At AQUILA, we’re lucky enough to be able to shift a large percentage of our workforce to remote without any break in services while facilitating a safer environment for our critical team members who are maintaining properties, paying the bills and keeping construction projects moving forward.

We’re thankful to report that our AQUILA family is healthy and safe, and we hope to hear the same from each of you.

This article was originally published in AQUILA’s 1Q 2020 Austin Office Market Report. This article will not be updated, but please contact us if you have specific questions regarding the information in this article.

As an Austinite, I’ve been impressed and inspired watching how quickly retailers and restaurants have pivoted. Retailers like Antonelli’s Cheese and William Chris Winery are offering virtual tastings, and restaurants large and small, from neighborhood favorites to some of Austin’s most lauded restaurants including Jeffrey’s and Red Ash, have shifted gears and embraced takeout and delivery. Texas grocer H-E-B continues to be an exemplar in responding to the pandemic.

At AQUILA, we’ve been working with our clients over the past several weeks to understand what their near-term options and solutions are. In order to be a resource for our clients, we created a COVID-19 Austin Real Estate Resource Center with answers to our client’s top questions, including how the Paycheck Protection Program can help companies cover rent, how to cut office expenses, what workplace trends are emerging as a result of COVID-19 and more.

And now, we turn our attention to the next phase. We move on from solving the immediate pain points to planning for the future and the new normal ahead of us post-pandemic. As we look towards the future, we’ve become certain of one thing: Austin is in a prime position to thrive after this pandemic.

In this article, we’ll explain five reasons why we believe this to be true, including:

- Austin will continue to be a desirable place to live and work

- Austin suburbs are thriving and ready for growth

- Austin has a healthy tenant mix

- Developers have the opportunity to produce wellness-oriented buildings

- Austin is poised to adapt to the “new (office) normal”

1. Austin will continue to be a desirable place to live and work

Year after year, Austin finds itself at the top of lists featuring the best cities to live and work in. In 2019, U.S. News & World Report named Austin the No. 1 Best Place to Live in the U.S., and in February 2020, the Wall Street Journal named Austin-Round Rock MSA the best job market in the country.1

Other accolades for the city include the Best City for Dating in the U.S., the Best City to Start a Business, America’s Greatest Music City, and more.2 All of these individual factors contribute to what makes the city a desirable place to call home and open up shop. And if you follow the thread further, the desirability of the city explains why Austin was named the Best U.S. Market for Real Estate Investment by the Urban Land Institute in 2019.3

In 2020, Austin found itself atop a new list. In the face of COVID-19, some of the same attributes that have earned the city so much acclaim in recent years pushed it to the top of a new set of lists – the best cities for social distancing.

Austin has a large amount of park land per person, a factor that makes it one of the top cities to be quarantined in, according to Zippia.4

According to Zippia, Austin is the 10th best city to be quarantined in, based on four factors: average apartment size, amount of parkland per person, percentage of residents with broadband internet, and a number of takeout options.4

What pushed Austin into the top 10? Despite our relatively small average apartment size, Zippia indicated it was our fast internet speeds and access to parks that buoyed us to the top.

On a similar list, DeliveryRank found Austin to be the No. 1 city to quarantine in. This list considered food delivery options – including grocery delivery, restaurant delivery, and meal delivery options like Purple Carrot and Dinnerly – and internet speeds.5

As a tech-savvy city, we’re already equipped with a number of meal delivery and grocery delivery services. These practices have grown in popularity as a result of social distancing, and we expect them to maintain popularity after the fact. As all generations grow more comfortable with the process and become accustomed to the convenience, we expect these technologies will thrive and potentially minimize the need for onsite or surrounding restaurants and food options at office properties.

With the predictions that we may need to follow some socially distancing measures for an extended amount of time or that we may have to prepare for intermittent periods of social distancing, it may be compelling for tenants, owners, and developers alike to know that Austin is one of the best places to do so.6

Additionally, attributes that may have once counted against Austin, may now work in favor of the city.

