Commercial property management can be a complex and nuanced field, requiring a deep understanding of various industry terms and concepts. Whether you are a seasoned property manager or a new investor looking to learn the ropes, it is crucial to be familiar with the common terms and definitions used in commercial property management.

Read Next: The Ultimate Guide to Hiring a Commercial Property Management Company

From lease agreements to operating expenses and tenant improvements, having a comprehensive understanding of these concepts is essential to effectively manage a commercial property. In this article, we will explore some of the most common and difficult commercial property management terms and provide definitions to help you navigate the complex landscape of commercial real estate.

Below, you’ll find a collection of important commercial property management terms along with their definitions. Clicking on the provided hyperlinks will take you to comprehensive articles dedicated to each term, ensuring a deeper understanding of the topic.

Commercial Property Management Terms

1. CAM (Common Area Maintenance)

A fee charged to tenants to cover the cost of maintaining and operating the common areas of a commercial property, such as parking lots, sidewalks, and landscaping.

2. Net lease

A net lease requires the tenant to cover some of the costs associated with the operation of the building, as well as a predetermined base rent. This pro-rata share is referred to as the operating expense (op/ex). The specific costs the tenant is responsible for depend on what type of net lease is being used.

3. Gross lease

A lease agreement where the landlord is responsible for paying all operating expenses associated with the property, including property taxes, insurance, and maintenance costs, and the tenant pays a flat rent amount.

4. Triple Net Lease (NNN)

A triple net lease, also known as an NNN Lease, is a lease in which the tenant agrees to pay their pro-rata share of all expenses associated with property maintenance, taxes, and insurance, in addition to a predetermined base rental rate. These expenses are commonly referred to as operating expenses. In a triple net lease, your annual rental obligation, called gross rent, will be your base rental rate plus operating expenses.

Read Next: 5 Benefits of Using a Property Management Company to Manage Your Office Building

5. Rentable square footage

The total square footage of a commercial property that can be rented out, including both usable and non-usable space, such as hallways, elevators, and restrooms.

6. Usable square footage

The total square footage of a commercial property that can be used by a tenant, typically excluding non-usable space.

7. Gross leasable area (GLA)

The total amount of floor space in a commercial property that can be rented out to tenants, including common areas such as hallways and elevators.

8. Operating expenses

The costs associated with operating a commercial property – including property taxes, insurance, maintenance, and utilities.

Read Next: What Are Operating Expenses for Office Space in Austin, Texas?

9. Tenant improvement allowance

(TI allowance): A sum of money provided by the landlord to the tenant to cover some or all of the costs(s) associated with renovating or improving the interior of a commercial property to meet the tenant’s specific needs.

Read Next: 6 Tenant Improvement Allowance Construction Questions, Answered

10. Base year lease

A reference year used as a benchmark for calculating operating expenses in a commercial lease. The tenant is responsible for paying for any increases in operating expenses above the base year amount. The base rent is usually elevated to cover expenses to a certain limit.

11. Escalation clause

A provision in a commercial lease that allows the landlord to increase the rent or other charges over the term of the lease, often tied to increases in operating expenses or inflation. Typically base rent increases annually on the anniversary of the lease and operating expenses follow a calendar or fiscal year schedule

12. Tenant mix

The combination of tenants occupying a commercial property, which can have a significant impact on the property’s value and profitability.

13. Gross rent

The total rent paid by a tenant, including base rent, all operating expenses, taxes, insurance, and other fees.

14. Operating budget

A financial plan that outlines the projected revenue and expenses for a commercial property, typically prepared annually.

15. Rent roll

A summary of all tenants in a commercial property, including lease terms, rent amounts, schedule (base and opex), commencement/expiration dates, and security deposit amounts.

16. Gross-Up

Gross-up refers to the process of adjusting a tenant’s share of operating expenses in a multi-tenant commercial property to account for vacant or unleased space. This adjustment ensures that the property owner or landlord is not unfairly burdened with expenses related to unoccupied areas.

17. Lease Commission

A lease commission, also known as a leasing fee or broker’s fee, is a payment made to a real estate broker or agent for their services in securing a tenant for a commercial property. It is typically calculated as a percentage of the total lease value often paid in two parts – once when the lease is signed and another at lease commencement.

18. Tenant Ledger

A tenant ledger is a financial record that tracks all transactions and financial interactions between a tenant and a property management company or landlord. It includes details of rent payments, security deposits, maintenance charges, and other financial matters related to the tenant’s lease.

