Did you know that in 1985, construction on an office building in Austin was stopped when mastodon bones were found under the site?

Construction workers discovered an ancient mastodon burial ground on the site of what is now 301 Congress Ave, a 22-story office building in downtown Austin, Texas, in 1985. The discovery caused a sensation, and tens of thousands of people came to the site to see the bones of the mastodons, as well as those of a sabre-toothed tiger. While this was an exciting discovery for residents and archeologists, it caused delays and increased costs for the office project.

This is an example of why when it comes to investing in commercial real estate, due diligence is a critical process that cannot be overlooked.

In this article, we give you an overview of due diligence, outline the major items that should be included in your due diligence process, and explain why due diligence is a critical part of your investment.

Read Next: How To Develop an Office or Industrial Building on the Property You Own

What Is Due Diligence?

Due diligence is the process of thoroughly investigating and evaluating a property before making a purchase, to ensure that it meets your investment objectives and that there are no hidden issues or liabilities that could negatively impact your investment. In other words, due diligence is essentially understanding what you’re buying and making sure it’s a good deal.

One of the most important reasons to conduct due diligence is that it makes the investment very real. It’s the time when the hard work is done, and all potential issues are uncovered before the investment is finalized. It’s crucial not to cheap out on due diligence because once the deal is closed, there is no turning back.

Read Next: How Do High Interest Rates Affect Land Values?

Major Items To Consider During Due Diligence

Financial Analysis

Assess the property’s financial performance, including historical income and expenses, rent rolls, operating costs, and vacancy rates. Verify the accuracy of financial statements and ensure that they reflect the property’s true financial health.

Legal and Regulatory Compliance

Review all applicable laws, regulations, and zoning requirements to ensure that the property and its operations are in compliance. Check for any outstanding liens, encumbrances, or pending litigation related to the property.

Read Next: Zoning Districts in Austin, TX: What They Are & How They Affect Your Property

Property Inspection

Conduct a thorough inspection of the property, including structural, mechanical, and electrical systems, as well as common areas, landscaping, and parking facilities. Identify any necessary repairs or improvements, and estimate the costs associated with them.

Environmental Assessments

Evaluate potential environmental risks, such as soil and groundwater contamination or the presence of hazardous materials. Obtain an environmental site assessment (ESA) to identify any existing or potential environmental liabilities.

Lease Review

Analyze existing leases and tenant relationships, including lease terms, rent escalations, tenant creditworthiness, and the property’s tenant mix. Understand the lease termination and renewal clauses, as well as any rights and options granted to tenants.

Market Analysis

Research the local market and competitive landscape, including current and future supply and demand dynamics, rental rates, and market trends. This will help in determining the property’s potential performance and value appreciation.

Read Next: Why You Should Hire a Land Consultant To Get the Most Value for Your Property

Title and Survey Review

Examine the property’s title and survey records to ensure clear and marketable title, and to identify any encroachments, easements, or restrictions that could affect the property’s use or value.

Property Management

Assess the current property management team’s performance and capabilities, as well as the property’s overall management strategy. Consider whether any changes to the property management approach or personnel are necessary.

Financing and Capitalization

Speak to your lender and, if applicable, your equity partners to evaluate the financing terms and conditions you have at your disposal. You should consider factors such as the loan-to-value ratios you can expect, interest rates and amortization schedules, and any prepayment penalties or loan covenants associated with your acquisition.

Once you have determined the amount of debt (if any) you can use to finance the acquisition, you will be able to determine the required equity investment and the potential return to your equity through the duration of your investment.

It’s important to note that due diligence is not just about conducting surveys and inspections, but it’s also about drafting contracts, loan agreements, and partnership agreements with the assistance of an attorney. While this step in the process may feel tedious, it is crucial to ensure that you are protecting yourself and your partners from any unexpected liabilities or unforeseen risks.

Why Is the Due Diligence Process Important

During the due diligence process, a number of surveys and inspections may be conducted, depending on the property type. For example, for existing buildings, property condition reports, lease audits, utility information, and environmental assessments are among the most important studies to conduct. But every building is different and will require additional studies based on the building’s age, occupancy, and product type. It’s crucial to ensure that there are no hidden leases or environmental issues that could prevent you from using the property in the way you intend to.