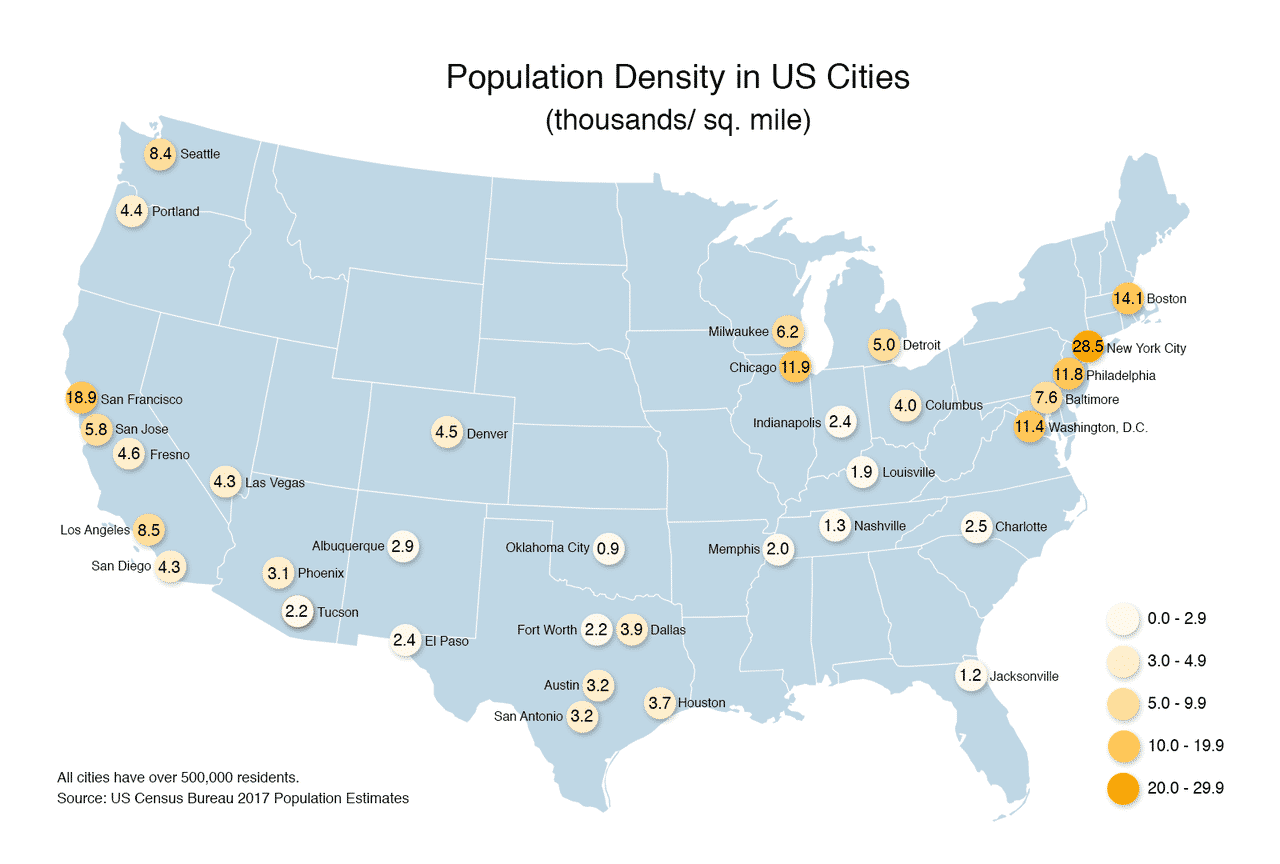

The first is density. Although Austin is the 11th largest city in the United States, it is only the 53rd most dense city in the country, with 3,191 people per square mile.7 For comparison, New York is the nation’s densest city at 28,492 people per square mile and San Francisco is the second at 18,868 people per square mile.8 Studies over the past decade have linked population density to higher worker productivity, and new urbanists have promoted the benefits of the walkable cityscapes that dense cities and developments allow for.9 However, during a pandemic, density can be a contributing factor to the vulnerability of a city to the spread of disease.10 Not to say that the dense walkable urban city is dead, but during a time when social distancing and the ability to successfully quarantine is paramount, a city like Austin may appeal.

