Owning and operating commercial property takes a significant amount of time and effort that you as the property owner may not have. A property management company provides a variety of services to facilitate property ownership by taking many of the day-to-day tasks off of your plate. Whether you hope for an additional stream of income or to leverage a long-term asset, hiring a third-party property management company can help you achieve your ownership goals.

Read Next: The Ultimate Guide to Hiring a Commercial Property Management Company

In this article, we will discuss the role of a property management company including who they are and what they do. We will also highlight the benefits they provide to a commercial property owner.

The Property Management Team

When hiring a property management company, the team that will you will work with typically includes:

- Property Manager

- Assistant Property Manager

- Property Administrator

- Property Accountant/Accounting Team

- Maintenance Engineer(s)

A property manager’s responsibility includes things like tenant relations, forecasting, contract services, and lease compliance. The assistant property manager handles the day-to-day tenant relations (work orders and correspondence), accounts payable and receivable as well as monthly tenant bill backs. Property administrators deal with work order management, service contracts, financial reports and event planning. The property accountant/accounting team works on full-cycle accounting, monthly financial reports, and vendor inquiries. And finally, maintenance engineers handle property maintenance, including tenant issues (like a leaky roof) and general property upkeep and preventative maintenance (like HVAC inspections).

What Does a Property Management Company Do?

Hiring a property management team can add value to your business by saving you time and money. Typically, the benefits of hiring a team include services that fall under one of two categories:

- Financial Services

- Management Services

Financial Services

Broadly speaking, a property management company helps the landlord achieve their financial goals for a property. The financial tasks, typically provided by property management companies, fall under one of three categories:

- Accounting

- Budgeting

- Rent Collection

Accounting

Property managers provide an assortment of financial statements that help you gain insight into the building’s performance. The monthly financial statements a property manager provides include, but are not limited to, the following:

Variance Analysis: This analysis compares the actual monthly and yearly financials to what was outlined in a property’s budget. The difference in these values, known as the variance, will be small for properties performing as expected and will be larger if the property is performing above or below expectations. By providing comments and background on both month-to-date and year-to-date performance, this analysis can help an owner understand the likelihood of achieving the forecasted future cash flow.

General Ledger: A general ledger provides an overview of all monetary transactions related to the property over a period of time. Giving an explanation of each transaction ensures the landlord is aware of each exchange and why it was needed.

Income Statement: The income statement tracks revenues and expenses incurred by the landlord. Using these numbers, the property’s profitability can be determined. The income statement will provide the landlord with an understanding of the financial performance of the property for the given time period.

Balance Sheet: A balance sheet gives the property’s capital structure at a point in time. It shows the property’s assets and liabilities, as well as how much money has been put into the property. This can supplement other financial reports, such as the income statement, to provide a more holistic overview of the financial performance of the property.

Rent Roll Reconciliation: A rent roll lists the rental terms of each tenant: the monthly rent, escalations, lease expiration date, etc. Complex escalations across multiple tenants can be difficult to track without meticulous records, so rent roll reconciliation helps ensure that both the landlord and tenants are aware of the rent that is due.

Aged Delinquencies: A report that shows if any tenants owe an outstanding balance or are behind on rent. Details about any payment plans, collections, and potential future issues can be added to help the owner understand the health of tenants in the building.

Statement of Cash Flows: Like the name would suggest, a statement of cash flows tracks the property’s inflow and outflow of cash. The statement breaks each transaction into one of three different activities:

- Operating activities: include those revenues and expenses that come with property operations, such as rent, repairs, supplies, property management fees, and taxes

- Commercial Real Estate Investing activities: including cash used for property investments, such as building upgrades

- Financing activities: include financial transactions, such as the actual purchase of the property itself

Using this statement, a property manager calculates the net increase or decrease in cash for the month.

Bank Reconciliation Statement: The bank statement provides the beginning balance, all transactions, interest earned, and the ending balance. A bank reconciliation statement looks for any discrepancies in the account’s bank statement.

