At AQUILA, our property management and leasing teams have worked with hundreds of tenants to help them understand the terms of their commercial leases. It is important that our tenants understand the terms of their lease and know what their rental dollars are going to.

A common clause in many commercial leases, especially triple net office leases, is a gross-up provision.

We know that understanding what a gross-up provision is, and why it is necessary, can be confusing and our goal is to help you gain a little bit better understanding after reading this article.

In this article we will explain:

- Exactly what a gross-up provision is

- How gross-up provisions can help both landlords and tenants

Read Next: Opex Reconciliation: Definition and What It Means for Tenants & Landlords

Background Information: Understanding Op/Ex

Before we dive into what a gross-up provision is, it is important to have a basic understanding of operating expenses, since these are what gross-up provisions relate to.

So what are operating expenses?

Operating expenses are the costs associated with operating and maintaining a commercial property. In double-net and triple-net leases, tenants are required to reimburse landlords for a portion of the building’s overall operating expenses.

In a multi-tenant building, each tenant usually pays their proportionate share of these operating expenses, based on the size of their lease relative to the total square footage of the building.

Operating expenses consist of:

- Property taxes – property and other taxes associated with running the property

- Insurance – insurance for the property

- Common Area Maintenance fees – these can include a wide variety of services from utilities, landscaping, HVAC day-to day-portering, and janitorial

Some of these expenses, including taxes and insurance, are fixed costs no matter the occupancy rate of the building, and are generally not part of a gross-up calculation. Other costs, such as; janitorial service, janitorial supplies, trash, electricity, water, and management fees, will vary based on how much of the building is occupied and are included in gross-up calculations.

For more information on operating expenses, what they include, and how they are calculated, read our blog post What Are Commercial Real Estate Operating Expenses (Op/Ex)?

So, what is a gross-up provision?

Simply stated, the concept of “gross up provision” stipulates that if a building has significant vacancy, the landlord can estimate what the variable operating expense would have been had the building been fully occupied, and charge the tenants their pro-rata share of that cost.

Read Next: What Are Commercial Real Estate Operating Expenses (Op/Ex)?

The gross-up provision only applies to expenses tied to occupancy, because these are incurred directly as a result of the tenant(s) occupying the building.

Fixed expenses are not a part of the gross-up, because the costs remain the same with or without tenants, and the landlord is obligated to pay those expenses regardless of the building’s occupancy.