Based on U.S. Census 2017 Population Estimates.11

The second of these, which relates to density, is a lack of access to public transportation. Amidst a pandemic, this con gets flipped on its head and instead can be presented as a lack of reliance upon public transportation. Although CapMetro has made a number of improvements recently, public transportation has yet to become the most prominent method for commuters in Austin.12 According to a 2016 study, only 6.0% of Austin households did not have a vehicle and on average each household had 1.65 vehicles, just below the national average of 1.8 vehicles per household.13 For comparison, 54.5% and 31.2% of households in the two densest cities, New York and San Francisco, did not have vehicles. During a period of social distancing, a city that relies more on private transportation than public transportation, like Austin, may be attractive to job seekers looking to relocate.

Austin will continue to be a desirable place to live and work, both for the reasons we’ve always known like the restaurants, the parks, the access to top talent, etc., and for new reasons like the ability to successfully and comfortable social distance as needed. It’s not to say that growth won’t be impacted by COVID-19, but it’s likely to be a slowing of the stream, rather than a full stop. In its presentation titled “Impact of the Coronavirus on the Austin & Central Texas Economy,” local economic development firm AngelouEconomics predicts an addition of approximately 35,000 residents in 2020 and 45,000 residents in 2021, compared to about 55,000 to 65,000 new residents during each of the past four years.14 The lower-than-usual projection is attributed to the tendency of people to stay put and avoid the risk of moving during a period of economic difficulty.15

As people and businesses alike continue to be attracted to our city of tacos, hill country living and live music, we expect this to continue to fuel the Austin economy.

2. Austin suburbs are thriving and ready for growth

As millennials grow up and start their own families, they are flocking back to the suburbs.16 As a result, we’re beginning to see a re-emergence of suburbia, or “Hipsturbia,” as it was dubbed in the Urban Land Institute and PWC’s 2020 Emerging Trends in Real Estate report.17

In Austin, we see this with the population booms of Cedar Park, Leander, and Lakeway. And as the report explains, these aren’t your parents’ suburbs. Millennials still want access to the live, work, play lifestyle that the city center has to offer, combined with the affordable housing and good school districts that the suburbs provide. In Cedar Park, you can see this take shape at The Park retail center, where downtown favorites JuiceLand, Easy Tiger, and Whole Foods all set up shop.

As a result, the population of Austin and the city’s talent pool have begun to shift towards the northwest. Additionally in the Austin market, we were already seeing many office tenants migrate out of the CBD.

A neighborhood in a North Austin suburb. As millennials grow up and start their own families, they are flocking back to the suburbs.16 As a result, we’re beginning to see a re-emergence of suburbia.

As the high-density tech user took over the downtown towers, traditional users complained of crowded elevators, overused facilities, and more. As these tech tenants planned their spaces for maximum efficiency, the 1980s-era towers that were built for 3-to-4:1000 density were being taxed at a much higher level.

Pushed by the congestion and high price per square foot of downtown and pulled by the population shift towards the northwest, the demand for suburban office campuses has grown, most notably demonstrated by the success of the Domain.

CBD-adjacent micromarkets are also prospering, including East Austin, South Lamar, and South Congress, and master-planned, mixed-use developments like the Highland Redevelopment, The Grove, and Mueller.

Now, in the face of COVID-19, these issues with the existing downtown towers that were once seen as mere inconveniences may now be seen as a dangerous recipe for spreading germs.

On the other hand, these suburban and CBD-adjacent markets are, by nature, set up to appeal to the post-pandemic tenant.

The office product in these markets consists of low-to-midrise buildings, which allow tenants to avoid crowded elevators, either by taking a reasonable number of stairs or through direct access to their floor from attached parking. Additionally, these properties allow access to outdoor spaces, including surrounding trails, on-site courtyards, and even larger private patios and balconies. Finally, should a tenant need to take more space to accommodate for social distancing measures in their workplace design, the lower rental rate will allow for these larger footprints at a lower overall cost than compared to the CBD.