Cash Reserves Summary: Because cash flow is a common goal for many landlords, a Cash Reserves Summary is a very important tool to help the owner know if distributions can be made or not. Everything from future leasing commissions, tenant improvement allowances, capital improvements, and accruals for property and other taxes can be included in this summary.

Budgeting

In addition to tracking the financial standing of the property, a property manager will also project the income and expenses of the property and establish a budget that reflects the owner’s goals, assuming the property performs as expected. Reports can be customized depending on each landlord’s unique needs.

An executive summary will be written periodically to inform the landlord how the property is performing relative to the budget. If the budget is not met, the property manager will record the difference in the variance and track the cause.

For example, say budgeted expenses were $5,000 and an unexpected burst pipe increased actual expenses for the month to $6,000, the variance would be $1,000 (20%). The property manager would clearly note the increase in expenses was due to the unexpected burst pipe.

Rent Collection

Ensuring tenants pay their rent is a key step toward meeting ownership goals. Multiple tenants with a variety of rental terms and rates, each with separate account balances, requires meticulous record-keeping. Property management companies maintain tenant ledgers to keep track of each tenant’s account balance and rent schedule.

If a tenant violates their lease (i.e., doesn’t pay their rent) a landlord typically holds the right to put the tenant in default. Knowledge of the process is imperative if one hopes to cure the default of a tenant, as there are various legal intricacies involved. Property managers act on behalf of landlords as agents and pursue default remedies when necessary.

Management Services

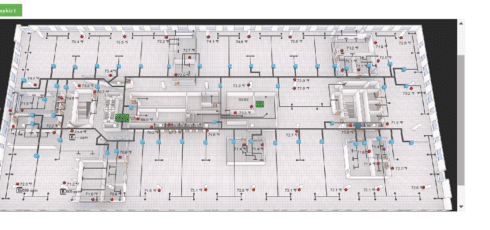

The physical condition of the property is a valuable asset that can quickly deteriorate without proper care. A good property manager will have a detailed maintenance schedule to perform periodic property, lighting and HVAC inspections. They make sure the property’s infrastructure remains in good condition and repairs are made when necessary.

They may also suggest investing in property upgrades, such as new landscapes or other improvements. While upgrades may be costly, keeping a property updated and in good shape can pay off in the long run.

Property updates are like laundry. When you don’t wash your clothes as often as you should, you either stink and alienate people or you run out of clothes to wear. When you do your laundry, you look good, smell good, and people enjoy being around you – leading to valuable friendships. Now compare this to your property updates.

When you don’t update your landscape, your property will be uninviting, and people will not want to be around it. When you do the necessary updates, your property will have more appeal and people will enjoy its atmosphere – drawing more people to it in the long run and creating more customers. Do yourself a favor and do your laundry and keep your property updated.

The property management company serves as a landlord’s maintenance representative. In many cases, if a problem occurs at the property (the electricity goes out, a pipe bursts, etc.), a tenant can call the property manager to get the problem fixed. Because the forms, severity, and responsibility of these issues can vary from lease to lease and building to building, it is important to have a quality property manager that can effectively handle problems when they inevitably occur. Property managers are also knowledgeable about leases and can clearly communicate when something is a tenant’s responsibility and not the owner’s. While these problems may derive from circumstances beyond their control, a good property manager tries to minimize the likelihood of these problems arising and effectively handles the damages when they do.

Read Now: Heavy Rain? How to Prepare Your Commercial Property (5 Steps)

Conclusion

Having a quality property management team is an essential asset for a commercial landlord. As you can see, the cost to hire a property management company is well worth the service they provide. Outside of taking care of the property operations, the property management company will help the property owner achieve their financial goals. Hiring an accredited property management firm can indicate a strong record of property management excellence. In fact, AQUILA is one of the few property management teams in Austin to be an AMO® Accredited Management Organization. To earn an AMO® Accreditation firms must demonstrate business and financial stability, follow a strict code of ethics and meet a long list of other criteria. These requirements hold the firm to a high standard when it comes to “trust, credibility, and performance.”

If you would like to learn more about property management and how an experienced management team can be of use to you, schedule a consultation with AQUILA Property Management today.