A helpful example…

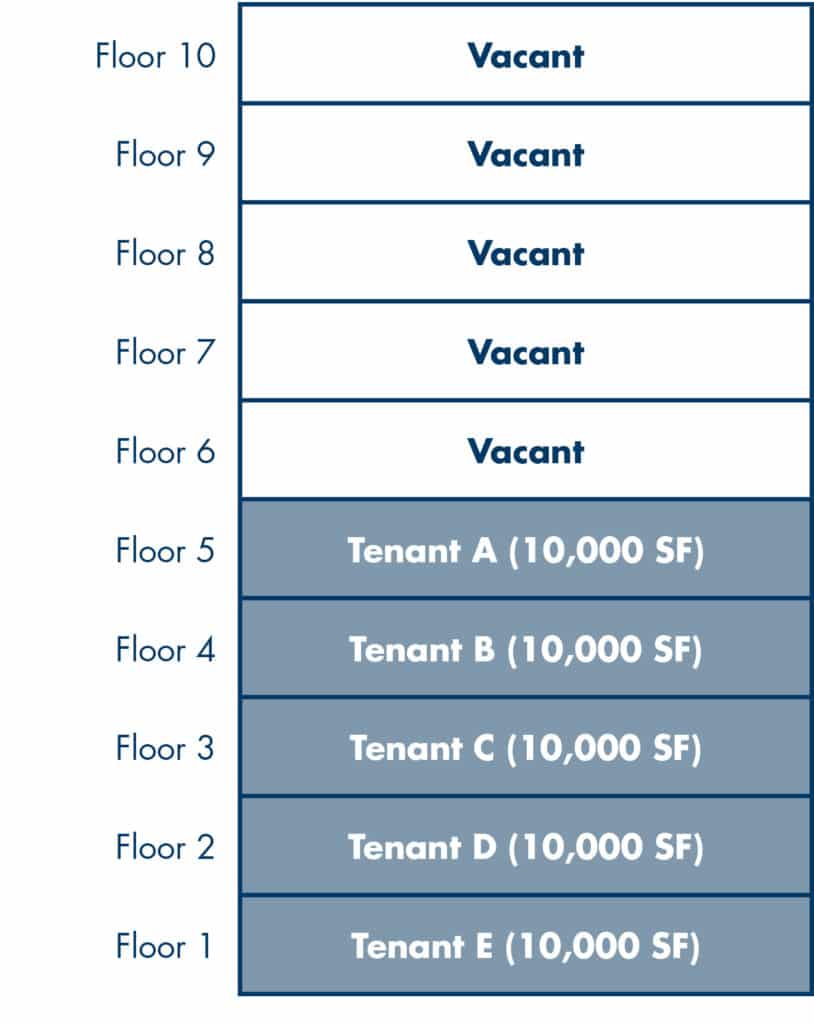

Imagine a 10-story office building with 10,000 square feet per floor, totaling 100,000 square feet.

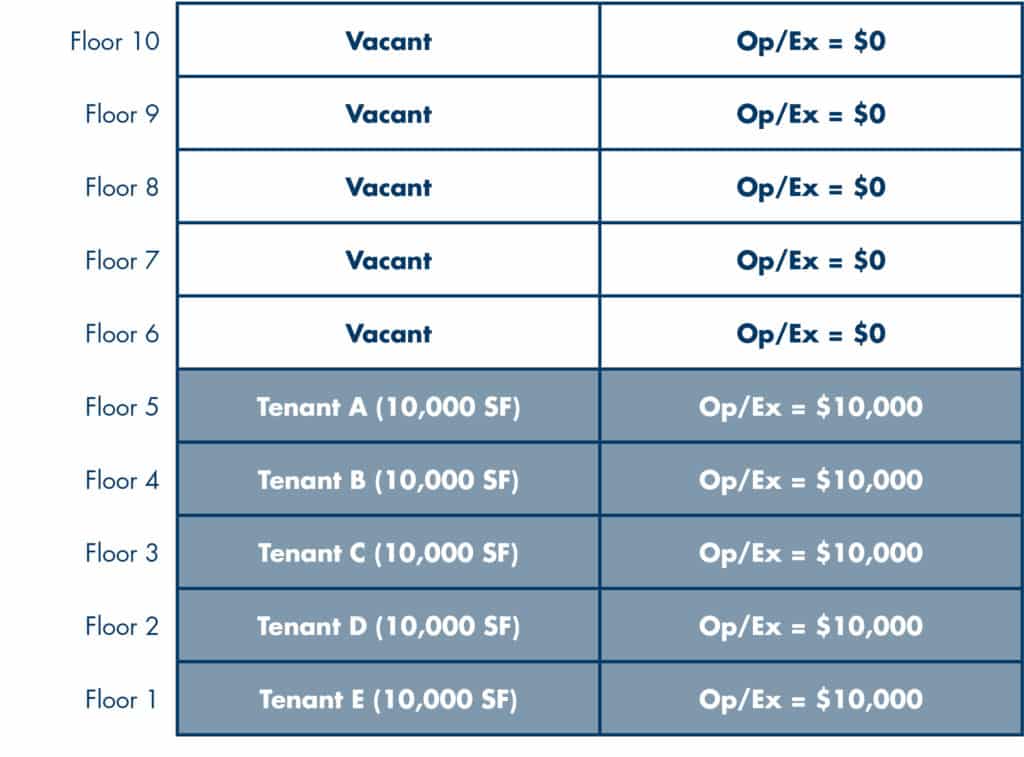

If the building has five different tenants, each occupying one floor, each tenant’s proportionate share would be 10% (1/10 of the total building).

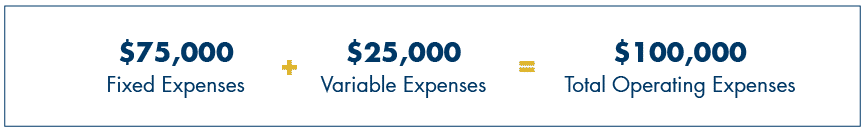

Let’s say that the landlord’s annual operating expenses for the building are $100,000, with $75,000 going towards fixed expenses, and $25,000 going towards expenses that vary with occupancy.

If there was not a gross-up provision in the lease, each tenant would pay its pro-rata share of the $100,000 operating expenses: $10,000 ($7,500 for fixed expenses and $2,500 for expenses that do vary by occupancy).