The Austin market is well positioned to accommodate a growing suburban office environment, with nearly 80% of existing office product and 70% of projects under construction located in the suburbs and CBD-adjacent districts.

3. Austin has a healthy tenant mix

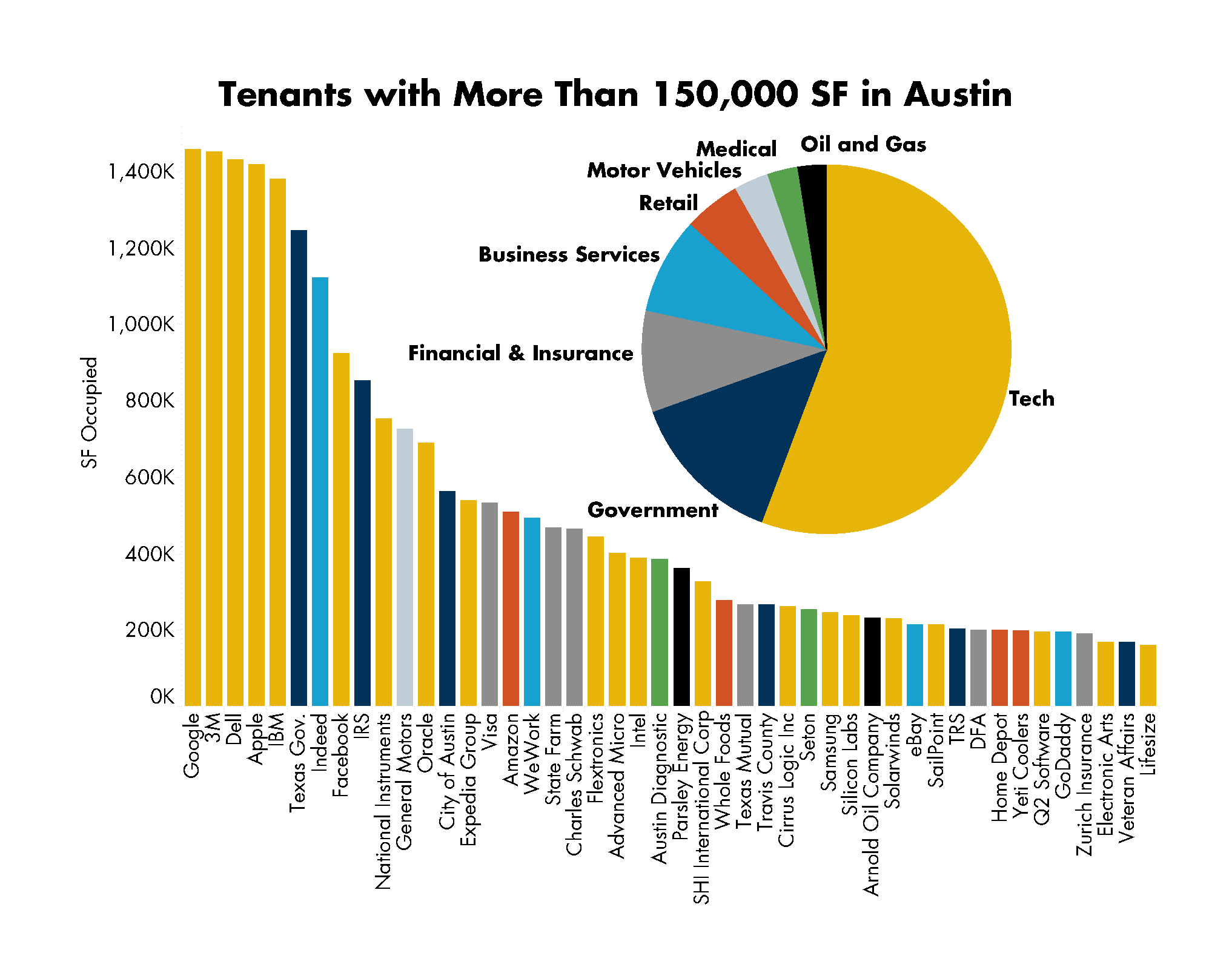

On the other side of the equation, Austin boasts a diverse mix of office tenants. This diversity should provide insulation to the city’s economy, at least to a certain degree, during any impending recession or economic downturn.18 In fact, in March 2020, Smart Asset ranked Austin the fifth most recession-resistant city.19 Although it may seem like we’re a city made up almost exclusively of tech tenants, with names like Amazon, Apple, Oracle, Facebook, and Google popping up in the city’s real estate and business headlines seemingly every day, our city is actually home to a rather diverse economy. (This is in no small part due to the efforts of Opportunity Austin, the business recruitment initiative spearheaded by the Austin Chamber of Commerce.)

In AQUILA’s 2019 study of the largest companies in Austin, it came as no surprise to find that, of the 24 million square feet occupied by the city’s largest tenants, 45% was occupied by tech tenants. Additionally, the five largest tenants in Austin were all tech tenants.20

What was compelling, is that the other 55% is made up of a diverse set of tenants including:

- Government agencies, the three largest being the Texas Government, IRS and City of Austin

- Financial institutions and insurance agencies, Visa and State Farm being the largest

- Business services, which includes Indeed and the high-risk WeWork

- Retailers, Amazon and Whole Foods the two largest independently

- Motor vehicle production made up solely of General Motors

- Medical, which includes Austin Diagnostic and Seton

- Oil and gas, comprised of Parsley Energy and Arnold Oil Company

And of the tech tenants, while there are a number of these headline-grabbing names, there are also a number of Austin institutions who are not participating in the continual real estate grabs. Included in this group are IBM, Dell, and 3M, all of whom hold spots as three of the five largest Austin tenants. Further down the list are other long-standing Austin names like National Instruments and Silicon Labs.

In addition to this, according to the Austin Chamber, no one single industry employs more than 18% of the Austin MSA employment base.21