19. Tax/Mill Rate

The tax or mill rate is the rate at which property taxes are assessed on a property’s assessed value. It is typically expressed in mills, where one mill is equal to one-tenth of one percent (0.1%). Property owners pay taxes based on this rate applied to the assessed value of their property.

Read Next: What Are Commercial Property Tax Rates in Williamson and Hays County, Texas?

20. Per Square Foot

Per square foot is a common unit of measurement in commercial real estate to express various costs and prices, such as rent or sales prices. For example, a lease rate of $20 per square foot means that the tenant pays $20 for each square foot of leased space each year.

21. Net Operating Income (NOI)

Net Operating Income is a key financial metric in commercial real estate. It represents the income generated from a property after deducting all operating expenses but before deducting debt service, income taxes, or capital expenditures. NOI is often used to assess a property’s profitability and value.

22. Recoverable/Non-Recoverable Expenses

Recoverable expenses are costs incurred by the landlord that can be passed on to tenants as part of their lease agreements. Non-recoverable expenses are costs that the landlord must bear entirely and cannot be charged back to tenants.

23. Cap Rate (Capitalization Rate)

The cap rate is a ratio used to estimate the potential return on investment (ROI) for a commercial property. It is calculated by dividing the property’s Net Operating Income (NOI) by its current market value or acquisition cost. Cap rates are used by investors to assess the risk and return of a property. These are key to assessing value from an income-based approach.

24. Electricity and Janitorial (E&J)

These are common operating expenses in commercial property management. Electricity expenses cover the cost of providing electrical power to the building, while janitorial expenses are related to cleaning and maintenance services.

25. Preventative Maintenance (PM)

Preventative maintenance refers to proactive measures taken to prevent equipment or building systems from failing or deteriorating. It helps reduce the need for costly repairs and ensures that the property remains in good condition.

26. Cash Accounting

Cash accounting is an accounting method where transactions are recorded when cash is received or paid out. It is a straightforward way to track actual cash flow but may not provide a complete picture of a property’s financial performance.

27. Accrual Accounting

Accrual accounting is an accounting method where transactions are recorded when they are earned or incurred, regardless of when cash is exchanged. It provides a more accurate representation of a property’s financial position over time.

28. Fiscal Year

A fiscal year is a 12-month accounting period used for financial reporting and budgeting purposes. It may or may not align with the calendar year and is chosen by the property owner.

29. Landlord Representation

Landlord representation is a service provided by real estate brokers or agents who represent property owners or landlords in leasing or selling commercial properties. They work to secure tenants, negotiate leases, and protect the landlord’s interests.

30. Tenant Representation

Tenant representation is a service provided by real estate brokers or agents who represent tenants in leasing or purchasing commercial properties. They help tenants find suitable properties, negotiate leases, and advocate for the tenant’s interests.

31. Underwriting Budget

An underwriting budget is a financial plan used to assess the feasibility and potential profitability of a commercial real estate investment. It includes projected income, expenses, and other financial data to evaluate the viability of the investment opportunity. These are usually completed during acquisition and serve as a guide for ownership.

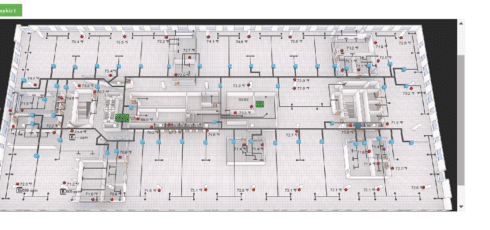

32. Stacking Plan

A visual diagram showing the layout and occupancy details of tenant spaces on different floors of a building, facilitating effective space management and leasing.

33. Encumbrance Schedule

A document that outlines and details any financial or legal obligations, restrictions, or encumbrances affecting a property, such as mortgages, liens, easements, or zoning regulations.

34. Reforecast

A revised financial projection or budget that reflects updated assumptions and data, typically prepared during the course of a fiscal year, to provide a more accurate and current financial outlook for a property or portfolio.

Understanding the terminology of commercial property management is key to successful management and investment in commercial real estate. By having a firm grasp of the terms and definitions associated with this field, property managers and investors can more effectively negotiate leases, manage expenses, and ultimately maximize the value of their properties.

Read Next: How to Choose the Right Commercial Property Management Company

Whether you are just starting out or are a seasoned professional, staying up to date with industry terms and best practices is critical to success in commercial property management. With this knowledge in hand, you can confidently navigate the complex landscape of commercial real estate and make informed decisions that will benefit your investments in the long run.

If you would like to learn more about property management and how an experienced management team can be of use to you, schedule a consultation with AQUILA Property Management today.