But when the landlord collects the $10,000 from each tenant, they would only receive $12,500 total to put towards the variable operating expenses ($2,500 x 5), which is only one-half of the total $25,000 in variable operating expenses that the landlord actually incurred.

If there is a gross-up provision in the lease, the landlord can project what the variable operating expense would be at full occupancy. Because at 50% occupancy the variable expenses are $25,000, they can estimate that at 100% occupancy, the variable expenses will be $50,000.

This grossed-up variable expense, plus the fixed expense, now brings the total operating expense to $125,000. Each tenant will pay $12,500, with $7,500 going towards fixed expenses and $5,000 going towards variable expenses. At this rate, the full $25,000 variable expense is covered ($5,000 x 5).

Here is the same example ($25,000 variable expense) in table format:

|

Occupancy |

Actual Costs |

10% Tenant |

Other Tenants |

Landlord’s Portion |

Explanation |

|

100% |

$25,000 |

$2,500 |

$22,500 |

– |

This is the variable cost of running the building at 100% occupancy |

|

50% (without gross-up) |

$12,500 |

$1,250 |

$5,000 |

$6,250 |

The building is actually 50% occupied, the costs are half |

|

50% (with 100% gross-up) |

$25,000 |

$2,500 |

$10,000 |

– |

With a gross-up, you set the expenses where they would be at 100% occupancy (first line) and recoup all of the actual expenses paid out |

Why do landlords use gross-up provisions?

A gross-up provision allows the landlord to preserve his income stream and cover the actual costs to operate the property despite below-average occupancy. It is also used so that tenants pay the actual amount incurred to operate their space within the building.

When there is high vacancy at a property, the landlord becomes responsible for whatever portion of fixed expenses the tenants are not covering in their operating expenses. In the example above, the landlord would have paid $37,500 in fixed expenses, because only half of the $75,000 total fixed expenses were covered by the tenants’ op/ex ($7,500 x 5).

In the example above without the gross-up provision, the landlord would have also been responsible for the $12,500 gap between collected variable operating expenses and the total occupancy-based expenses.

This occupancy-based expense was only incurred because the tenant was occupying the building. If the tenant wasn’t there, there would be no need for janitorial services, the air conditioning usage could be lowered, and the water and electric usage would be dramatically less.

In essence, without a gross-up provision, it actually cost the landlord, in our example, money to have tenants in the building.

The gross-up provision ensures that the tenants cover any operating expenses incurred because of their occupancy.

When do gross-up provisions help tenants?

Tenants will see two primary benefits of having a gross-up provision in their lease.

First, it allows for predictable budgeting. Without a gross-up provision, operating expenses could vary drastically from year to year, making predicting annual real estate expenses a nightmare.

Second, if operating expenses are based on a base year, the gross-up provision can protect the tenant from a big spike in their share of operating expenses.

To explain this second point, let’s consider another example.

Let’s say a tenant moves into a new building that is only partially occupied, with a lease that doesn’t contain a gross-up clause.

If the tenant pays operating expenses based on a year where operating expenses are decreased, due to low occupancy, then when the building becomes fully occupied in later years, the tenant’s pro-rata share of operating expenses will experience a significant jump.

By having a gross-up provision in the lease, the tenant is protected from the risk of wildly fluctuating operating expenses or large reconciliation bills at the end of the year.

Are gross-up provisions negotiable?

The short answer is yes.

The terms of a gross-up provision can and should be negotiated and outlined in your lease. The two points of negotiation are:

- At what occupancy the gross-up provision can be enforced. Typically, a gross-up provision will kick in when the average occupancy for the year falls below a certain percentage. Typically this percentage is below 95% to 100%.

- What occupancy rate the expenses can be grossed up to. In our examples, we assumed 100%. However, this can range between 95% and 100%.

However, whether you have a gross-up provision or not is non-negotiable. They are simply a fact of nearly all commercial office triple net leases, to protect both the landlord and the tenant.

Hopefully, you now understand exactly what a gross-up provision is and why it is a crucial detail in any commercial lease.

However, if you have any further questions, we’d be happy to discuss them with you further. Schedule a consultation with one of our tenant representation experts today.

Or, to continue learning about how commercial leases are structured, check out these helpful articles:

- Your Guide to the Elements of a Commercial Lease (Terms, Definitions)

- Typical Types of Commercial Leases in Austin, Texas

- What are Common Area Maintenance (CAM) fees? (Definition, Calculation)

- What is a Tenant Improvement Allowance and What Does it Cover?

This article was originally published in June 2018 but was updated in May 2022.