While it would be foolish to assume each of these major Austin companies will come through unscathed (in fact multiple groups on the list including Parsley Energy and General Motors have already begun marketing space for sublease), it is our assertion that the wide array of industries represented in our market means that a decline of any one industry would not result in a collapse of the whole market.

Another compelling aspect is the relatively new presence of the Army Futures Command and the Dell Medical Center at The University of Texas at Austin. Each stand to attract a new type of tenant to the city, in the defense and biomedical industries respectively.

4. Developers have the opportunity to produce wellness-oriented buildings

Of cities in the U.S., Austin has the second-highest ratio of office space under construction as a percentage of existing inventory, with Nashville boasting the highest.22 If developers can adapt quickly, we can lead the nation with an inventory made up of the most desirable office buildings.

Even prior to COVID-19, we began to see an emerging interest in wellness-oriented buildings and offices.

In February, EverlyWell, a producer of at-home medical tests, debuted plans for its new health-focused headquarters at 823 Congress.23 Healthy amenities included abundant sunlight, access to a variety of diet-compliant snack options, Peloton bikes, and a yoga room.

While these health benefits don’t necessarily align with today’s top-of-mind health practices, it shows a company’s interest in putting employee wellness at the forefront of its office design.

Additionally, in 2019 we began to see a growing interest from developers in healthy building design as a method to attract tenants. RiverSouth, for example, lists “Well Building Measures,” such as daylight harvesting and superior indoor air quality, alongside “Green Building Measures” and featured amenities in marketing materials.

The Foundry, a mixed-use development in East Austin, took the idea a step further, achieving the first WELLTM Certification in Austin.24 A certification that could likely be on track to become the LEED designation of the 2020s. According to the WELLTM project directory, there are already a handful of planned WELLTM developments in Austin.25

The main success of LEED is that it made sustainability a marketable attribute of a building, but now that energy codes have become more strict and the overall idea of sustainability has become more commonplace I would say it has become less of a goal for developers. I think we will see more developers aim to attain WELLTM Certification moving forward. Whereas LEED is focused on a building’s efficiency, WELLTM is focused on improving the health and wellness of the people within the building.”