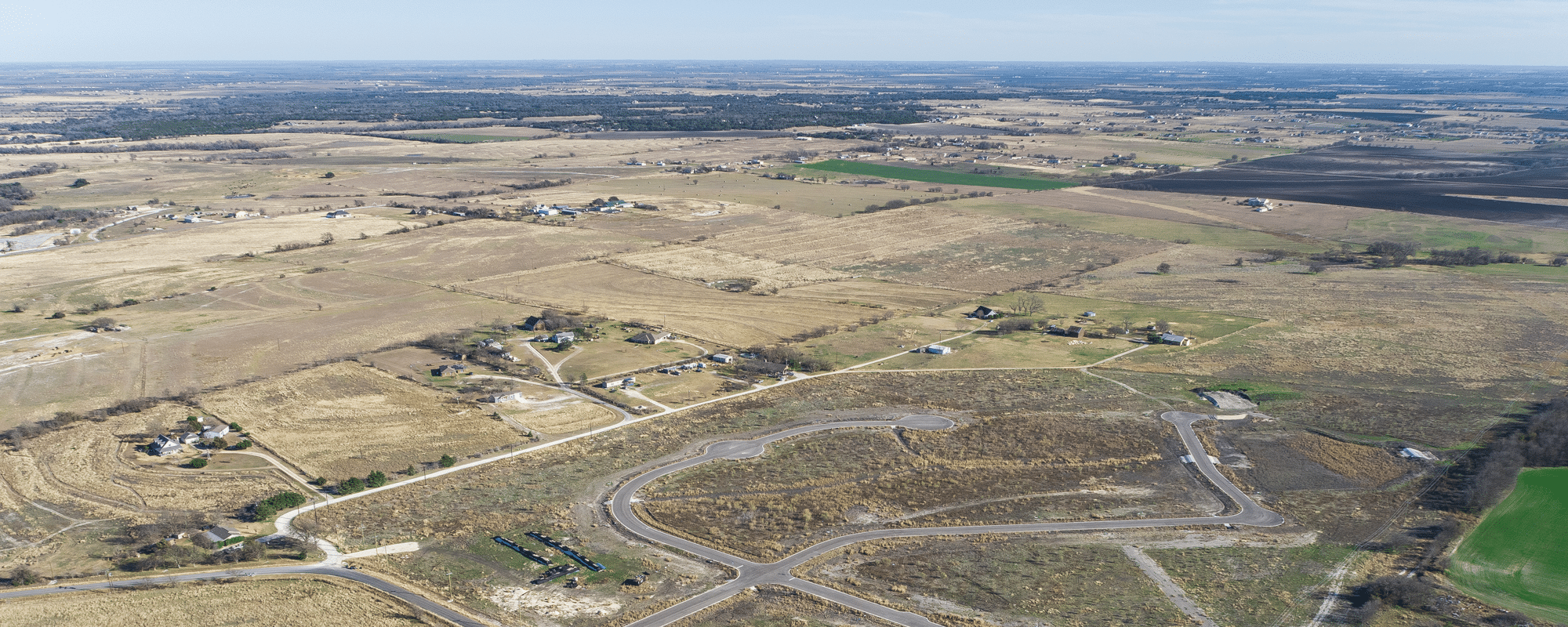

On the other hand, when it comes to land, it’s important to investigate entitlements such as zoning regulations and title restrictions to ensure that you can build what you want. In addition, lengthy environmental assessments are often conducted to test soil samples and uncover any potential issues, such as toxic waste, instability, or even the discovery of ancient artifacts or fossils, as was the case in the mastodon bones example we mentioned at the beginning of this article.

Read Next: A Complete Guide to Common Commercial Real Estate Underwriting Terms & Definitions

For industrial properties, extra attention should be paid to environmental inspections. This is because, depending on the historical user/tenants that occupied the property, industrial properties may have a higher risk of environmental issues, such as chemical spills or other types of pollution.

Ultimately, while it is impossible to account for every potential issue in a real estate investment, a thorough due diligence process can save you millions of dollars. From hazardous soil to incorrect zoning, you must do everything you can to ensure that your investment will be safe from unforeseen issues down the road.

Conclusion

Working with a good investment services team can make all the difference when it comes to due diligence. They can guide you through the process, help you identify potential risks and issues, and know which experts to hire to conduct the necessary surveys and inspections.

Due diligence is a critical process in commercial real estate investments. It involves thoroughly investigating and evaluating a property to ensure that it meets your investment objectives and that there are no hidden issues or liabilities. Depending on the property type, different surveys and inspections may be conducted, and it’s important to ensure that everything is ready to go before closing the deal.

So, what happened to the mastodon bones that were found at the 301 Congress site in Austin? Many of the bones ended up in displays in the lobby of the office tower, and a nearby jazz club was named The Elephant Room in honor of the extinct creatures. If you ever think about skipping due diligence on your commercial real estate investment, go take a look at those bones!

Are you looking for a team that can successfully guide you through the due diligence process? Schedule a free consultation with one of our commercial real estate investment service experts today.