surrounding how it would impact the market as a whole. However, many of us had a hunch that the total square footage number was inflated as companies tested the waters while their employees worked from home, and that does now seem to be the case. A number of subleases have come off the market as these same companies return to the office.

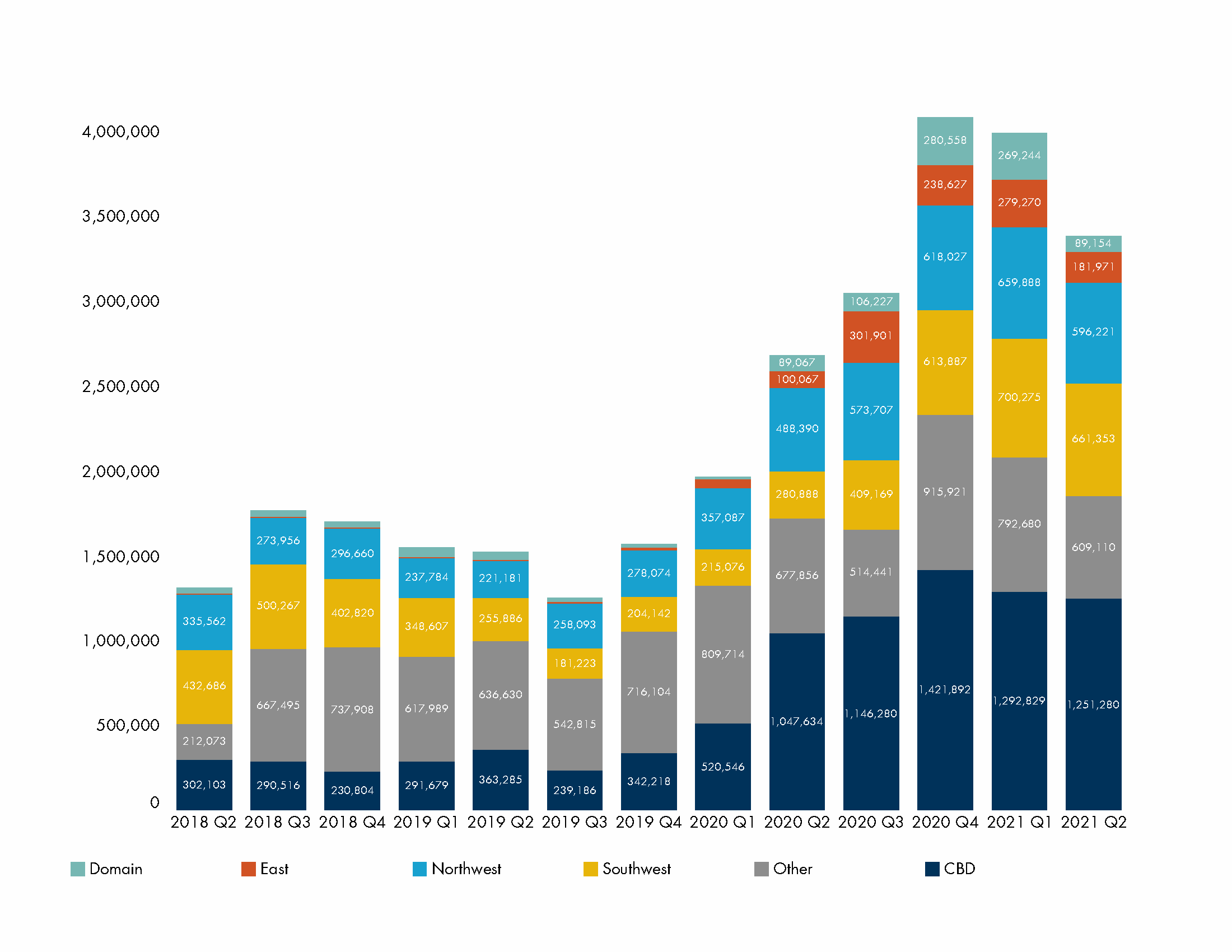

As of the end of 2Q 2021, sublease space in Austin has decreased from a peak of over 4 million square feet in 4Q 2020 to just under 3.4 million square feet. Although this is still 1.9 million square feet more than the amount of sublease space available prior to COVID-19, everything points to the decrease continuing through the remainder of 2021.

Subleases Breakdown by Year, Submarket, and Size

A portion of this decrease can be attributed to larger subleases coming off the market, either due to being successfully leased or being withdrawn. For example, VRBO’s 114,000 square feet of space at Domain 2 was recently taken by Amazon. Other tenants, like RigUp at One Eleven Congress and GLG at 301 Congress, have opted to reoccupy their space now that returning to the office is a possibility. TRS’s 101,000-square-foot sublease at Indeed Tower is also off the market due to Kilroy releasing TRS from its lease obligation at the building.1

At the same time, we are also seeing very few, if any, large sublease spaces being put on the market. If all of these trends continue, we should continue to see a decreasing sublease market through the end of the year.

Big Projects Gaining Traction

The other interesting trend we are seeing is a number of large-scale development projects beginning to move forward. As with the sales market, several of these projects are being undertaken by new-to-Austin commercial real estate investors.

Springdale Green, for example, received final zoning approval in June 2021 and is expected to bring 775,000 square feet of office space to a 30-acre tract in East Austin. The project is being developed by Jay Paul Co., who is new to Austin but is well known as a premier developer on the west coast.

Read Next: East Austin Developments (Under Construction and Proposed)

Trammell Crow and Karlin Real Estate also recently announced plans to redevelop the 3M plant in Northwest Austin (different from the 3M property Karlin recently purchased through a foreclosure sale) into a 1.2 million-square-foot office park, 485,000 square feet of which is expected to start construction in 3Q 2021.

The projects don’t stop there either. 29 Gateway in Leander (200,000 square feet of commercial space), River Park in Southeast Austin (10 million sf of mixed-use space), The District in Round Rock (3 million square feet of office space), Northline in Leander (115-acre mixed-use), Velocity near ABIA (7.9 million square feet total, 2.9 million square feet of office space) and more are all making headway.

If these projects and others like them all come to fruition, Austin’s office market and its suburbs could be set to see a significant amount of growth in the coming years.

Conclusion

It has been a big relief to see Austin’s office market begin to recover so rapidly after such an unexpected crisis, and it further confirms that our market is as resilient as ever. The Austin market appears poised for a strong second half of the year.

1News about TRS being released from its lease obligation at Indeed Tower was officially published in July 2021. Numbers in the graph above and through the remainder of this report still reflect the space available for sublease. The transition to direct space will be reflected next quarter.