– Andy Kennedy, The Beck Group, 2Q 2019 AQUILA Office Market Report

The WELLTM Certification focuses on creating a building that promotes employee health and productivity. To achieve WELLTM Certification, buildings must meet certain standards in regards to clean air, water filtration, healthy food, lighting requirements, promotion of physical fitness, physical comfort (thermal, acoustic, ergonomic, etc.), and cognitive and emotional health.

Many of these improvements go hand-in-hand with post-pandemic building design recommendations.25 For example, improved airflow, ventilation and filtration are all recommended in order to prevent the spread of disease within buildings.27

Additionally, we anticipate a shift towards a number of touchless technologies in buildings. What this looks like is still in the early stages and will likely vary from system to system. Gensler predicts a shift from shared devices to personal devices – using your phone to access a building, call the elevator, etc. – as well as an integration of gesture and voice-activated systems.28

Austin’s position as a technology leader, consistently in the top 10 of Savills’ Best Tech Cities list, should give our market an advantage in its ability to adapt post-COVID-19.29

With nearly eight million square feet in downtown office construction planned, developers have the opportunity to embrace new technologies and wellness recommendations in order to create products that keep tenants healthy and productive.

By carefully considering and implementing these WELLTM Certification requirements and emerging technologies, developers will be able to attract and keep healthy, productive and happy tenants.

It is AQUILA’s assumption that the emergence of these new towers would have driven older, existing downtown product into obsolescence even prior to the pandemic. If these new towers can respond well to tenants’ new health needs, this will only accelerate this trend.

Read Now: Austin CBD in 2024: What Could Austin’s Downtown Market Look Like in the Future?

5. Austin is poised to adapt to the “new (office) normal”

The question on many people’s minds is: with so many employees proving their ability to work from home, will the corporate office go the way of the buffalo?

In short, no. But it might look a little different.

Gensler’s U.S. Workplace Survey 2020 finds that given the choice, people still prefer the office.30 According to AQUILA’s own survey of our clients, just over 30% of respondents believe they will allow more employees to work from home after offices are reopened. And in a recent study, JLL reported that only 4.9% of office workers reported that they would prefer to work exclusively from home going forward.31

This same report goes on to explain that the most frequently cited reason for employees wanting to work in the office was innovation. The second most cited reason was culture. As many of us who have transitioned rather abruptly to a new work-from-home situation, there’s a sense of collaboration and culture that occurs when employees gather in the office that’s hard to replicate via Zoom calls and Slack channels.

While the office does appear to be here to stay, it’s likely that many companies will need to be open to ways of working including virtual collaboration tools and flexible hours or “in office” hours.32 JLL’s workplace study found that while very few employees desired a fully remote position, over 60% of workers did prefer to split time between their office and their home office.

The study goes on to explain that this desire for a mix of working from home and the office indicates a need for both work-life balance as well as a need for a workspace that allows for deep concentration.

Austin, with our strong job market and access to top restaurants, music, parks, and more, has a reputation for our strong work-life balance. In 2017, the city was ranked the No. 1 city for job seekers, receiving the highest marks for our work-life balance.33

Our comfort with this balance, plus our access to technology and fast internet that has been described throughout this article, should allow Austin companies to adapt quickly and more easily to flexible work schedules.

Read Next: 3 Reasons Austin, TX Is One of the Most Innovative Cities in the U.S., 2Q 2018 Eagle’s Nest

This ability for more flexible work also allows for sick or immunocompromised employees to work from home more easily and for the potential implementation of shift work – be it one week in, one week home, or a morning shift and an afternoon shift – to minimize the number of employees in an office at one time during periods of social distancing and subsequent reentry into the workplace.34

This flexibility combined with new wellness-oriented buildings and health-centric space planning in the office should result in employee and employer confidence in reentering the workplace.

Building confidence and creating a safe work environment is a major factor in getting the city back to work quickly and on the road to recovery.

During the Great Recession, Austin was the last in and the first out. By 2017, WalletHub named Austin the most recession-recovered large city in the United States.35 And we believe we’re in an even better position now than we were then.

Conclusion

As an Austin-based company and, personally, as someone who has called Austin home for more than a decade, AQUILA and I ardently believe that, because of the reasons listed above, the city will be well positioned after COVID-19.

There may be some bumps in the road, but we are poised to come out of this period continuing to be a desirable place to live, work, and run a business.

For more insights into how the Austin real estate market is responding to COVID-19, visit our COVID-19 Austin Real Estate Resource Center.

For more information about Austin’s performance over the past year and to see what new accolades have been added to our list of recognition, see the updated Austin Tops the Charts list.

Download our latest Austin Office Market report to learn more.

1Source: U.S News & World Report – 125 Best Places to Live in the U.S.; Wall Street Journal – Austin, Nashville Rank at Top of Hottest U.S. Job Markets

2Source: Apartment List – The Best & Worst Cities for Dating 2019; Austin Business Journal – Inc.: There’s no better place to start a business than Austin; Thrillist – America’s 12 Greatest Music Cities, Ranked

3Source: Austin Business Journal – Austin is again No. 1 US market for real estate investment in closely watched study

4Source: Zippia – The Best (and Worst) Cities to be Quarantined

5Source: DeliveryRank – 7 of the Best US Cities to Be Quarantined In

6Source: Yahoo News – Americans may need to wear masks for up to 18 months, Yale expert says; Harvard School of Public Health – Intermittent social distancing may be needed through 2022 to manage COVID-19

7Source: U.S. Census Bureau – The 15 Most Populous Cities: July 1, 2016

8Source: Cleveland.com – Cleveland is nation’s 27th most densely populated big city; Columbus 37th, New York 1st

9Source: Federal Reserve Bank of New York – Productivity and the Density of Human Capital; Congress for the New Urbanism – What is New Urbanism?

10Source: CityLab – What We Know About Density and Covid-19’s Spread

11Source: Maps on the Web – Population Density – US Cities.

12Source: CapMetro – Major Projects

13Source: Governing.com – Vehicle Ownership in US Cities Data and Map

14Source: AngelouEconomics – Impact of the Coronavirus on Austin & Central Texas Economy

15Source: CultureMap – Austin’s population growth will dramatically drop due to COVID-19, says economist

16Source: Forbes – ‘Hipsturbia’: It’s What All The Cool Suburbs Are Doing And It’s A 2020 Trend

17Source: Urban Land Institute – Emerging Trends in Real Estate®

18Source: Austin Business Journal – Executives see diversification boosting resilience of Austin’s economy

19Source: Smart Asset – Most Recession-Resistant Cities – 2020 Edition

20Source: AQUILA Commercial – What are the Largest Companies in Austin Today?

21Source: Austin Chamber – Employment by industry

22Source: CoStar – U.S. Office April 2020

23Source: Austin Business Journal – EverlyWell packs new Austin HQ with healthy amenities

24Source: KVUE – Foundry building in East Austin aims to make tenants healthier

25Source: WELL Certification – Projects Directory

26Source: Gensler – Redesigning Mixed-Use Environments for a Post-Pandemic World

27Source: Gensler – How Should Office Buildings Change in a Post-Pandemic World?

28Source: Gensler – Understanding the Touchless Workplace

29Source: Savills – Savills Tech Cities Index

30Source: Gensler – In an Era of Choice, Workers Still Prefer the Office

31Source: JLL – Tenant needs in a post-pandemic world: 2020 Forecast Series

32Source: Gensler – What Happens When We Return to the Workplace?; JLL – Tenant needs in a post-pandemic world: 2020 Forecast Series

33Source: Austin Business Journal – Austin one of best US cities for job seekers, according to Indeed

34Source: Gensler – 10 Considerations for Transitioning Back to Work in a Post-COVID-19 World

35Source: WalletHub – 2017’s Most & Least Recession-Recovered Cities